Self-Employment Income Support Scheme SEISS Grant Extension Today the Chancellor announced that the UK Government is increasing the overall level of the next SEISS grant from 55 to 80 of trading profits. However the guidance now states that a new employer can claim in respect of an employee who TUPE transferred to them after 31 August 2020 if the following conditions are met.

Key Take Aways From The Chancellor S Package Of Measures To Support Workers In The Coronavirus Crisis Resolution Foundation

Key Take Aways From The Chancellor S Package Of Measures To Support Workers In The Coronavirus Crisis Resolution Foundation

And second for both schemes 20 October 2020 is the first.

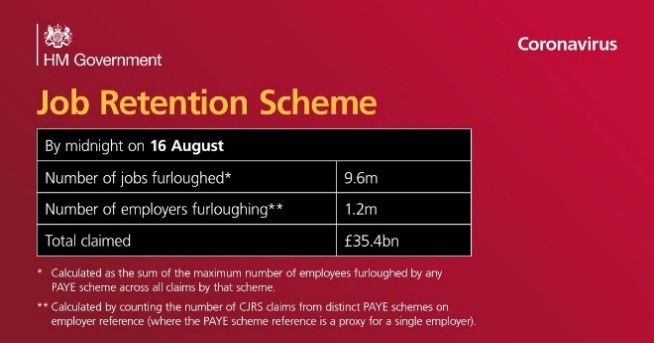

Self employment job retention scheme. This update provides a snapshot of those that were furloughed as at 30 September 2020. From 1 August 2020 employers will have to start contributing to the wage costs of. 22 October 2020 Statistics.

Find out more about how the scheme is changing. We have multiple opening in UK process. This grant will cover a three-month period from the start of November until the end of January.

462020 Coronavirus Job Retention Scheme. 1182021 Coronavirus Job Retention Scheme CJRS Self-Employment Income Support Scheme SEISS Id also like to update you on the information well be publishing on CJRS claims from this month. The employers contribution was phased in in 3 stages as follows-.

Claims for furlough days in March 2021 must be made by 14 April 2021. And its why we want to see the scheme extended now to protect those who still cant get back to work. 5282020 Thats why trade unions were at the forefront for arguing for a scheme to protect the incomes of the self-employed as the Job Retention Scheme has protected the wages of employees.

This update provides a snapshot of those that were furloughed as at the 31 August 2020. The Coronavirus Job Retention Scheme CJRS is a furlough scheme announced by Rishi Sunak the Chancellor of the Exchequer on 20 March 2020. 3262020 If you have other employment as a director or employee paid through PAYE your employer may be able to get support using the Coronavirus Job Retention Scheme.

Find out more about how the scheme is changing. Ad Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix. Coronavirus Job Retention Scheme CJRS Extension.

6112020 Coronavirus Job Retention Scheme and Self-Employment Income Support Scheme statistics. HM Revenue and Customs HMRC have published the number of claims made to the Coronavirus Job Retention Scheme CJRS and the Self-Employment Income Support Scheme SEISS up to 30 September 2020. Coronavirus Job Retention Scheme.

The scheme was announced on 20 March 2020 as providing grants to employers to pay 80 of a staff wage and employment costs each month up to a total of 2500 per person per month. Are you looking telecalling part time jobs. The coronavirus job retention scheme is due to last 19 months with effect from the 1st March 2020 until the 30th September 2021.

Why the scheme matters. 5132020 The Self-Employment Income Support Scheme claim service is now open. You can watch videos and register for.

Claims for furlough days in March 2021 must be made by 14 April 2021. Employees will receive 80 of their usual salary for hours not worked up to a maximum of 2500 per months until January 2021. However from the 1st August 2020 employers were asked to contribute towards the salaries of their furloughed staff.

There are important deadlines during October affecting the SelfEmployment Income Support Scheme SEISS and the Coronavirus Job Retention Scheme CJRS which advisers should be aware of. Ad Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix. Coronavirus Job Retention Scheme CJRS This update provides a snapshot of those that were furloughed as at the 31 January 2021.

612020 The Chancellor has announced three changes to the job retention scheme. We have multiple opening in UK process. 28 July 2020 Information about what to do if you were not eligible.

Coronavirus Job Retention Scheme. CJRS will remain open until 31 March 2021. HM Revenue and Customs HMRC have published the number of claims made to the Coronavirus Job Retention Scheme CJRS and the Self-Employment Income Support Scheme SEISS up to 31 October 2020.

HM Revenue and Customs HMRC have published the number of claims made to the Coronavirus Job Retention Scheme CJRS and the Self-Employment Income Support Scheme SEISS up to 15 February 2021. The Government will review the policy in January. First for the SEISS no further claims can be made after the scheme closes on 19 October 2020.

4202020 The Coronavirus Job Retention Scheme has been extended until 30 September 2021. Coronavirus Job Retention Scheme and Self-Employment Income Support Scheme statistics. 3222021 Previously it was unclear whether new employers could benefit from the coronavirus job retention scheme if the employees transferred after 28 February 2020.

Are you looking telecalling part time jobs. From 1 July 2020 the scheme will be made more flexible to enable employers to bring previously furloughed employees back part time and still receive a grant for the time when they are not working. Eligibility criteria for employers.

3262020 The Coronavirus Job Retention Scheme has been extended until 30 September 2021.

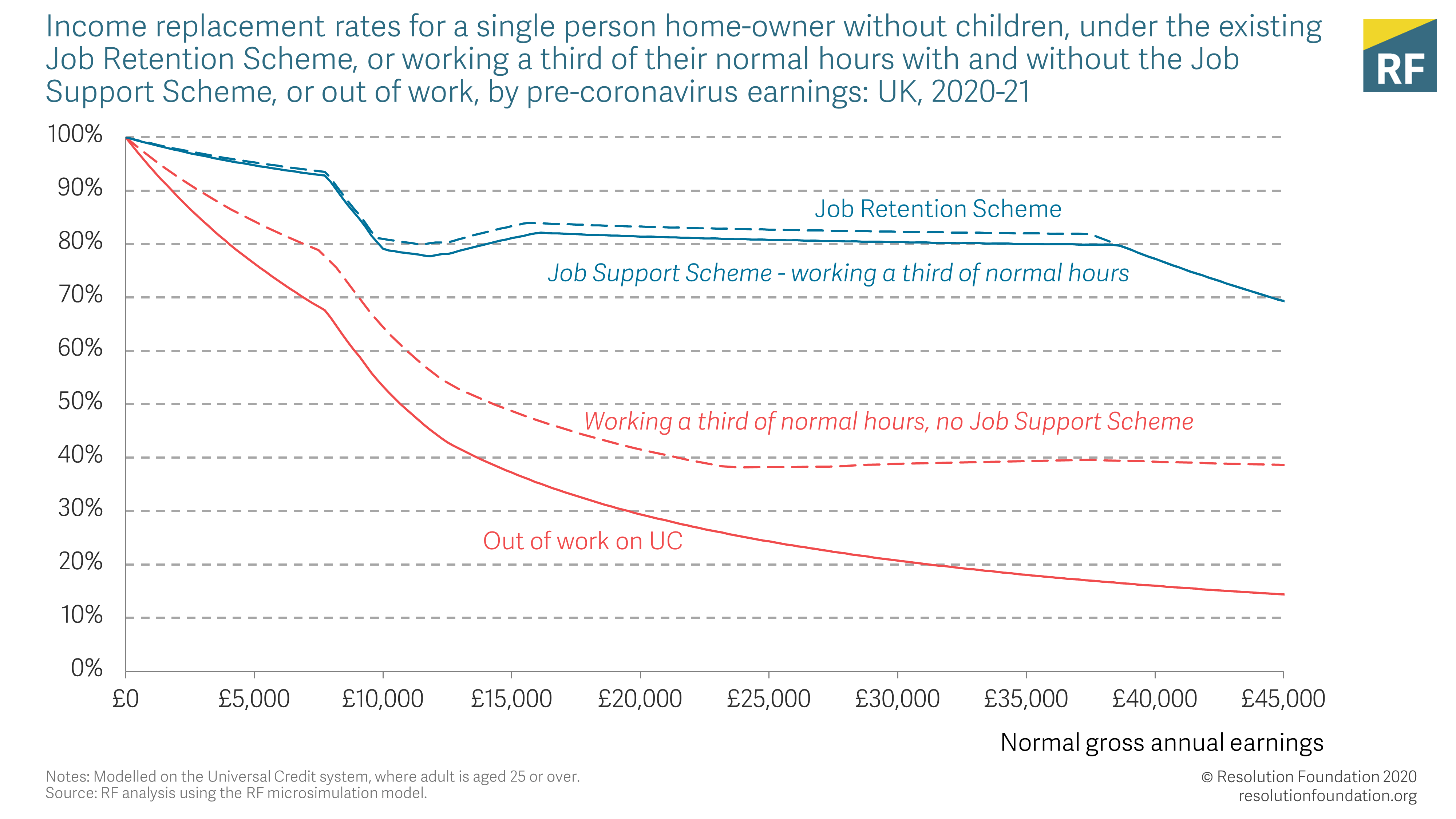

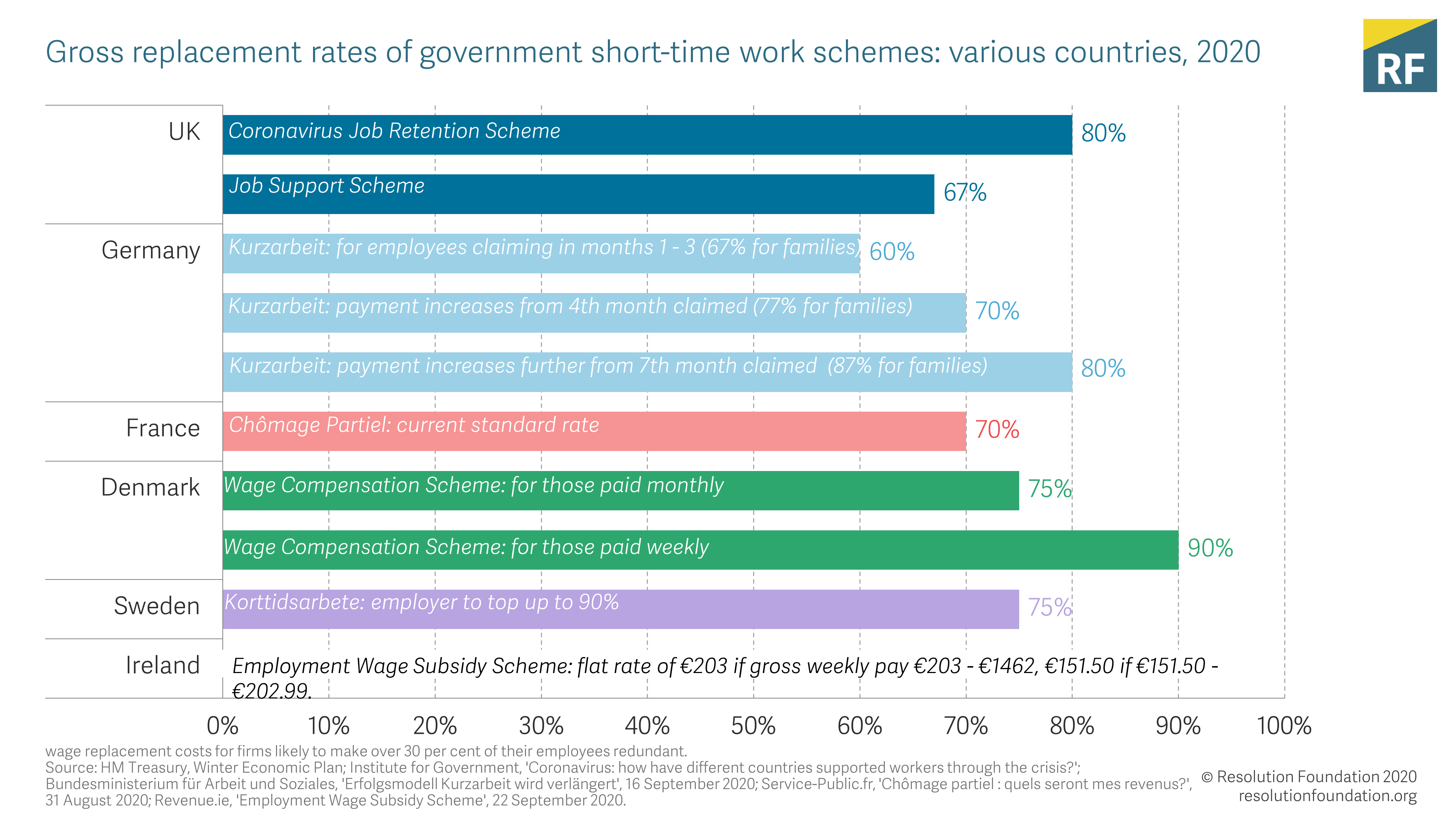

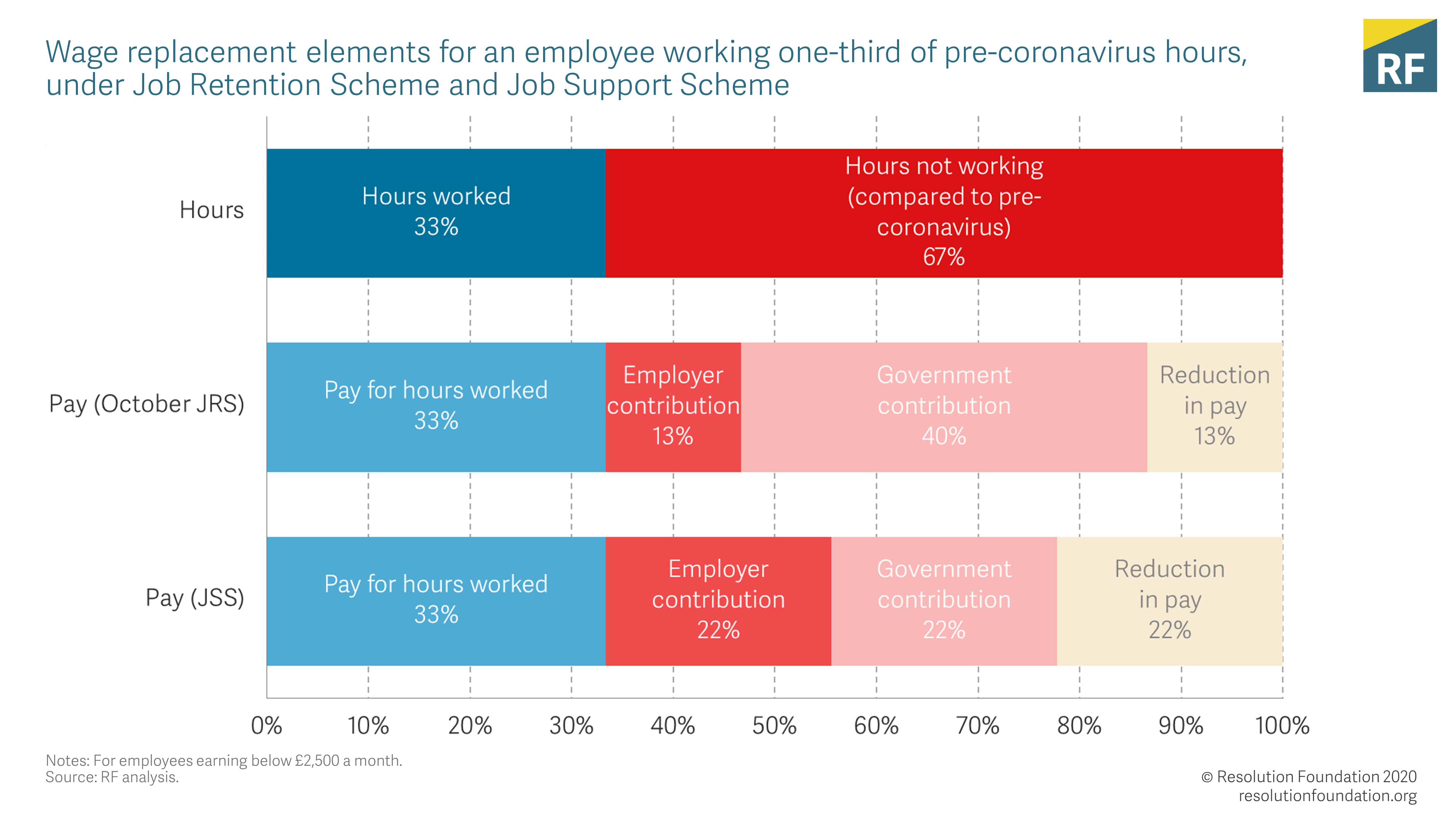

The Winter Economy Plan Is Coming Resolution Foundation

The Winter Economy Plan Is Coming Resolution Foundation

Germany S Short Time Work Scheme Can Its Past Success Be Replicated Ecoscope

Germany S Short Time Work Scheme Can Its Past Success Be Replicated Ecoscope

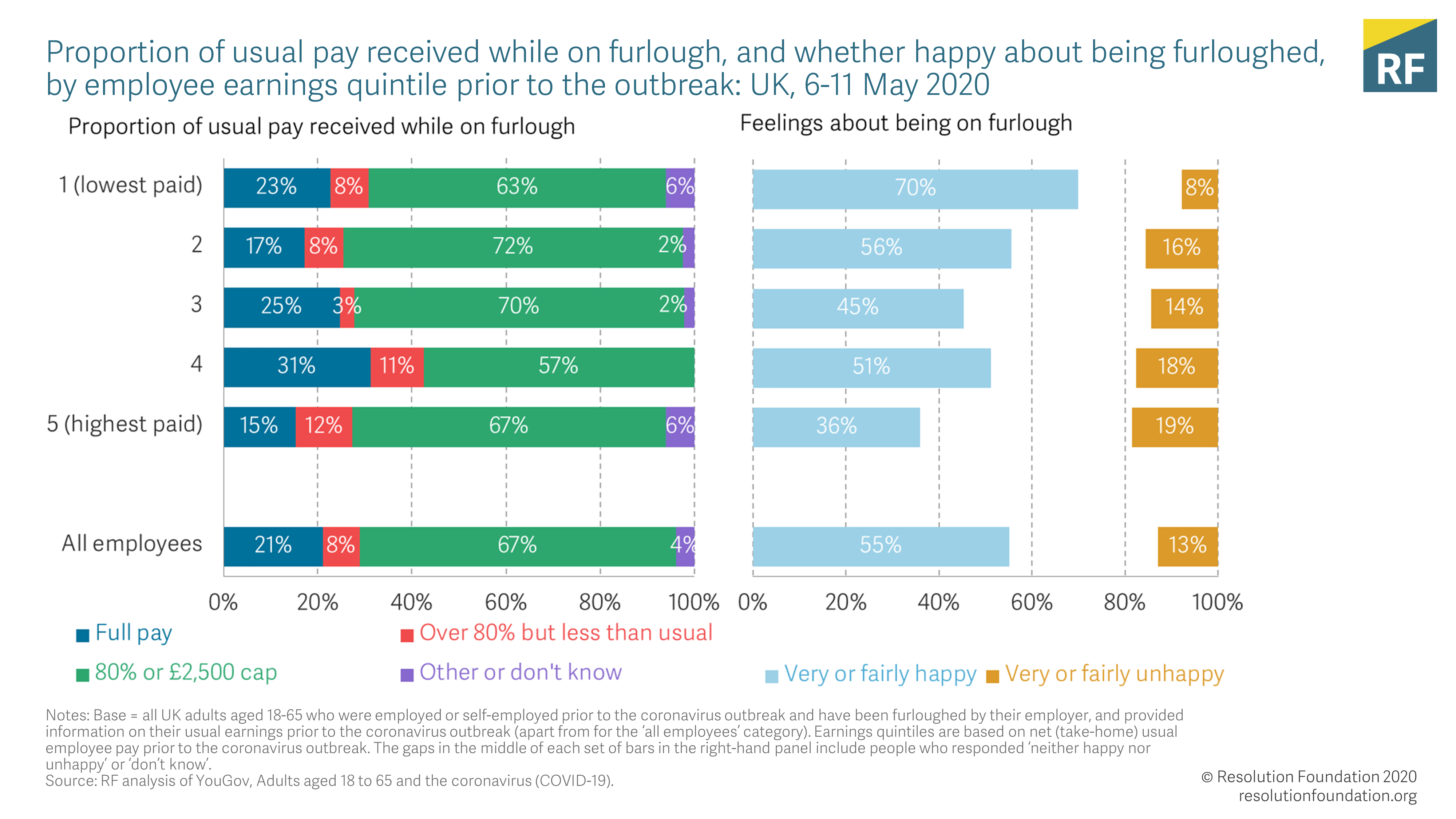

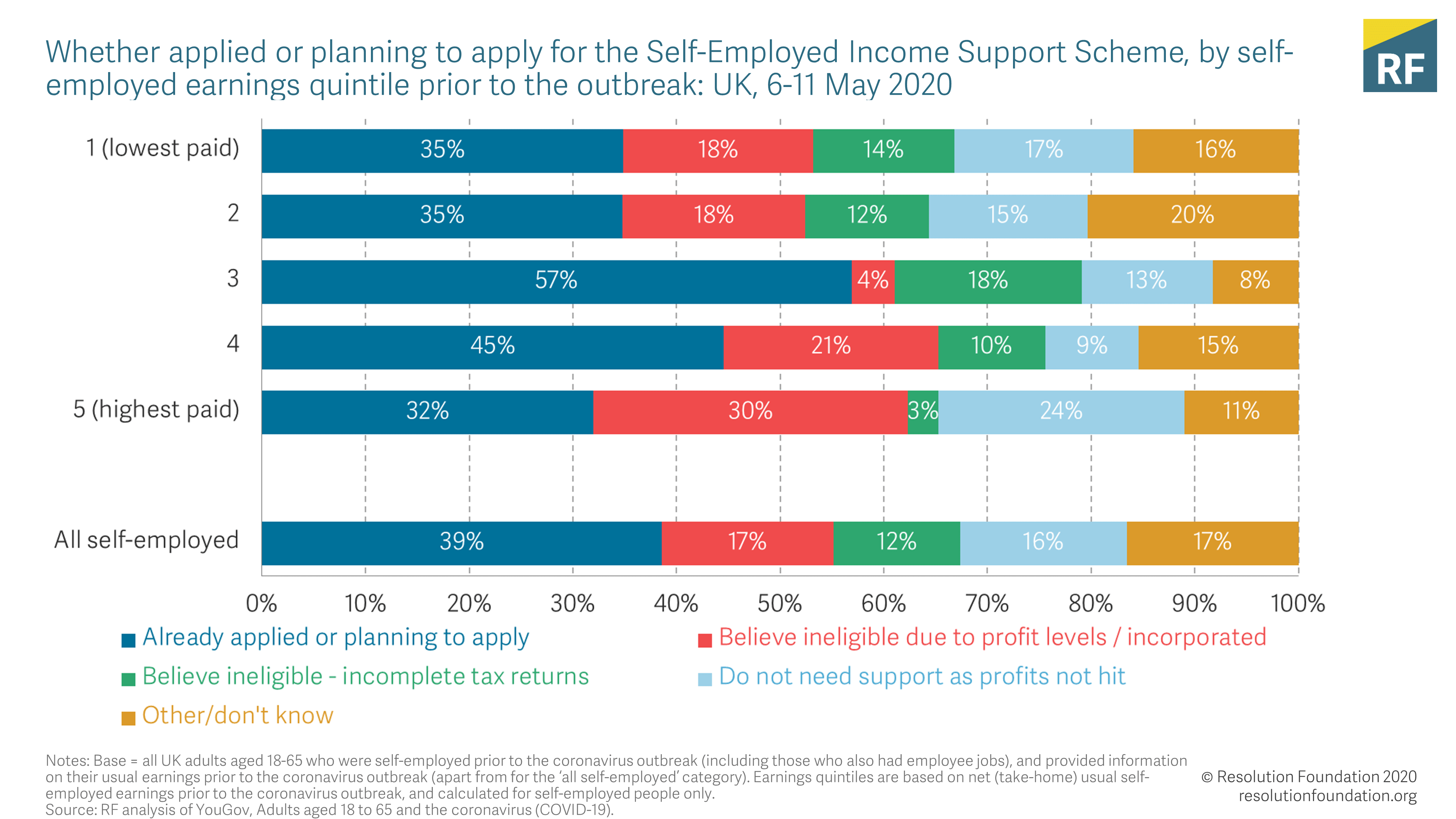

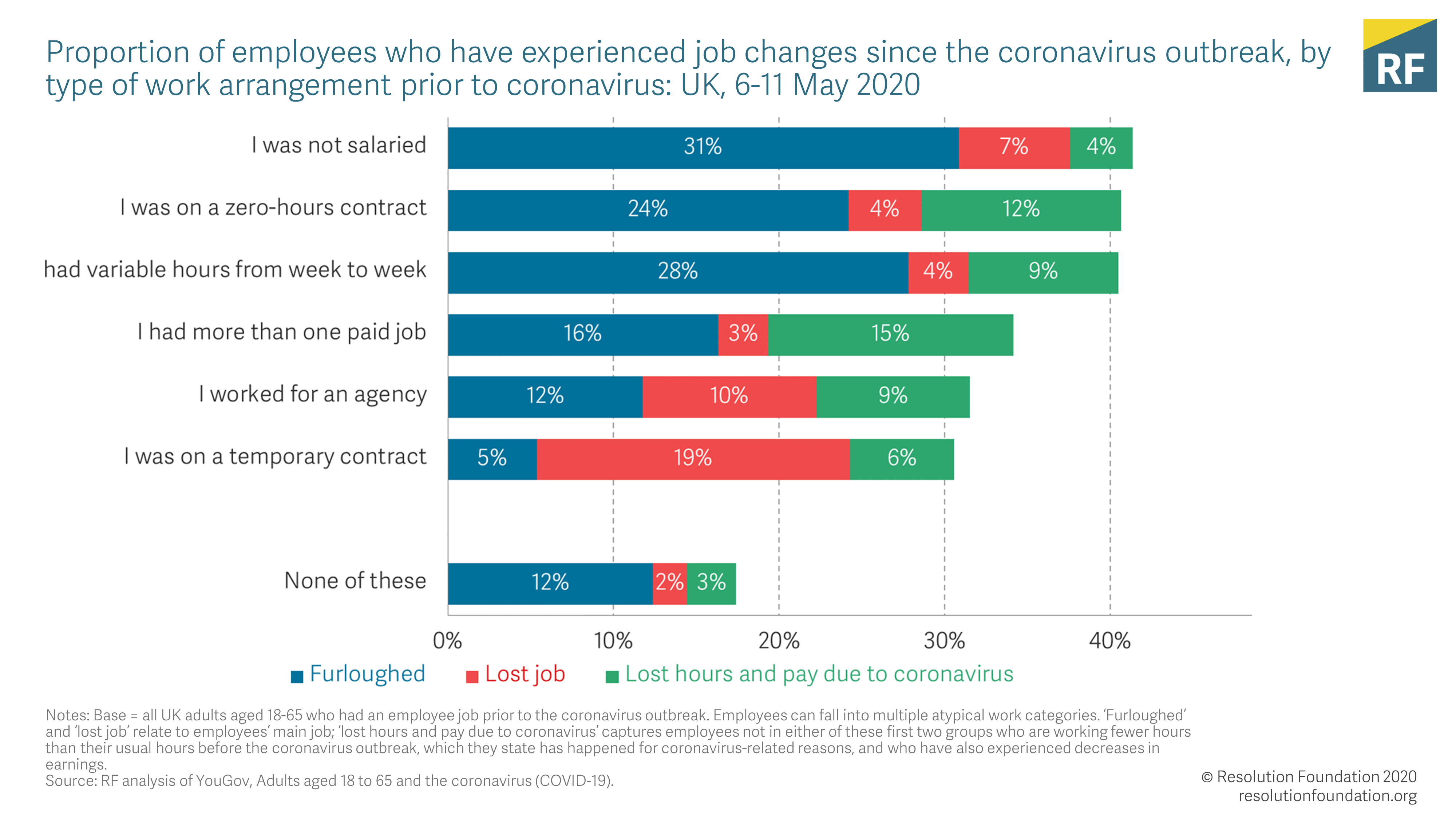

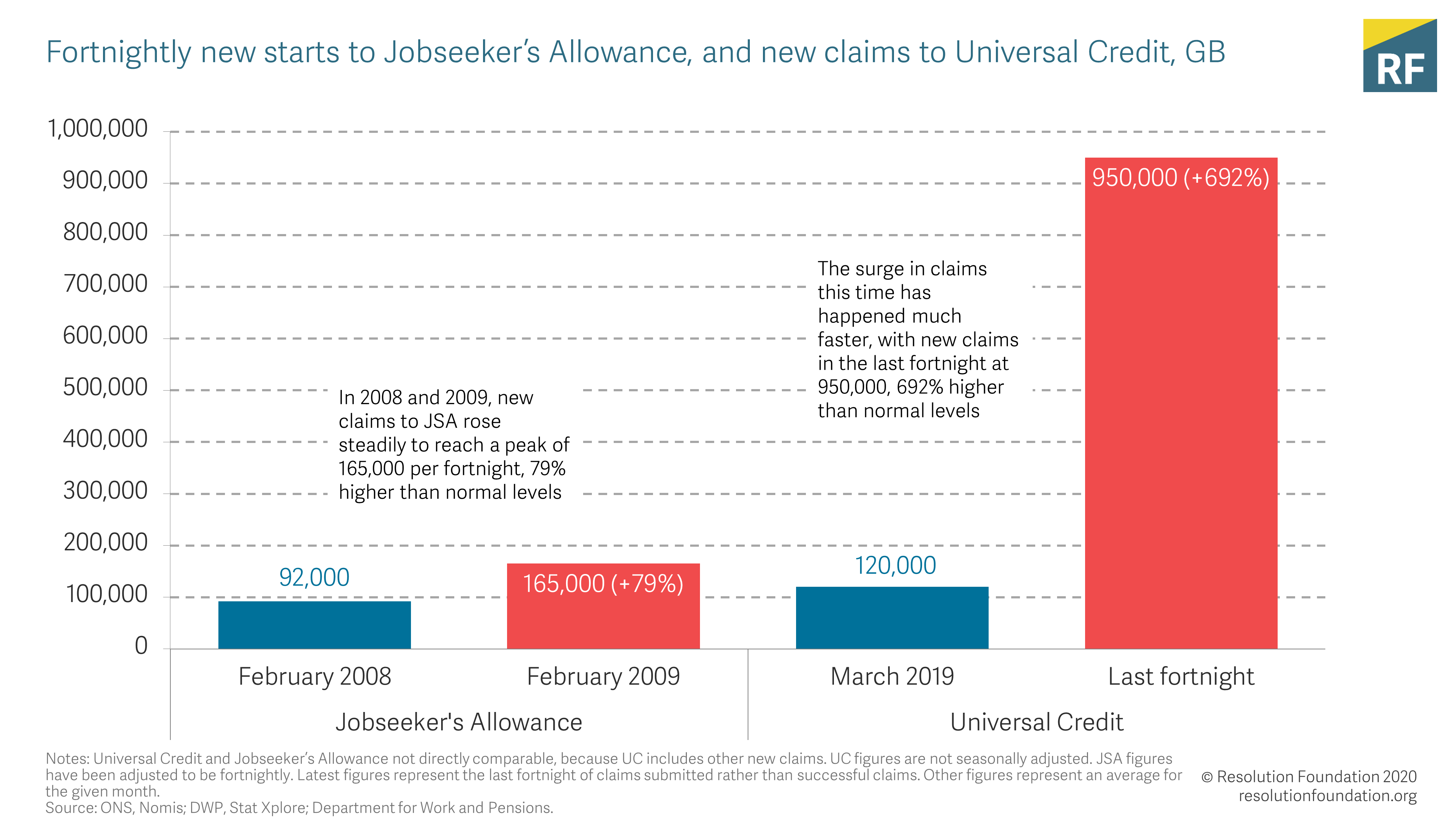

The Effects Of The Coronavirus Crisis On Workers Resolution Foundation

The Effects Of The Coronavirus Crisis On Workers Resolution Foundation

Monthly Economic Brief February 2021 Gov Scot

Monthly Economic Brief February 2021 Gov Scot

Germany S Short Time Work Scheme Can Its Past Success Be Replicated Ecoscope

Germany S Short Time Work Scheme Can Its Past Success Be Replicated Ecoscope

The Effects Of The Coronavirus Crisis On Workers Resolution Foundation

The Effects Of The Coronavirus Crisis On Workers Resolution Foundation

The Winter Economy Plan Is Coming Resolution Foundation

The Winter Economy Plan Is Coming Resolution Foundation

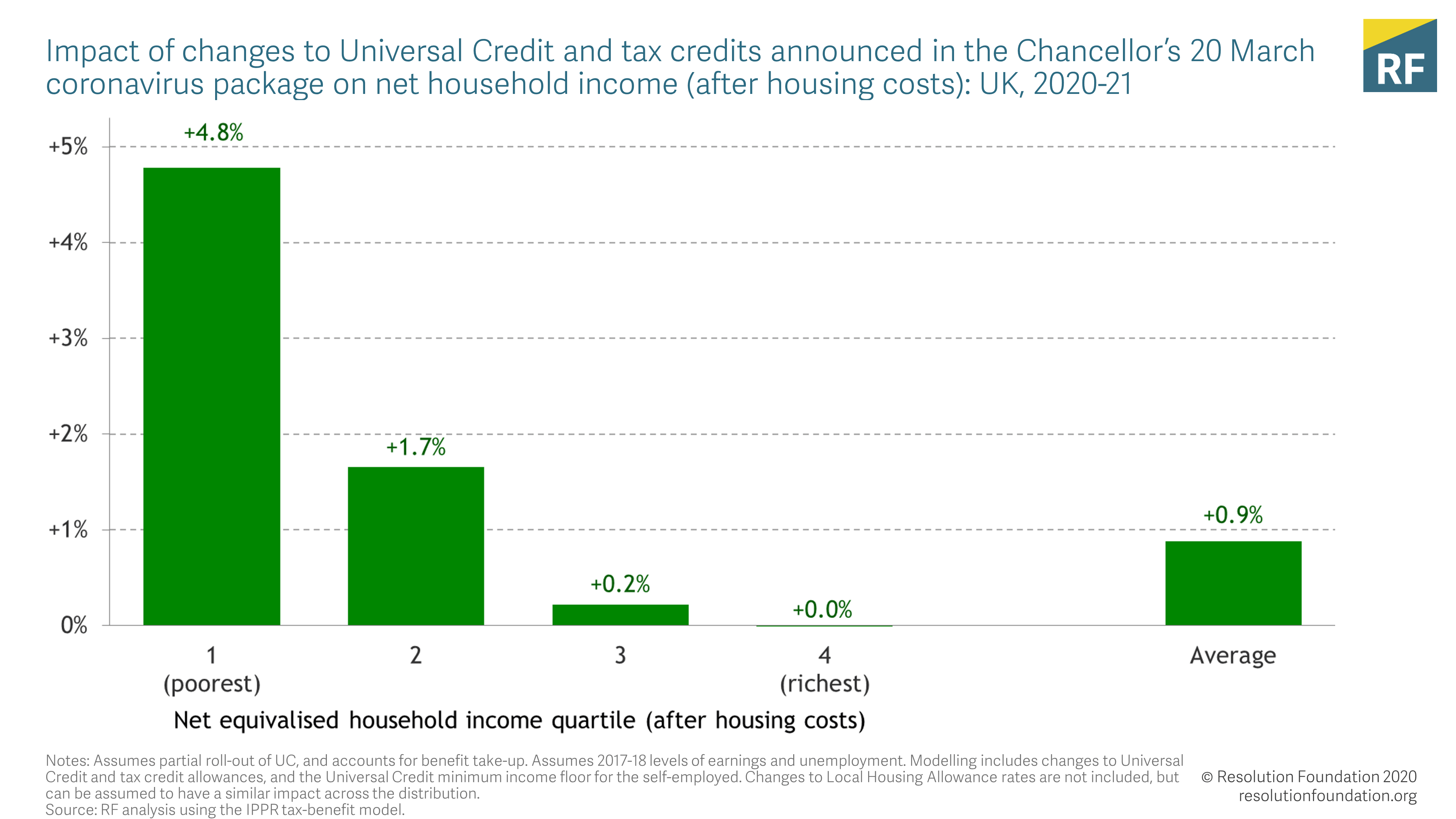

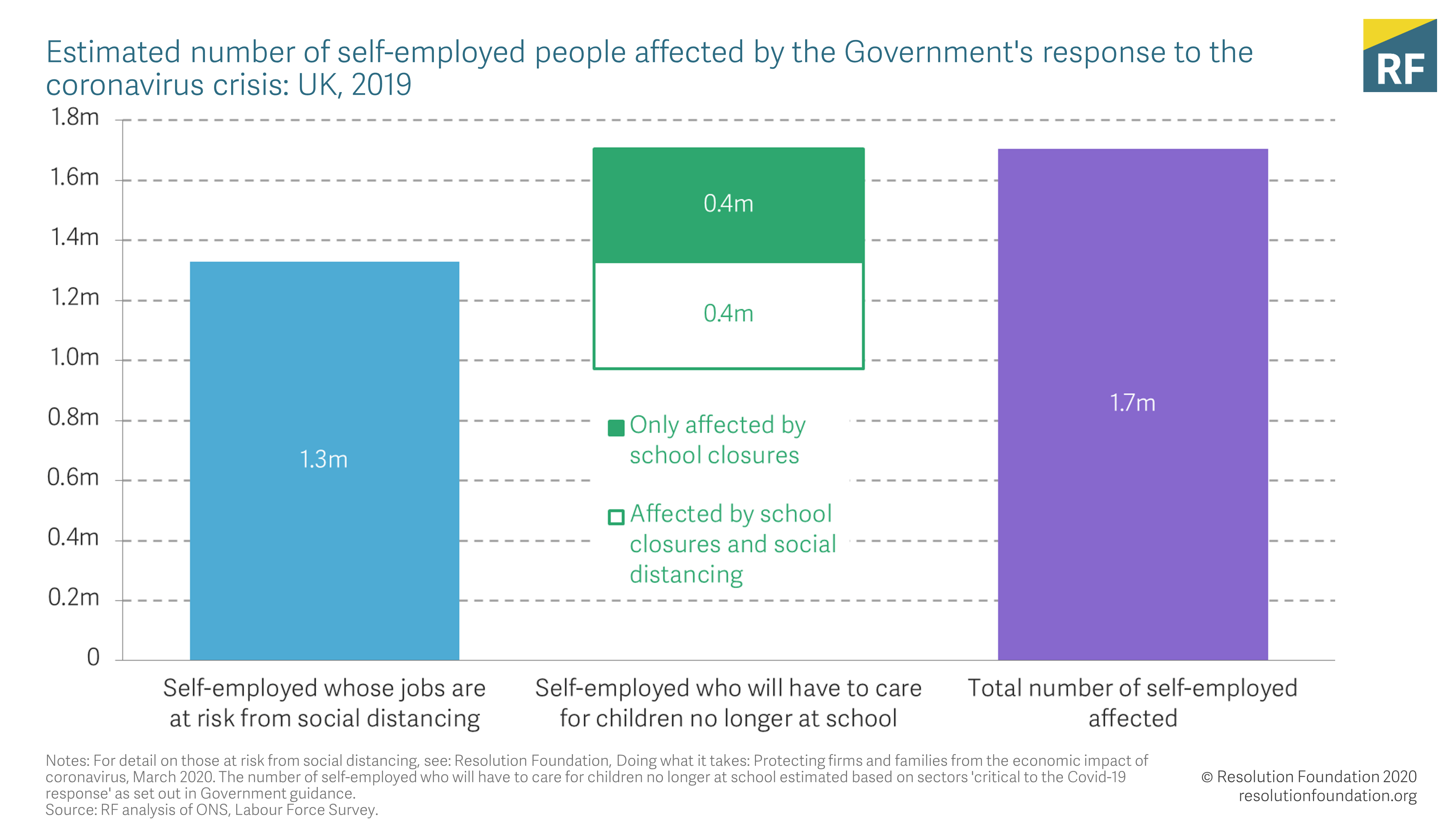

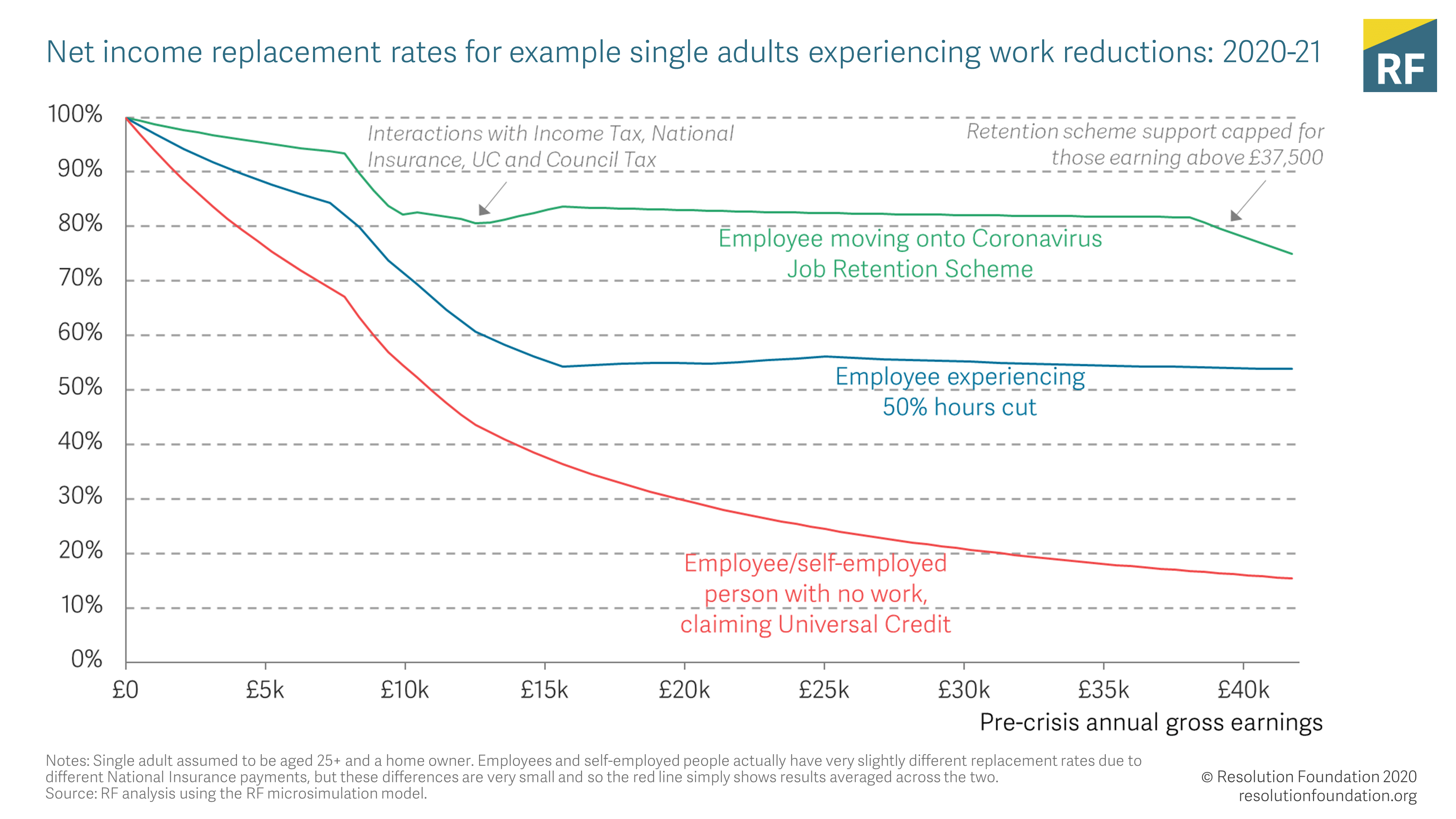

Next Steps To Support Family Incomes In The Face Of The Coronavirus Crisis Resolution Foundation

Next Steps To Support Family Incomes In The Face Of The Coronavirus Crisis Resolution Foundation

The Effects Of The Coronavirus Crisis On Workers Resolution Foundation

The Effects Of The Coronavirus Crisis On Workers Resolution Foundation

The Data Science Behind Hmrc S Covid 19 Response Hmrc Digital

The Data Science Behind Hmrc S Covid 19 Response Hmrc Digital

The Coronavirus Job Retention Scheme Updated Faqs For Uk Employers Lawyers Solicitors London

The Coronavirus Job Retention Scheme Updated Faqs For Uk Employers Lawyers Solicitors London

Job Retention Scheme Millions Of Furloughed Workers Show Why Unions Fought For Wage Protection Tuc

The Winter Economy Plan Is Coming Resolution Foundation

The Winter Economy Plan Is Coming Resolution Foundation

No Work No Pay Resolution Foundation

No Work No Pay Resolution Foundation

Coronavirus What Is The Job Retention Scheme Low Incomes Tax Reform Group

Coronavirus What Is The Job Retention Scheme Low Incomes Tax Reform Group

Next Steps To Support Family Incomes In The Face Of The Coronavirus Crisis Resolution Foundation

Next Steps To Support Family Incomes In The Face Of The Coronavirus Crisis Resolution Foundation

Job Retention Scheme Millions Of Furloughed Workers Show Why Unions Fought For Wage Protection Tuc

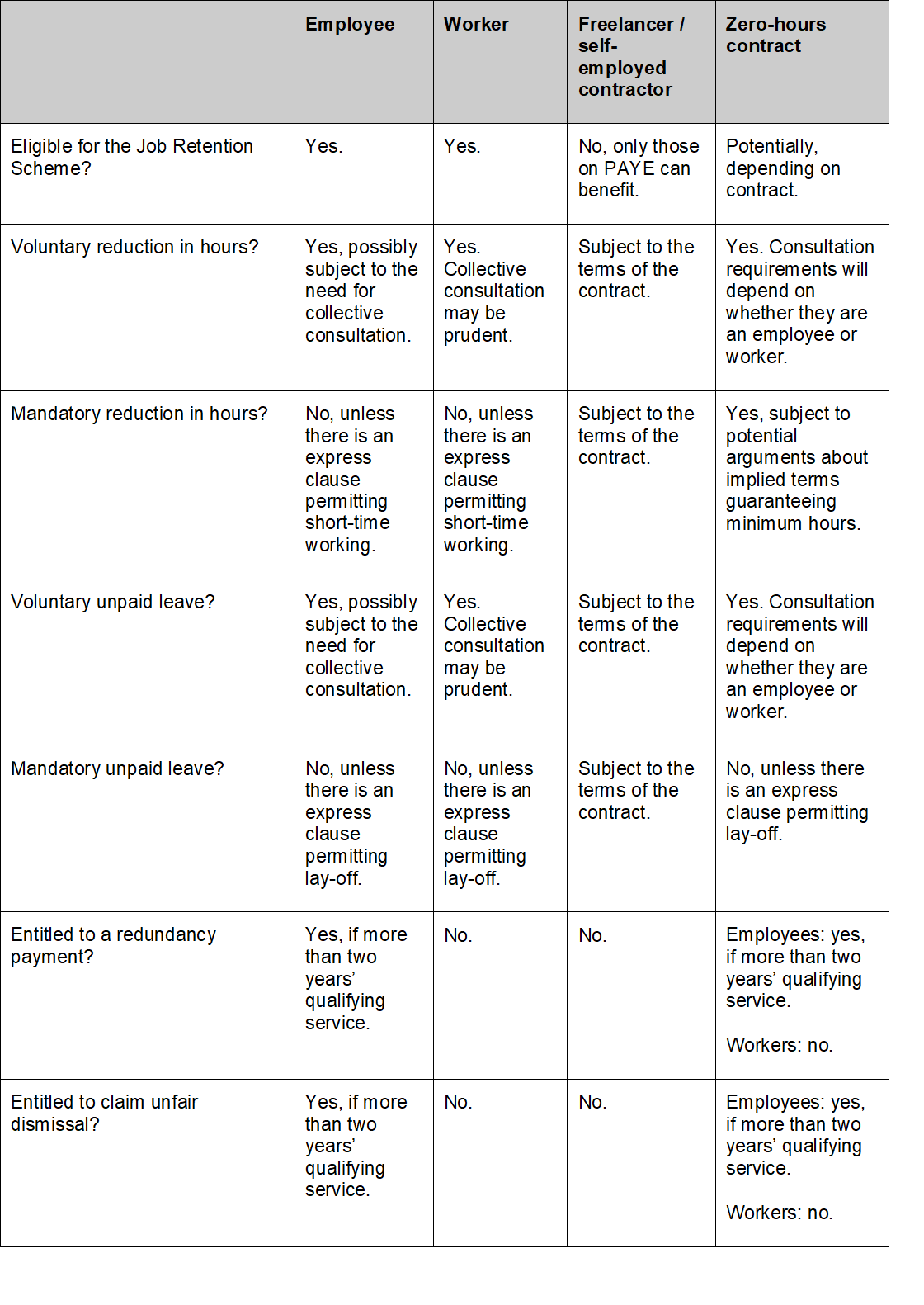

Coronavirus And Contractual Variation

Coronavirus And Contractual Variation