For the year Jan. If you are self-employed you are responsible.

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

And what does and does not make up self-employment income is discussed in greater depth in the instructions for the form 1040-SS and the form 1040-PR.

U.s. self-employment tax return. 31 2019 or other tax year beginning 2019 and ending 20. 31 2020 or other tax year beginning 2020 and ending 20. 7122019 The SE tax is the way the Feds collect Social Security and Medicare taxes on non-salary income from work-related activities.

11252009 The Self Employment Tax is a Social Security and Medicare tax on the net earnings of self-employed individuals in the United States. Self-Employment Tax Return OMB No. For the year Jan.

Self-employment tax is due when an individual has net earnings of 400 or more in self-employment income over the course of the tax year or 10828 or. Income tax return if you had 400 or more of net earnings from self-employment regardless of your age. 31 1994 or other tax year beginning 1994 and ending 19.

1112019 The self-employment tax rate for 2018 is 153. Virgin Islands Guam American Samoa the Commonwealth of the Northern Mariana Islands or Puerto Rico. The tax rate can be divided into two with 765 making up the employer contributions and 765 the employee contributions.

Yes the same amount as self-employment tax on just 50000 instead of the whole 100000. Virgin Islands Guam American Samoa the Commonwealth of the Northern Mariana Islands CNMI or Puerto Rico. The rate consists of two parts.

Self-Employment Tax Return Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico US. SE tax applies no matter how old you are and even if you already are receiving social security or Medicare benefits. Tax return each year as proof of the US.

Exemption from self-employment taxes. Self-Employment Tax Return Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico US. Self-Employment Tax Return Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico in February 2021 so this is the latest version of Form 1040-SS fully updated for tax year 2020.

1545-0090 Form 1040-SS Virgin Islands Guam American Samoa the Commonwealth of the Northern Mariana Islands CNMI or Puerto Rico Department of the Treasury Internal Revenue Service For the year Jan. Virgin Islands Guam American Samoa the Commonwealth of the Northern Mariana Islands or Puerto Rico. Virgin Islands Guam American Samoa the Commonwealth of the Northern Mariana Islands or Puerto Rico.

The Social Security Administration SSA uses this information to figure your benefits under the social security program. One purpose of the form is to report net earnings from self-employment SE to the United States and if necessary pay SE tax on that income. For 2019 the SE tax.

Federal income tax returns and is subject to self-employment tax to the extent such services are performed within the United States. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Self-Employment Tax Return Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico US.

In accordance with Revenue Procedure 84-54 the foreign certificate serves as proof of the exemption from US. Government determines who owes self-employment tax on income earned while living abroad. You must pay self-employment tax on.

Social Security taxes for the period shown on the. If you make 100000 in earnings from your S Corp you can have that income paid out as 50000 in salary and 50000 in profit. For the year Jan.

Youll pay FICA payroll taxes 153. From this amount 124 accounts for Social Security and 29 goes towards Medicare. Presently the government requires that you file a US.

For the year Jan. That rate is the sum of a 124 Social Security tax and a. 31 2011 or other tax year beginning 2011 and ending 20.

31 2014 or other tax year beginning. So as I mentioned earlier the form 1040-SS which is the US. Citizens the income paid for services rendered to a foreign government or international organization is reportable as self-employment income on their US.

Self-Employment Tax Return or the 1040-PR which is the Spanish version of the form is used to report and pay self-employment tax. The remaining 50000 of your income is only subject to income tax. The self-employment tax rate is 153.

Self-Employment Tax Return Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico US. Citizen or resident must attach a photocopy of the foreign certificate to his US. We last updated the US.

9112019 The self-employment tax rate for 2021 As noted the self-employment tax rate is 153 of net earnings. Self-Employment Tax on Foreign Income.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png) Schedule C Profit Or Loss From Business Definition

Schedule C Profit Or Loss From Business Definition

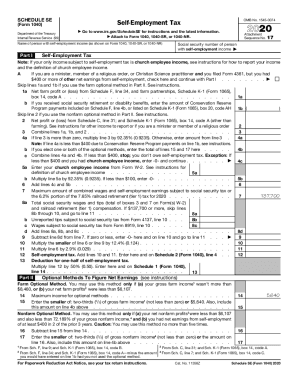

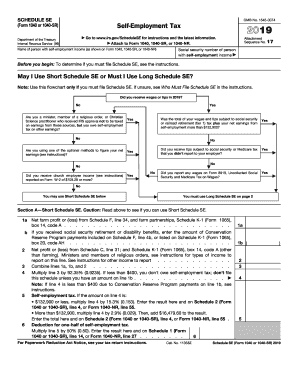

Irs Schedule Se 1040 Form Pdffiller

Irs Schedule Se 1040 Form Pdffiller

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

Self Employed Health Insurance Deduction Healthinsurance Org

Self Employed Health Insurance Deduction Healthinsurance Org

What Types Of Business Partnerships Must File Form 1065 Silver Tax Group

What Types Of Business Partnerships Must File Form 1065 Silver Tax Group

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

Schedule Se 1040 Year End Self Employment Tax

Schedule Se 1040 Year End Self Employment Tax

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Self Employed Calculate Your Quarterly Estimated Income Tax Xendoo

Irs Schedule Se 1040 Form Pdffiller

Irs Schedule Se 1040 Form Pdffiller

Self Employed And Taxes Deductions For Health Retirement

Self Employed And Taxes Deductions For Health Retirement

7 Self Employment Tax Forms For Home Business Owners Tax Forms Business Tax Small Business Finance

7 Self Employment Tax Forms For Home Business Owners Tax Forms Business Tax Small Business Finance

Tax Return Fake Tax Return Tax Letter Of Employment

Tax Return Fake Tax Return Tax Letter Of Employment

Form 1040 Ss U S Self Employment Tax Return Form 2014 Free Download

Form 1040 Ss U S Self Employment Tax Return Form 2014 Free Download

Top 8 Irs Tax Forms You Need To Know Taxact Blog

Top 8 Irs Tax Forms You Need To Know Taxact Blog

Your Self Employed Tax Return Youtube

Your Self Employed Tax Return Youtube

Do Self Employed Individuals Need To Pay Taxes Selfemployed Taxes Paying Taxes Tax Services Income Tax

Do Self Employed Individuals Need To Pay Taxes Selfemployed Taxes Paying Taxes Tax Services Income Tax

Customizing You To Your Market Home Business Business Tax Return

Customizing You To Your Market Home Business Business Tax Return

Form 1040 Ss U S Self Employment Tax Return Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico