The rate consists of two parts. What Is Not Considered Self-Employment Income.

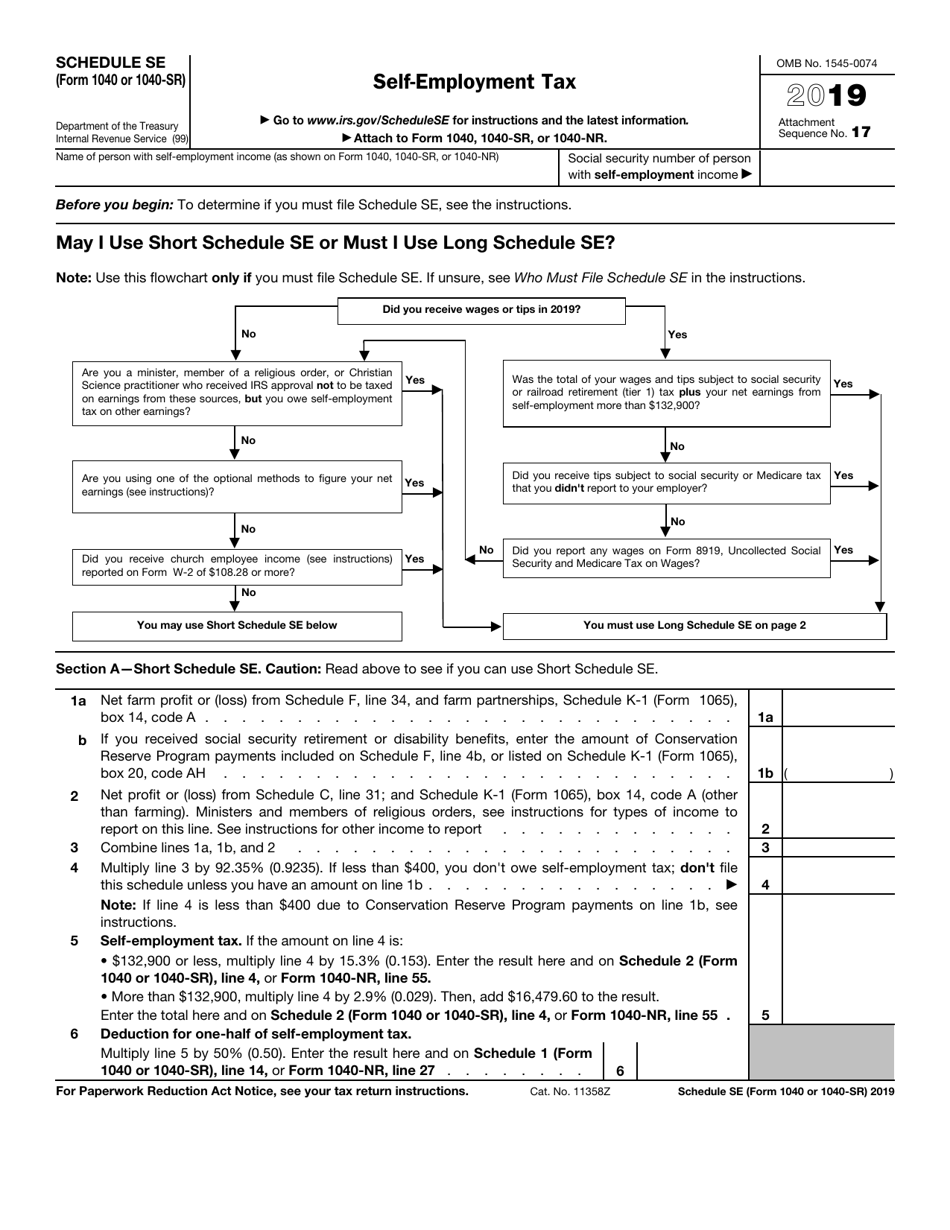

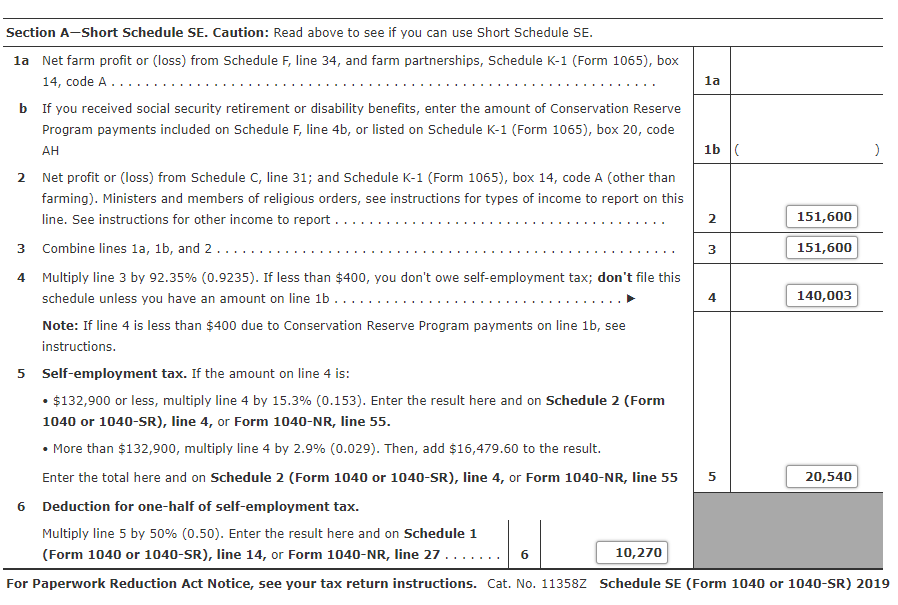

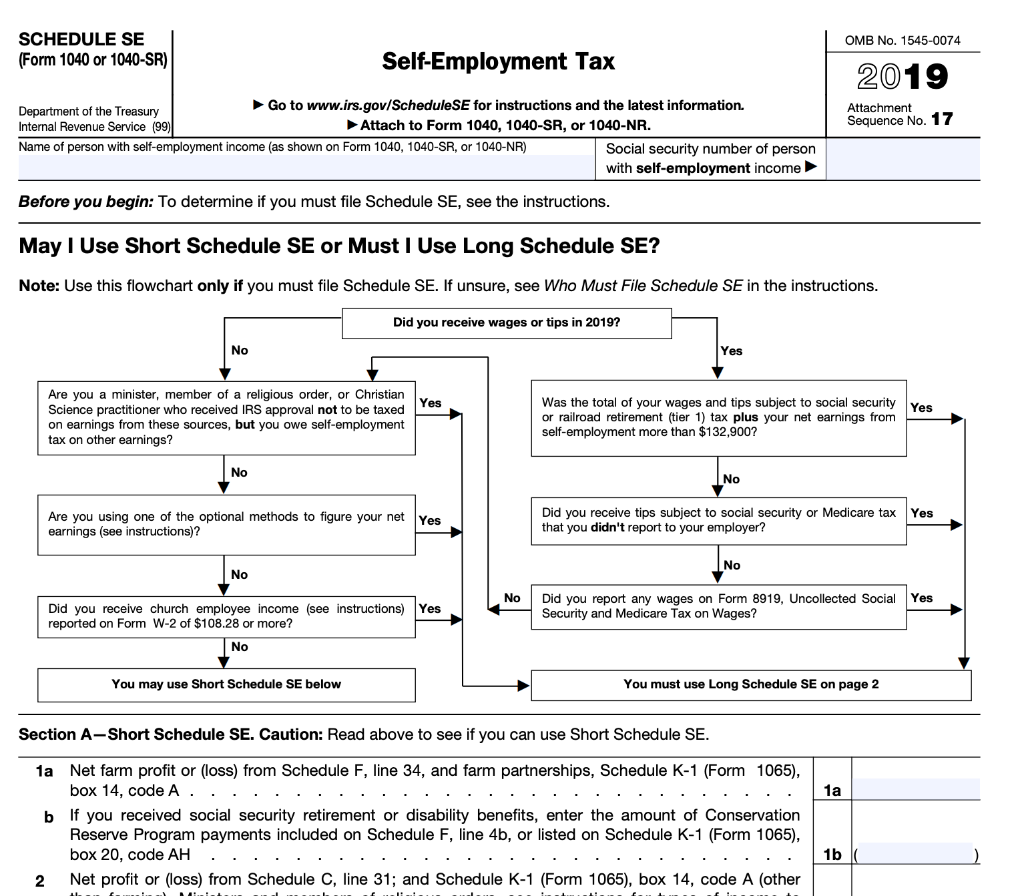

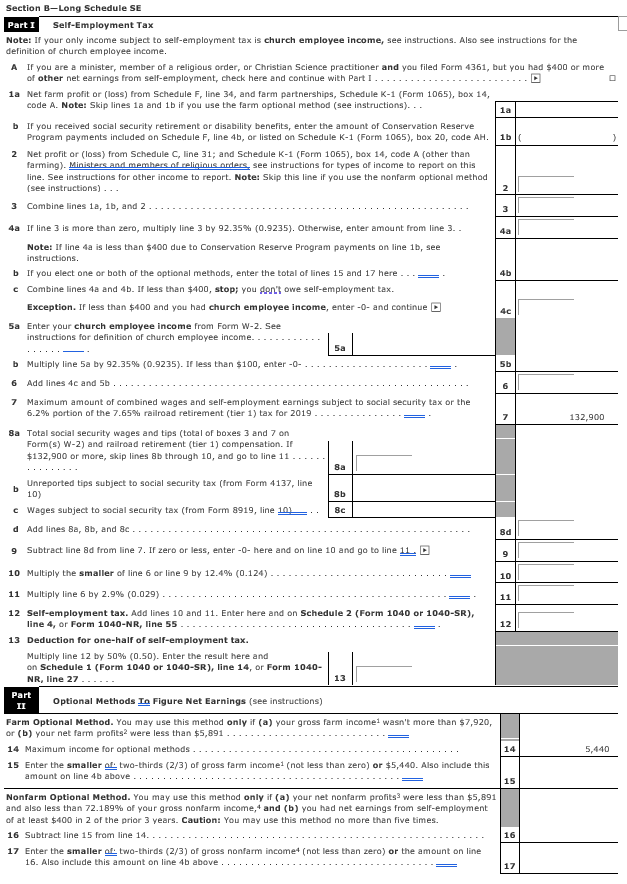

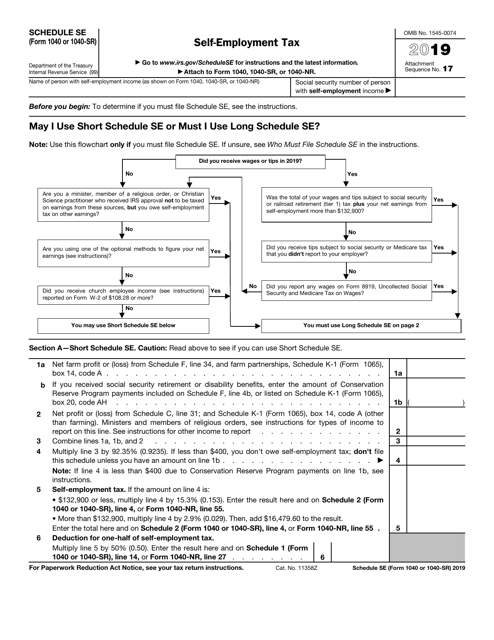

Irs Form 1040 1040 Sr Schedule Se Download Fillable Pdf Or Fill Online Self Employment Tax 2019 Templateroller

Irs Form 1040 1040 Sr Schedule Se Download Fillable Pdf Or Fill Online Self Employment Tax 2019 Templateroller

As long as you remain qualified your election cant be re-.

Is schedule f income subject to self employment tax. The net profit calculated on Schedule C transfers to Form 1040 Line 12 and to Schedule SE for purposes of calculating self-employment SE taxes. Conversely if the income is from a trade or business report the amount on Schedule C or Schedule F if the income relates to farming. Schedule F line 15a Farmers use Schedule F of Form 1040 to calculate total farming income or losses which is recorded on line 36.

What Is Material Participation. If the taxpayer is in trade or business and elects to report both expenses and gains and losses on schedule. Each of you must also file a separate Schedule SE Form 1040 to pay self-employment tax as applicable.

The SE tax is reported on Form 1040 Line 56. This self-employment tax is imposed in addition to the regular income tax you already pay and is imposed on your self-employment earnings. One half of the self-employment.

Instead its considered to be passive income by the IRS and therefore is not subject to self-employment tax. If not it generally is reported as other income on Form 1040. Generally if you are an employee your employer pays half of the Medicare and Social Security Tax that makes up FICA.

Under the regular method of determining earnings subject to self-employment tax net farm profit from Schedule F Form 1040 is multiplied by 9235 percent on Schedule SE Form 1040 Self-Employment Tax before applying the FICA tax rate. 5232020 Self-employment tax includes Social Security and Medicare taxes. The self-employment tax rate for self-employment earnings is generally 153.

Unlike wages from a job or a business you participate in rental income isnt considered to be earned income. 11132020 For lease income that is reported on Schedule F self-employment tax will apply except for any portion of the rental income that relates to the rental of real estate improvements eg a farm building or grain bin. Completing Schedule F involves some calculations.

1272020 Your self-employed income is any income from self-employed business activities Schedule C farming Schedule F the self-employed earnings of a partner Schedule E and work as clergy or employee of a religious organization. The 137700 ceiling is called the Social Security wage base. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

However for 2011 the rate is reduced to 133. Sole proprietors must file Schedule C with their tax returns and self-employed farmers report their income and expenses from their farming businesses on Schedule F. Interestingly on line 8 of form 1099-G ProSeries asks if the amount reported in box 2.

You must file a separate Schedule F Form 1040. 432019 In general this income is subject to self-employment tax. The tax is computed on the Schedule SE Self-Employment Tax attached to a Form 1040 Individual Income Tax Return.

Its not classified as investment income like capital gains interest and dividends are. Of course net income from a trade or business is subject to both income tax and the 153 self-employment tax while other income generally is subject only to income tax. 2202021 The 2500 was reported to the taxpayers LLC on form 1099-G in box 6 entitled taxable grants.

When you are your own boss you pay the full amount of those taxes based on your net income. ProSeries links box 6 taxable grants of Form 1099-G to Schedule 1 Additional income line 8 Other Income bypassing Schedule C and thus avoiding Self Employment Taxes. Generally a taxpayers share of ordinary income reported on a Schedule K-1 from a partnership engaged in a trade or business is subject to the self-employment tax.

Form 1040 line 21 If you report any miscellaneous self-employment income on your personal tax return youll record it on line 21 of Form 1040. In a response to a September 1999 taxpayer inquiry on this subject the IRS said Self-employment tax does not apply since the sale of a capital asset is involved and the profit or loss is ordinary only because of the mark-to-market election Whether or not a day trader is subject to self-employment tax is ambiguous. 4212021 The IRS doesnt treat all income equally particularly when it comes to reporting it.

The amount of annual rental payments must be reported on line 4b Taxable Amount except to the extent it is for the permanent retirement of cropland base and allotment history generally reportable on Form 4797 Sales of Business Property. On each line of your separate Schedule F Form 1040 you must enter your share of the applicable income deduction or loss. If you are self-employed or a contractor self-employment tax takes the place of FICA tax on a W-2 or pay stub.

422021 Individuals must report all CRP payments on Schedule F Profit or Loss From Farming line 4a Agricultural Program Payments. After youve calculated your income you will need Schedule SE to calculate the self-employment tax. The self-employment tax rate is 153.

The amount apportioned to real estate improvements should be reported on Schedule E. 172020 If youre a farmer youll use Schedule F and if your self-employment income comes from a partnership youll use Schedule K-1.

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

/SchedF-0ace017c310b43189a3050710d298e4c.jpg) Schedule F Form Profit Or Loss From Farming Definition

Schedule F Form Profit Or Loss From Farming Definition

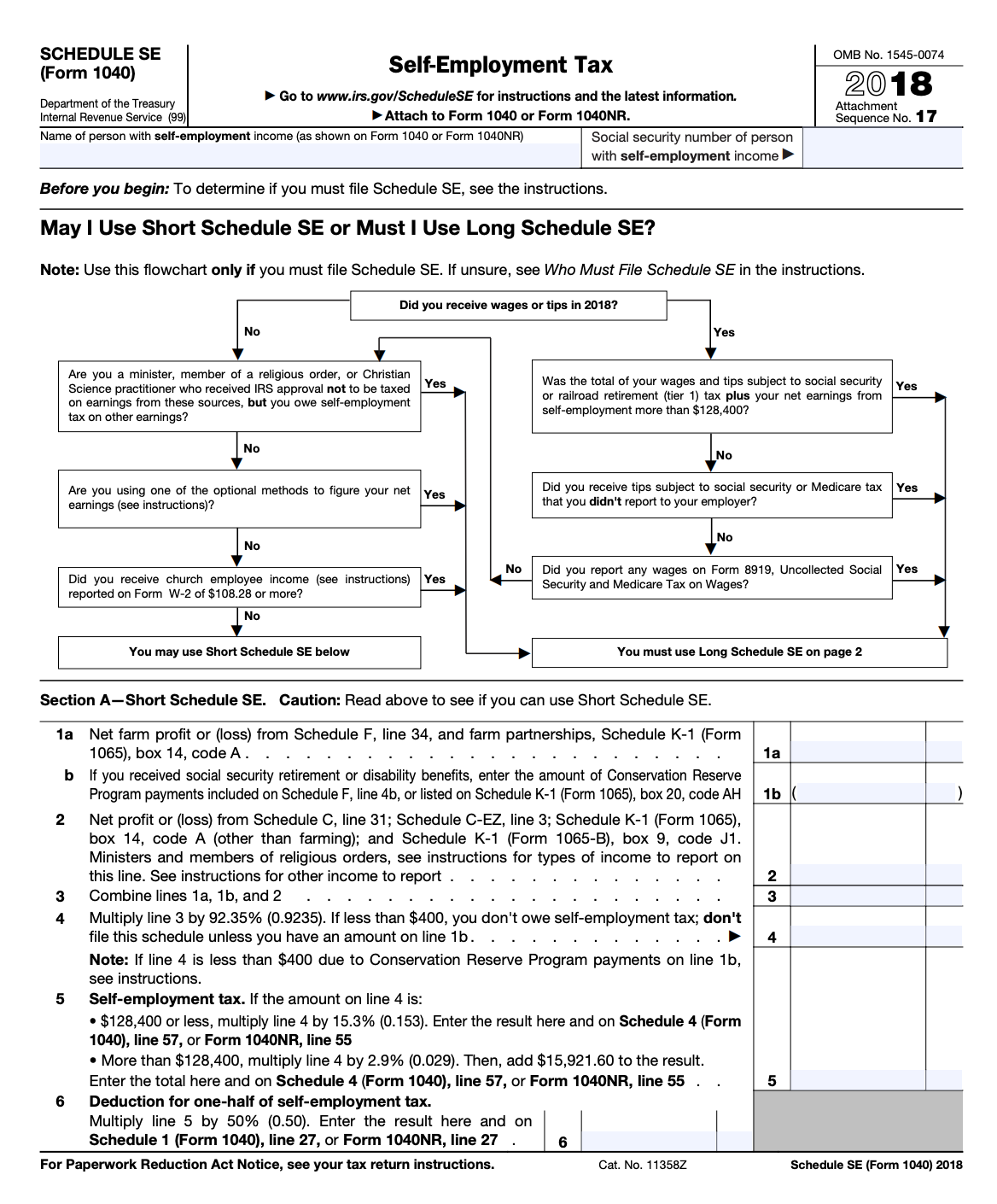

Form 1040 Schedule Se Self Employment Tax

Form 1040 Schedule C 2016 Instruction Income Tax Return Internal Revenue Service Irs Forms

Form 1040 Schedule C 2016 Instruction Income Tax Return Internal Revenue Service Irs Forms

Form 1040 Schedule Se Self Employment Tax

Cryptocurrency Tax Reporting How To Pay Tax On Crypto Tokentax

Cryptocurrency Tax Reporting How To Pay Tax On Crypto Tokentax

Complete Guide To Taxes Freelancers And The Self Employed Addition Words Tax Guide Employee Tax Forms

Complete Guide To Taxes Freelancers And The Self Employed Addition Words Tax Guide Employee Tax Forms

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

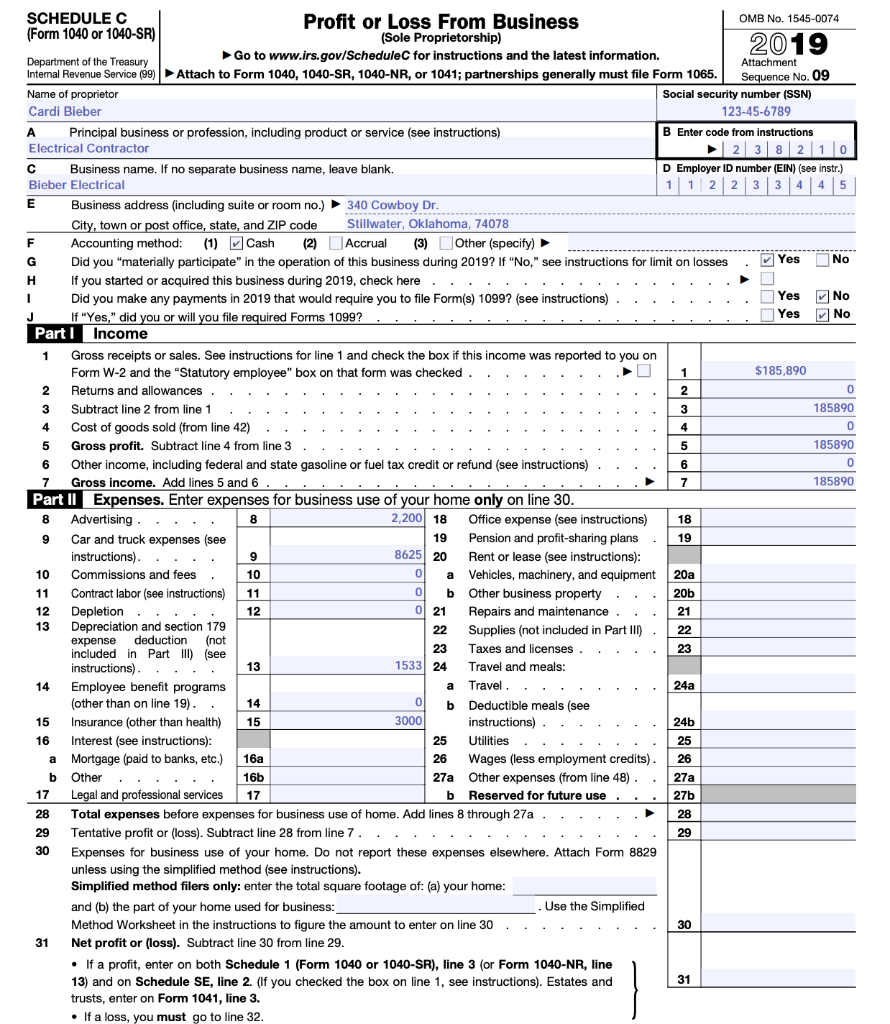

Bieber Is A Self Employed Electrician Her Busines Chegg Com

Bieber Is A Self Employed Electrician Her Busines Chegg Com

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png) Schedule C Profit Or Loss From Business Definition

Schedule C Profit Or Loss From Business Definition

Bieber Is A Self Employed Electrician Her Busines Chegg Com

Bieber Is A Self Employed Electrician Her Busines Chegg Com

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png) Schedule C Profit Or Loss From Business Definition

Schedule C Profit Or Loss From Business Definition

Freelance Writer Taxes Self Employment Tax Freelance Writer Freelance Writing Profit And Loss Statement

Freelance Writer Taxes Self Employment Tax Freelance Writer Freelance Writing Profit And Loss Statement

What Is Schedule Se The Tax Form For The Self Employed

What Is Schedule Se The Tax Form For The Self Employed

Schedule Se Everything You Need To Know Rethority

Schedule Se Everything You Need To Know Rethority

What Is A Schedule C Tax Form H R Block

What Is A Schedule C Tax Form H R Block

Irs Form 1040 1040 Sr Schedule Se Download Fillable Pdf Or Fill Online Self Employment Tax 2019 Templateroller

Irs Form 1040 1040 Sr Schedule Se Download Fillable Pdf Or Fill Online Self Employment Tax 2019 Templateroller