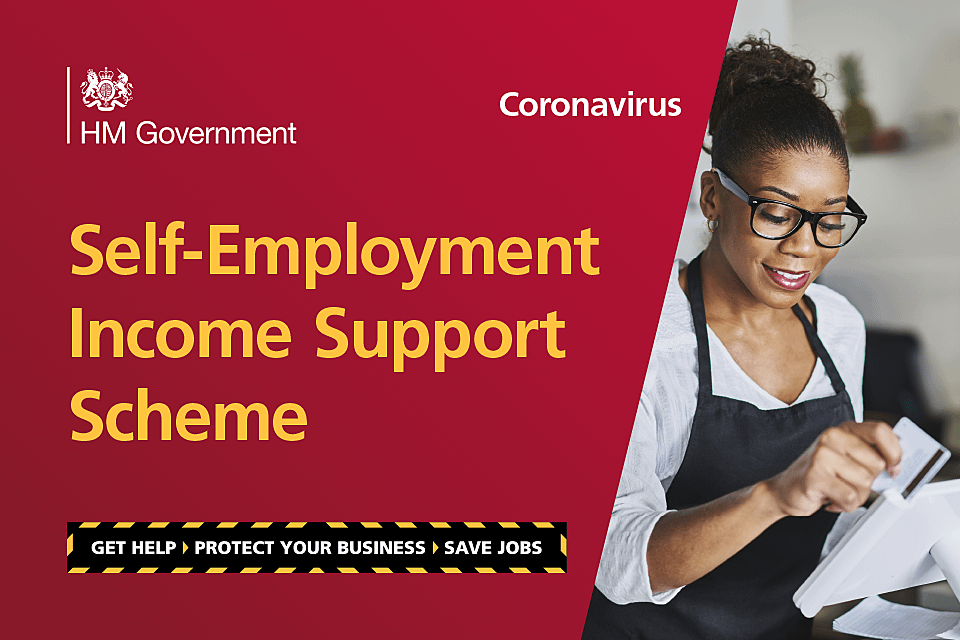

Nature of the allowance If youre self-employed and own your limited company you can take money out of your company as a dividend or you may receive a dividend payment if you own company shares. THE Singapore government will provide direct cash assistance to self-employed persons to help them ride out the Covid-19 storm under a supplementary budget announced on Thursday afternoon.

What Are Articles Of Association Go Self Employed Video Video Articles Of Association Financial Motivation Business Plan Template

What Are Articles Of Association Go Self Employed Video Video Articles Of Association Financial Motivation Business Plan Template

20000 12500 02 1500.

Self employment 1000 allowance. 1000 Trading Allowance Small Self Employments From April 2017 there is a 1000 Property and Trading Income Allowance in HMCs own words. The Trading Allowance You can claim the first 1000 of income from self-employment as a flat tax-free allowance. The allowance is really geared up for people who have odd-jobs like baby sitting but it is useful if you are just starting out as self-employed.

Eligible self-employed persons will receive S1000 a month. Self-employed persons to get S1000 cash each month more training allowance. This is on your gross income.

This means if. You wont be eligible to claim other expenses though including the allowances listed below. That is income before any expenses.

Youre now entitled to a tax-free trading allowance on your first 1000 of self employment income. First 12500 is tax-free then its 20 and so on. If your income is more than 1000 you will need to register with HMRC and fill in a.

Enter the trading allowance claim as an expense to reduce your income to zero or by 1000. The Personal Allowance which has different tax bands ie. It applies to individuals onlynot partnerships eg husband and wife trading in.

According to DPM Heng the government expects to reach out to most of the self-employed persons who depend on. The allowance can be used against any trading casual or miscellaneous income. For 202021 this is set at 2000 so if youre thinking of branching out to be self-employed or have made the switch last year this is what you need to consider.

The trading allowance has been introduced for the 201718 tax year onwards to exempt trading casual andor miscellaneous income of up to 1000 per tax year from income tax. Trading and Property Allowance You can earn up to an extra 1000 tax free from what is called the trading or property allowance. Then when tax-time comes you can make your claim within the self-employment section of the tax return.

Tax-free allowances on property and trading income. Still for most self-employed people this is more than their expenses. This is called the Trading Allowance.

1142019 Yes the new self employment trading allowance has been agreed at 1000. 472017 The trading allowance is a tax exemption of up to 1000 a year for individuals with trading income from. The trading allowance in the UK is a very simple new 1000 allowance designed to reduce paperwork both for HMRC and self employed folk.

Youre still self employed see below but you just dont need to fill in a tax return sort of. If youre self-employed you can get up to 1000 each tax year as a tax-free allowance. 3212016 Under the new allowances from April next year individuals with property or trading income wont need to declare or pay tax on the first 1000 they earn from each source per year.

The first 1000 from self-employment like freelancing or contracting. Does this mean that if I earned 20000 as an employee and 1000 as a freelancer I only pay this amount of tax. The government announced at Budget 2016 the introduction of a 1000 allowance for property income and a 1000 allowance for trading income from the 2017 to 2018 tax year.

This is 1000 in turnover not profit. To claim the 1000 trading allowance youll need to fill out two boxes. Under the scheme self-employed persons will receive S1000 a month for nine months.

If your income is less than 1000 you dont need to declare it. The exemption is automatic and if your self employed income is 1000 or less you do not need to tell HMRC or file a tax return. 8102020 You get 100000 tax free for self-employment or property only this is known as the Trading Allowance.

Thats 1000 turnover not profit. This might include income from what is often known as the sharing economy for example car. The trading and property allowance allows everyone in the UK to earn 1000 from self-employment income or rental payments tax-free.

Enter income within the turnover section. The Allowance is 1000 of GROSS income. Self-employment casual services for example babysitting or gardening helpsheet 325.

Self Employed Tax Dummies Guide To Tax And Self Employement

Self Employed Tax Dummies Guide To Tax And Self Employement

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Spreadsheet Bookkeeping Templates Bookkeeping

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Spreadsheet Bookkeeping Templates Bookkeeping

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Guide To Self Employment Versus Limited Company

Guide To Self Employment Versus Limited Company

Are You Planning To Take Advantage Of All Your Tax Free Allowances From 6 April 2017 Uk Accounting Tax Advise Tax Free How To Plan Allowance

Are You Planning To Take Advantage Of All Your Tax Free Allowances From 6 April 2017 Uk Accounting Tax Advise Tax Free How To Plan Allowance

Employment Jersey Law Employment 1950s Employment 61401 Employment Contract Definition Home De Job Application Form Job Application Contract Template

Employment Jersey Law Employment 1950s Employment 61401 Employment Contract Definition Home De Job Application Form Job Application Contract Template

Do You Constantly Debate The Employed V Self Employed Argument Plus Accounting

Do You Constantly Debate The Employed V Self Employed Argument Plus Accounting

A Guide To Self Employment For Uk Fitness Professionals

A Guide To Self Employment For Uk Fitness Professionals

Have You Correctly Claimed The Third Self Employment Income Support Scheme Seiss Grant Low Incomes Tax Reform Group

Have You Correctly Claimed The Third Self Employment Income Support Scheme Seiss Grant Low Incomes Tax Reform Group

A Guide To Deciding Between Sole Trader V Limited Company V Umbrella

A Guide To Deciding Between Sole Trader V Limited Company V Umbrella

Self Employed And Taxes Deductions For Health Retirement

Self Employed And Taxes Deductions For Health Retirement

Using Self Employment To Meet The Settlement Uk Spouse Visa Income Threshold Cross Border Legal Solicitors

Using Self Employment To Meet The Settlement Uk Spouse Visa Income Threshold Cross Border Legal Solicitors

How To Invest Money Best Small Investments Uk For 10 To 1000 Investing Investing Money Best Money Saving Tips

How To Invest Money Best Small Investments Uk For 10 To 1000 Investing Investing Money Best Money Saving Tips

Schedule C Income Mortgagemark Com

Schedule C Income Mortgagemark Com

Seiss Grant Extension Fourth Grant Feb To April 2021

Seiss Grant Extension Fourth Grant Feb To April 2021

Coronavirus Seiss Fourth And Fifth Grants Low Incomes Tax Reform Group

Coronavirus Seiss Fourth And Fifth Grants Low Incomes Tax Reform Group

Top Self Employment Ideas Business Opportunities From Home Self Employment Employment Business Ideas List

Top Self Employment Ideas Business Opportunities From Home Self Employment Employment Business Ideas List

New Enterprise Allowance Christmas Market Lylm Blog New Enterprise Successful Business Owner Marketing

New Enterprise Allowance Christmas Market Lylm Blog New Enterprise Successful Business Owner Marketing