If playback doesnt begin shortly try restarting your device. How To Claim 600WEEK Unemployment - YouTube.

Self Employment Robergtaxsolutions Com

1112021 How Much Is the Self-Employment Tax.

Self employment tax $600. But note that social security tax is applied on maximum maxed 137700 for the tax year 2020 This was 132000 for 2019. The self-employment tax rate is 153. But how do you calculate it.

You each also pay Medicare taxes of 145 percent on all your wages - no limit. You will only receive a 1099 form if you earned more than 600 from a company but youll still have to report all income less than that so keep accurate financial records. 172020 Calculating Self-Employment Income If you receive 1099 forms tally up the totals in Box 7 titled Nonemployee Compensation.

I made just over 600 from livestreaming this year and I know I have to file for self-employment tax. To get a more accurate calculation use our tax rate calculator above to estimate how much you should set aside for taxes. Are you looking telecalling part time jobs.

662019 Form 1099-MISC is required to be issued to independent contractors or the self-employed who have been paid 600 or more. Social Security and Medicare. Whether you earn 1 or 100000 youre required to report your earnings at tax time.

If you were paid less than 600 for your services an amount that doesnt trigger a 1099-MISC youre still responsible for reporting the income. Payers are typically not required to complete a Form 1099-Misc unless they pay at least 600. If you are self-employed your Social Security tax.

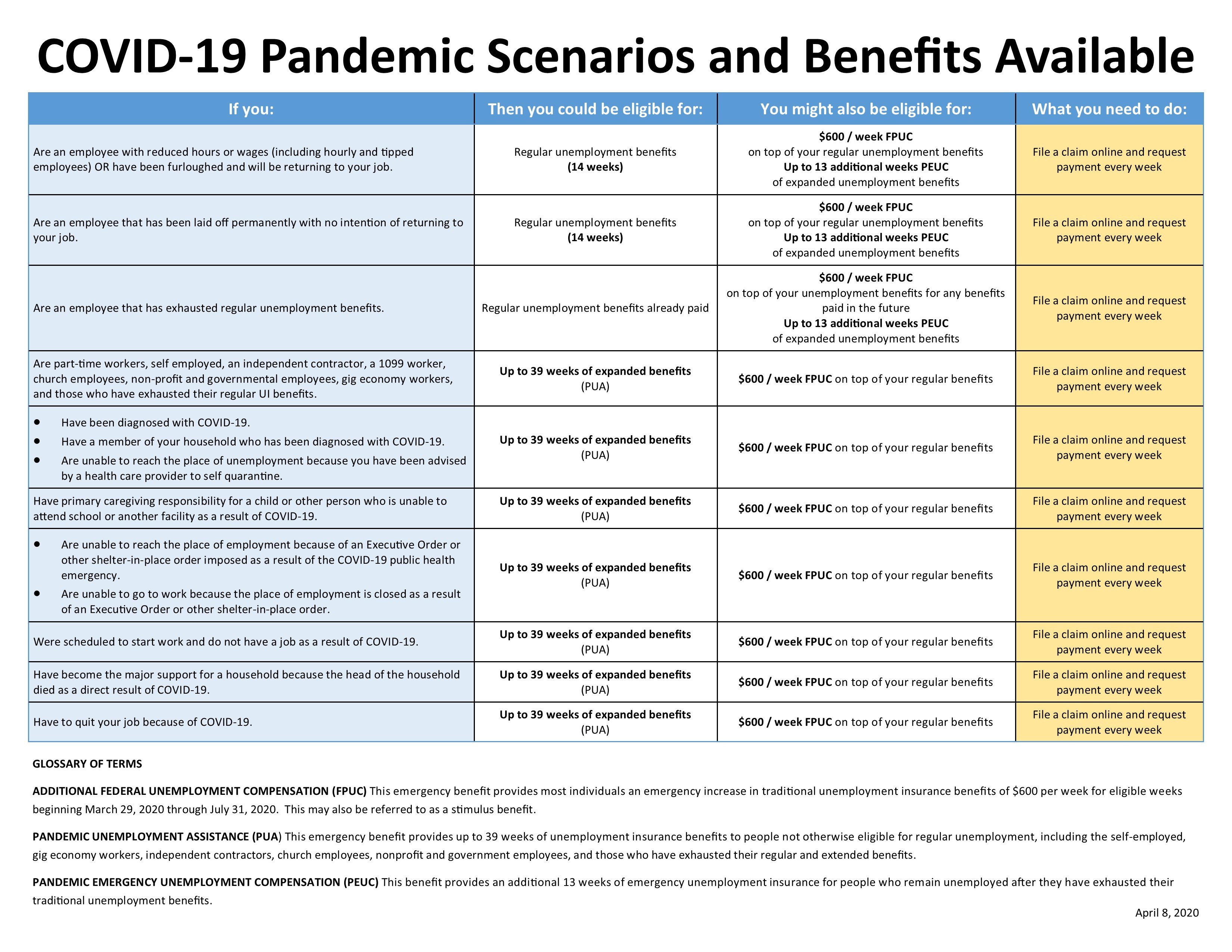

The benefit amount will be similar to traditional unemployment benefits plus an additional 600 per week. Hi quick question regarding taxes as this is my first year filing pretty late to be doing them I know. We have multiple opening in UK process.

2122020 On you Schedule SE where you calculate your self employment tax they have you take 765 off your business profit before you start calculating the self employment tax. In a way you could say your self employment tax is really 1413. Before you can determine if you are subject to self-employment tax and income tax.

662019 Yes if you are required to file a tax return you have to report ALL income whatever the amount including self-employment income under 600. For the self-employed aggregate payments over 600 require a 1099. That doesnt mean that lesser payments arent taxable but the client doesnt have to furnish a 1099 to the contractor.

This means that along with filing an annual return youll need to pay income taxes and self-employment taxesand yes those are two different types of taxes. Note that the 600 is a threshold below which a payer is not required to issue a form 1099-MISC but the recipient of the income must report it even for less than 600. So like I said once you hit 400 or more in self-employment income during the year youre on the hook for the self-employment tax.

Its included in taxable income whether a 1099-MISC was issued or not. You may not have to pay self-employment tax though. From my understanding I dont owe income tax I believe that threshold is around 10000.

3182021 If you earned more than 400 working for yourself last year the IRS considers you a self-employed individual. In general anytime the wording self-employment tax. Well the short sweet and slightly inaccurate answer is that the self-employment tax is 153 of your net self-employment income.

Self-Employed Income Taxpayers who are self-employed or who operate a side business and who receive remuneration for goods sold or services rendered usually receive a Form 1099-Misc documenting the amount they received. The rate is made up of 29 for Medicare or hospital insurance and 124 for social security or survivors old-age and disability insurance. The Pandemic Unemployment Assistance PUA program - PUA will provide up to 39 weeks of benefits to self-employed workers 1099 tax filers and some other individuals who previously were not eligible for unemployment benefits.

That is why we recommend that you place 30 of the money each time you are paid into a short-term savings account. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. So using the 10000 profit example that means your income is now considered to be 9235.

You multiply that by 153 1413. Self employment taxes are comprised of two parts. 322020 What is the self-employment tax rate.

That is the self employment tax you owe. The 600 rule often gives payees the wrong impression that they dont have to report their own 1099 earnings if they make less than 600. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

Plus if you anticipate owing at least 1000 on your annual tax return youre required to file all your taxes. 12282020 The 1099-NEC Nonemployee Compensation is replacing the tax Form 1099-MISC Miscellaneous Income for self employed people starting the tax year 2020. Ad Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix.

You will pay 62 percent and your employer will pay Social Security taxes of 62 percent on the first 128400 of your covered wages. The total self-employment tax rate is 153 comprising of 124 for Social Security and 29 for Medicare for both 2020 and 2019. Is used it only refers to Social Security and Medicare taxes and not any other tax like income tax.

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

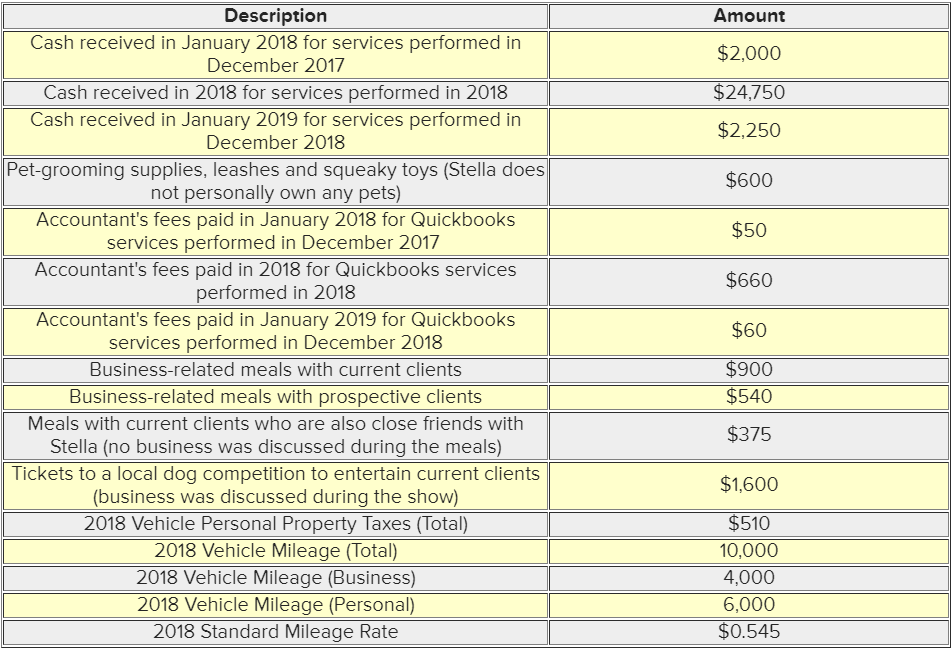

Solved Stella Is A Single Taxpayer And Operates A Self Em Chegg Com

Solved Stella Is A Single Taxpayer And Operates A Self Em Chegg Com

Ask The Taxgirl Reporting Income Under 600

Ask The Taxgirl Reporting Income Under 600

Do You Have To File A 1099 Under 600

Do You Have To File A 1099 Under 600

Who Is Eligible For A Stimulus Check Forbes Advisor

Who Is Eligible For A Stimulus Check Forbes Advisor

Covid 19 Tax Credits And How Self Employed Workers Benefit Stride Blog

I Make 15 An Hour I Work A 40 Hour Week How Much Do I Take Out For Taxes Since I M Self Employed Quora

Filing Taxes When You Are Self Employed Quarterly Or Yearly

Filing Taxes When You Are Self Employed Quarterly Or Yearly

Alabama Society Of Certified Public Accountants

Alabama Society Of Certified Public Accountants

Unemployment Assistance For Self Employed Now Available Senator John R Gordner

Unemployment Assistance For Self Employed Now Available Senator John R Gordner

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

A 600 Mistake Why It Pays To Do Your Own Taxes Budgeting Money Saving Money Tax

A 600 Mistake Why It Pays To Do Your Own Taxes Budgeting Money Saving Money Tax

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience