Missed a minimum of 60 of their scheduled work in the week for which they claim the benefit. UFile is the Canadian Name in tax software.

Step By Step Tax Video Tutorials Internationalization Office Memorial University Of Newfoundland

Step By Step Tax Video Tutorials Internationalization Office Memorial University Of Newfoundland

UFile is Canadian tax software with a standard price tag of 1999.

Ufile self-employment. In the Left-side menu on the Interview tab select Interview setup. A welcome feature of UFile Online is that it provides users with online tax return storage for a full 10 years. UFileca February 27.

The online Software costs 15 for individuals. 83 talking about this. The benefit is taxable.

Your taxes your way taxesyourway. As part of this process we have introduced a new level of security for passwords requiring that you create a new password for your account. 134 talking about this.

UFile is the Canadian Name in tax software. The CERB EI benefits CRB CRSB and CRCB are considered taxable income just like employment income self-employment income or interest income. Get these features and more with UFile.

2495 for an additional spouse with no additional charge for dependents. You dont need a business number or to have registered with the CRA to complete this form. UFile is perfect for freelance and all kinds of self-employment returns.

But with several ways to get it for free you may want to take a look. This may be business professional commission farming or fishing income. Personal and small business.

UFile for Windows is very economically priced suggested retail price of 2299 for UFile 4 or 3499 for UFile 12. Heres everything you need to know about UFile Online UFile Windows and UFile. This video tutorial shows how self-employed individuals can apply for unemployment insurance benefits under the CARES Act COVID-19.

Select Change or reset your password below to use UFiles automated tool to change or reset your password. File smart with UFiles 20 years of experience serving Canadian taxpayers. Line 42100 was line 421 before tax year 2019.

Small and large families. The cost for purchasing the Windows version sadly they do not make it for Mac is 30 and can be used to prepare up to 8 returns you can be the tax preparer for extended family. Automatic additional payments of 300 per week until September 6 2021 to everyone qualified for unemployment benefits.

To enter this amount in the program please follow the steps below. CRSB and CRCB are considered taxable income just like employment income self-employment income or interest income. Your taxes your way taxesyourway.

4152018 Self-employment income - Form T2125 You must include in your tax return all income earned from self-employment. Youll get all the bells and whistles like express NOA auto-fill features and more. If you received a T4A watch the video for find where.

UFile is the Canadian Name in tax software. 272012 Ufile is available online or can also be downloaded to your computer. UFile Online comes as advertised a cloud-based software that you can access online.

At 1999 its reasonably priced. Earned at least 5000 in 2019 or in 2020. Must be reported on your income taxes.

12312020 Line 42100 - CPP contributions payable on self-employment and other earnings Note. You may need to complete this form even if you didnt know you have a business. 192 talking about this.

Forms and slips Federal Provincial Quebec Pension income splitting. When you receive self-employment income including contractor income you must report it on a form T2125. Since this income is not subject to payroll deductions you will owe the full amount of applicable income tax on your tax return.

Click here to begin. 3172021 If you work under a sharing economy app such as Uber Uber Eats Skip the Dishes etc your earnings are considered self-employment income and added to your taxable income. An extension through September 6 2021 for people already receiving unemployment benefits.

UFile ONLINE Canadas online tax preparation program is available free of charge to taxpayers with annual income of 20000 or less. Your taxes your way taxesyourway. Must be reported on.

Extension of the Pandemic Unemployment Assistance PUA program for self-employed or gig workers. UFile is always concerned about the security of your data. Resident of Canada at least 15 years of age and have a valid Social Insurance Number SIN employed or self-employed at the time of the application.

Only for individuals who are 60 to 70 years of age.

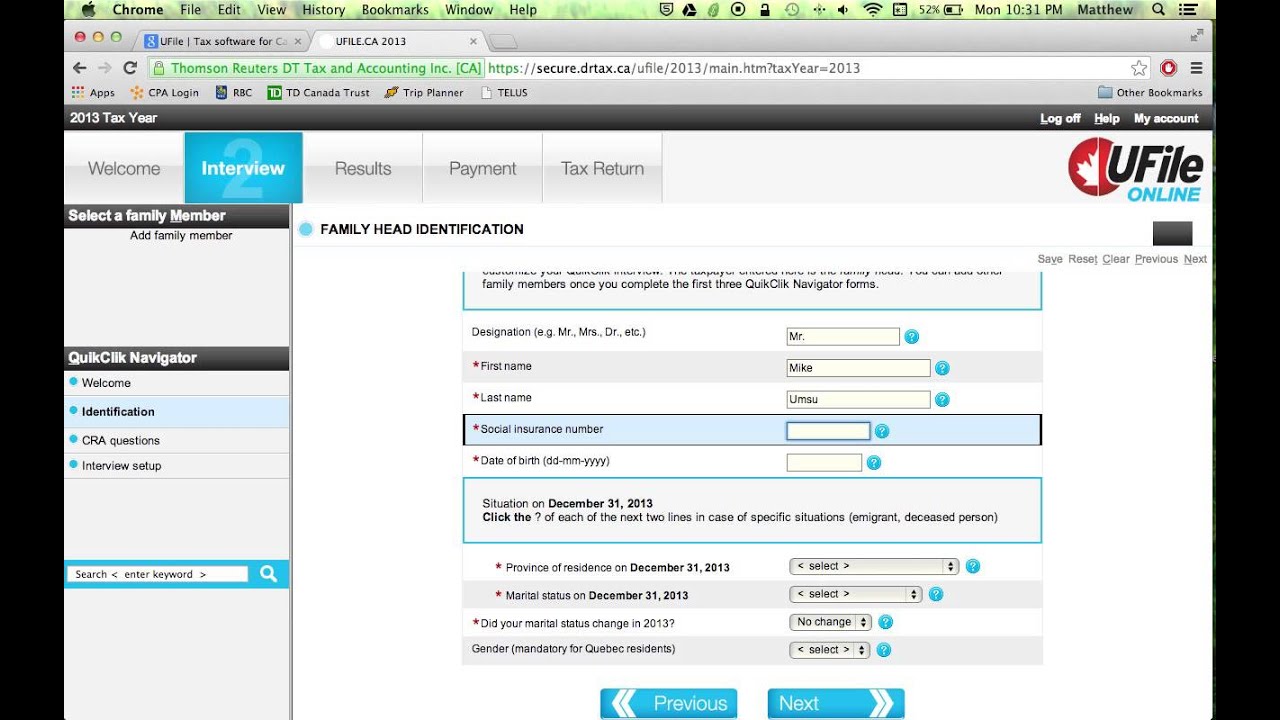

Ufile Help Video 1 Getting Started With Ufile Youtube

Ufile Help Video 1 Getting Started With Ufile Youtube

Ufile 4 For Tax Year 2020 Staples Ca

Ufile 4 For Tax Year 2020 Staples Ca

Start For Free With Ufile Online

Start For Free With Ufile Online

Let Ufile Online Do The Hard Work At Income Tax Time Review And Giveaway Canadian Budget Binder

Let Ufile Online Do The Hard Work At Income Tax Time Review And Giveaway Canadian Budget Binder

How To Use Ufile To Prepare Your Personal Income Tax Return Youtube

How To Use Ufile To Prepare Your Personal Income Tax Return Youtube

Ufile How To Tutorial T2125 Business Income Tax Return And Overview Of Ontario Credits Youtube

Ufile How To Tutorial T2125 Business Income Tax Return And Overview Of Ontario Credits Youtube

Ufile 12 For Tax Year 2020 Staples Ca

Ufile 12 For Tax Year 2020 Staples Ca

How To Claim Expenses As An Employee

How To Claim Expenses As An Employee

Ufile Help Video 2 Interview Questions Youtube

Ufile Help Video 2 Interview Questions Youtube

Can You Use Ufile Standard Edition For Self Employment Income Beyond The Rhetoric

Can You Use Ufile Standard Edition For Self Employment Income Beyond The Rhetoric

Http Support Drtax Ca Ufile Pdf Quickstart 20guide 2019 Webversion En Pdf

Preparing Your Tax Return With Ufile Youtube

Preparing Your Tax Return With Ufile Youtube

How To Report Covid Benefits Received Cerb Cesb Crb Crsb And Crcb On Your Tax Return Youtube

How To Report Covid Benefits Received Cerb Cesb Crb Crsb And Crcb On Your Tax Return Youtube

Free Tax Prep Checklist Jessica Moorhouse Tax Prep Tax Prep Checklist Tax Refund

Free Tax Prep Checklist Jessica Moorhouse Tax Prep Tax Prep Checklist Tax Refund

Worked From Home Due To Covid 19 Youtube

Worked From Home Due To Covid 19 Youtube