The amount of business expenses from the Supplemental Business Expense SBE Worksheet. Or Valid for Work Only with INS Authorization.

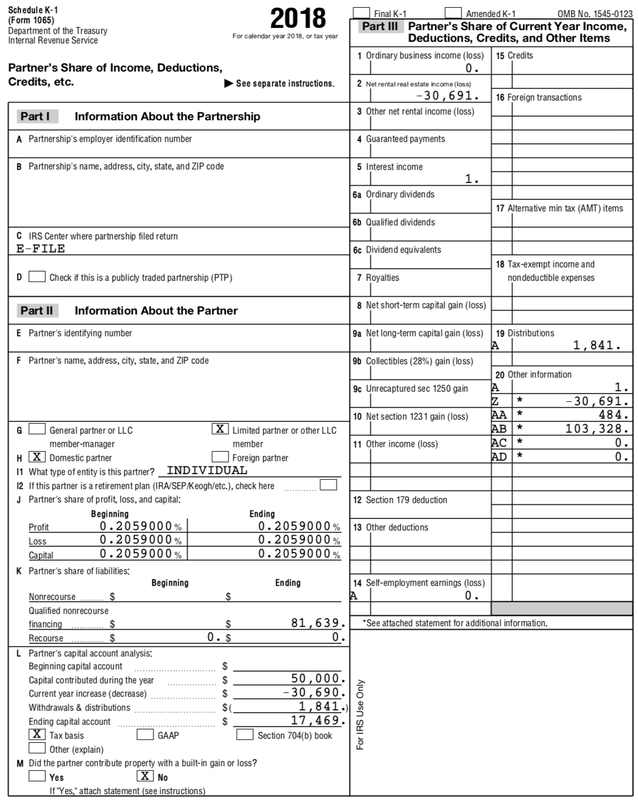

Dissecting And Understanding A Schedule K 1

Dissecting And Understanding A Schedule K 1

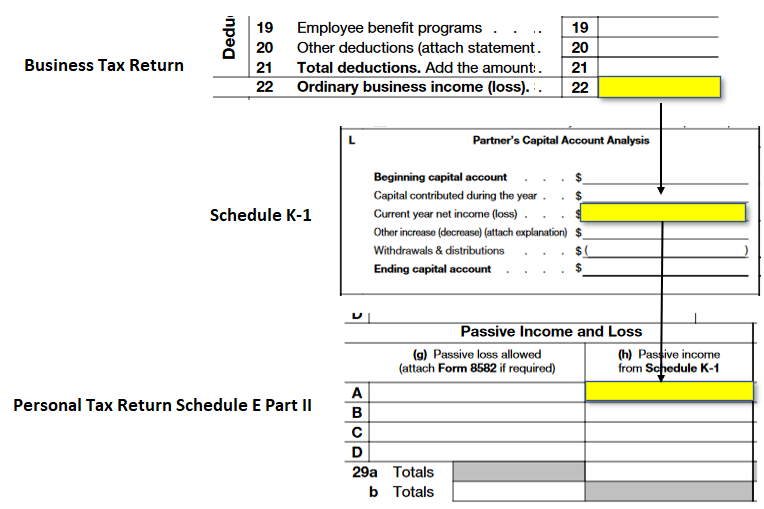

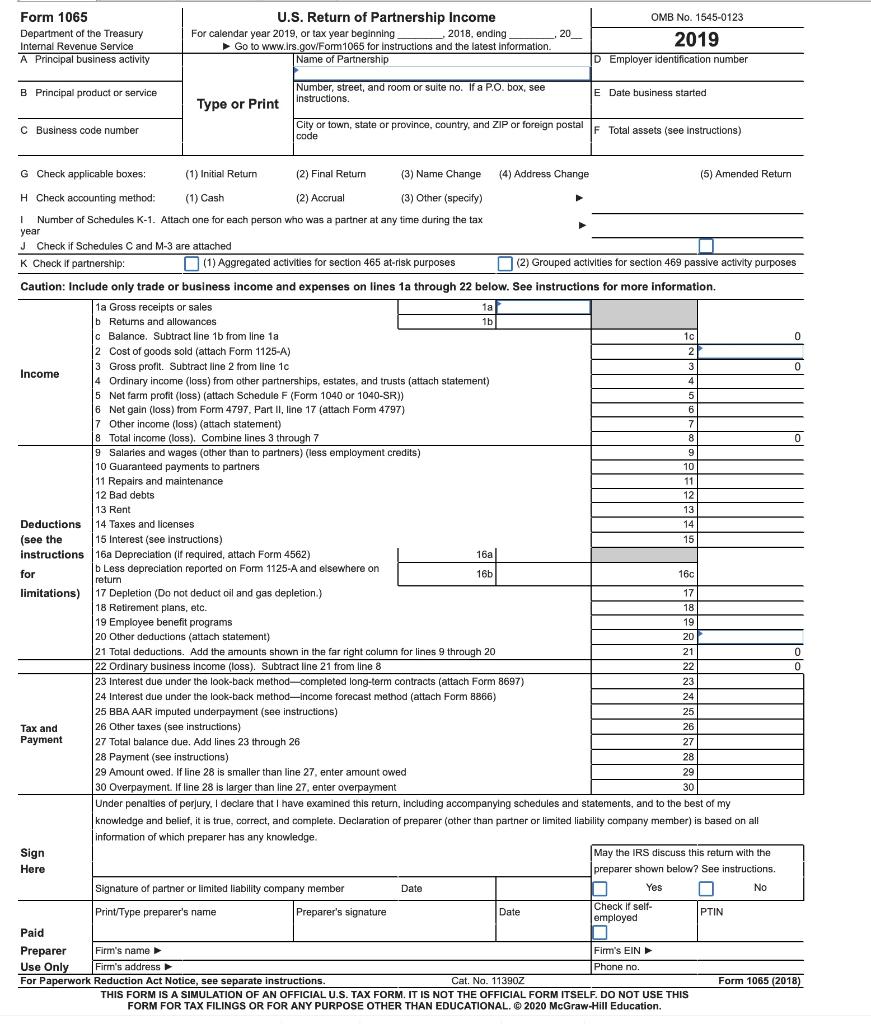

Generally a taxpayers share of ordinary income reported on a Schedule K-1 from a partnership engaged in a trade or business is subject to the self-employment.

Self employment k1. Ad Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix. Schedule K1 assists business partners in reporting their share of the profits losses deductions and credits. Are you looking telecalling part time jobs.

To wrap up this topic was way back in the shadows for years but now is front and center for your self-employed borrowers who use K1 income from 1065 and K1 income from 1120S to qualify. Amounts in the Debt-financed acquisition interest statement in the K1-3 screen with code 1. 8272014 Generally a taxpayers share of ordinary income reported on a Schedule K-1 from a partnership engaged in a trade or business is subject to the self-employment tax.

IRS Says Members K-1 Income Subject to Self-Employment Tax By Kenneth H. We have multiple opening in UK process. Schedule K-1 will show you your self-employment earnings from the partnership or LLC youre a member of.

Self employment tax income flowing from 1120S K-1 - Intuit Accountants Community. The amount on line 14a may differ from the total income loss included on line 1 Ordinary income or loss. This self-employment tax is imposed in addition to the regular income tax you already pay and is imposed on your self-employment earnings.

The self-employment tax rate for self-employment earnings is generally 153. The partnership files a copy of Schedule K-1 Form 1065 with the IRS. 612019 Income reported on a Form K-1 from an S-Corporation is not subject to self-employment tax so TurboTax is not going to generate a Schedule SE.

Are you looking telecalling part time jobs. If the amount is not flowing on the K1 screen choose the appropriate Partner type selection from the I1 drop list and verify if they are a limited or general partner. We have multiple opening in UK process.

Schedule SE generates from a K1P screen if there is an amount included on line 14 with code A - Net Earnings loss from self-employment. Conservative to aggressive depending on the facts in each case. LLCs and SE tax is a difficult area.

4272021 Self-employed individuals pay self-employment tax each year if their net earnings from self-employment are 400 or more. If the initial K-1 entry was previously keyed in double click on the entry in the K-1. This is because there are only proposed regulations that have been out since 1997 and as a result positions are taken across the board.

So you will need to pay self-employment tax on that amount. However the partnership has reported your complete identifying number to the IRS. 1262019 The Schedule K-1 Instructions state that input related to net earnings from self-employment should be entered for each Individual General Partner.

Bridges CPA PFS December 2014 Tax rules which were enacted long before the LLC format came into existence provide that a general partners K-1 ordinary business income is subject to self-employment tax while a limited partners K-1 income is not except for guaranteed payments. The tax is 153 124 for Social Security and 29 for Medicare on their annual net income from the business. But like anything IRS-related there are a few exceptions.

Rents Royalties Entities Sch E K-1 4835 8582 K-1 Input and select New and double-click on Form 1065 K-1 Partnership which will take you to the K-1 Heading Information Entry Menu. Schedule K1 is provided on IRS Form 1065 for taxpayers to report self-employment taxes related to a business partnership. Box 14 Code B relates to Gross Farming and Fishing Income and is also calculated by the Lacerte Program.

To enter Self-Employment Earnings loss from tax form Schedule K-1 Form 1065 in TaxSlayer Pro from the Main Menu of the Tax Return Form 1040 select. 622019 K1 income from an LLC taxed as a partnership and self-employment tax. Distributions are not subject to self-employment tax.

S corporations can pay out some of their profits as a distribution. Self-employment earnings or loss do not show on line 14a of the K1 for a 1065 if the partner is listed as one of these entities including an LLC corporation on the K1 line I1. For your protection Schedule K-1 may show only the last four digits of your identifying number social security number SSN etc.

Ad Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix. Different language in the two messages but same legal meaning. However like any general rule there are a myriad of exceptions including one excepting a limited partners share of ordinary income from a partnership.

SSA promises they may do this if they receive wage reporting against a SSN that was issued as Not Valid for Employment. However for 2011 the rate is reduced to 133. See the Net Earnings from Self-employment Worksheet for the detail of the taxpayer and spouse with self-employment earnings.

Self employment on a K1 On Thu 01 Apr 2004 092026 -0800 Chris Parker wrote.

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Https New Content Mortgageinsurance Genworth Com Documents Training Course Partnershipincome1065formk1 Presentation 0420 Pdf

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

A Small Business Guide To The Schedule K 1 Tax Form The Blueprint

A Small Business Guide To The Schedule K 1 Tax Form The Blueprint

K1 Visa Interview Requirements And Checklist Mrspresson Com Fiance Visa Visa Immigrant Visa

K1 Visa Interview Requirements And Checklist Mrspresson Com Fiance Visa Visa Immigrant Visa

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Contoh Surat Pemberitahuan Kegiatan Rt Paling Lengkap Untuk Kerja Bakti Rapat Dan Pertemuan Rutin Undangan Surat Pemerintah

Contoh Surat Pemberitahuan Kegiatan Rt Paling Lengkap Untuk Kerja Bakti Rapat Dan Pertemuan Rutin Undangan Surat Pemerintah

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

My American Job Get Your Copy Now American Jobs Business Entrepreneur Startups Startup Quotes

My American Job Get Your Copy Now American Jobs Business Entrepreneur Startups Startup Quotes

Nvidia Tegra K1 Vcm And Project Mercury Project Mercury Vcm Projects

Nvidia Tegra K1 Vcm And Project Mercury Project Mercury Vcm Projects

Latest Sss Contribution Table 2018 Sss Contribution Chart

Latest Sss Contribution Table 2018 Sss Contribution Chart

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Fiance K 1 Visa Process Flowchart Fiance Visa Fiance How To Plan

Fiance K 1 Visa Process Flowchart Fiance Visa Fiance How To Plan

Pengaturan Kehamilan Dan Kesehatan Reproduksi Kesehatan Kehamilan Perencanaan

Pengaturan Kehamilan Dan Kesehatan Reproduksi Kesehatan Kehamilan Perencanaan