A 1099 is a wage statement that your employer will give to you when you worked for them and they did NOT hold out taxes for you. FICA taxes and income taxes that have been withheld from employee pay are reported to the employee by the employer on Form W-2 the annual wage and tax report.

Saving For Taxes If You Re Non W2 Employed Saving Tax Self Employment

Saving For Taxes If You Re Non W2 Employed Saving Tax Self Employment

You are otherwise in business for yourself including a part-time business Back to top.

Self employment w2. Instead you must report your self-employment income on Schedule C Form 1040 to report income or loss from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit. Ad Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix. An employer withholds taxes from an employees pay and sends it to the IRS on the employees behalf.

11232020 Reporting and Paying Employment Taxes. 682018 As long as your borrower qualifies for the loan with W2 income only Fannie Mae explicitly states that you do not have to include and income or loss from self-employment and you can forget about documenting it as well. You are a member of a partnership that carries on a trade or business.

Ad Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix. Are you looking telecalling part time jobs. Employers must also file a Form W-2 Wage and Tax Statement annually for each employee along with a Form W-3 Transmittal of Wage and Tax Statements and furnish a copy of the Form W-2 to the employee.

Are you looking telecalling part time jobs. The same goes for income received from an activity that fits the narrow IRS definition of a hobby. Employers are also generally required to file Form 940 annually.

Some of us have opportunities to work as either a W-2 employee or a 1099 contractor or even to be self-employed as a small business owner. Change your mailing address. Federal government imposes income tax on net self-employed income after all deductions just as it does on employees W-2 incomes with one major difference.

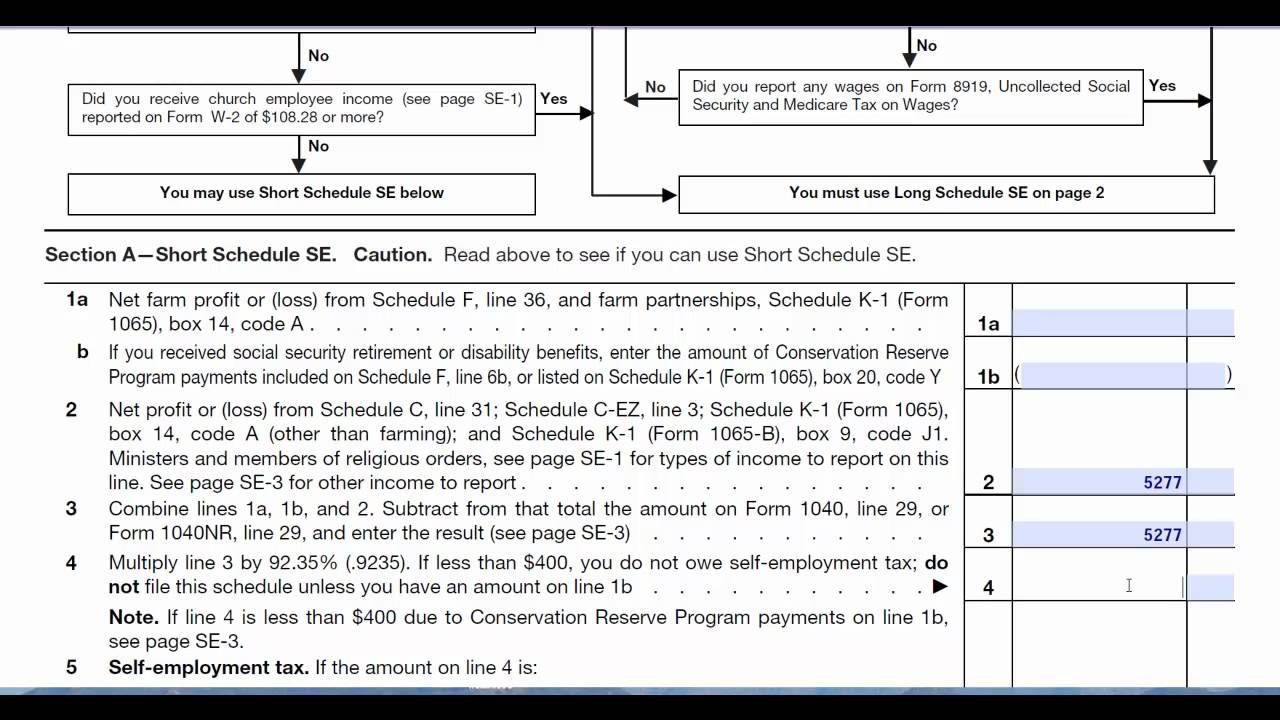

In addition you may also receive self-employment income that your customers reported to the IRS on a 1099-NEC form 1099-MISC in prior years. 892020 Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. View and print historical payslips and tax statements.

Enroll in or change your Homer Fund deduction. 172020 Income for which you received a W-2which would mean you are an employeecannot be calculated as self-employment income. Enroll in or activate a payroll card.

You carry on a trade or business as a sole proprietor or an independent contractor. Youll figure your self-employment tax on Schedule SE. 232018 If youre a regular employee full-time or part-time of a company then you earn a W-2 salary.

652019 A W2 is a wage statement that your employer will give to you when you worked for them and they held out taxes for you. What are My Self-Employed Tax Obligations. Receiving W-2 and 1099 Tax Forms If you were employed for part of the year your employer will likely report your employee income to the Internal Revenue Service IRS on Form W-2.

If youre an independent contractor or freelancer you instead get a 1099. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. You pay 153 for 2017 SE tax on 9235 of your Net Profit greater than 400.

Change or activate your direct deposit information. Review your associate profile. 1242019 When you hire people to work for you you should assume they are employees W2 unless you can prove that they are contractors 1099.

The Department of Labor released an opinion letter in April 2019 to help companies determine whether a person should be hired as a contractor or an employee. Keep in mind that some investors will impose their own overlays that supersede Fannie Maes guidelines. See Topic 759 for more information about Form 940.

From Self Service you can. 7272017 The Internal Revenue Service sets up guidelines to determine whether you are treated as an employee or as an independent contractor self-employed by the people and companies that you do business with. We have multiple opening in UK process.

The more independent you are in doing your job the more likely you are to be self-employed. 1222021 If a W-2 employee loses a job their income will drop to zero in the blink of an eye in the absence of unemployment insurance benefits. Generally you are self-employed if any of the following apply to you.

Change your tax withholdings. The employee then includes this information on their tax return Form 1040 or 1040-SR. 6142017 There is no W-2 self-employed specific form that you can create.

We have multiple opening in UK process.

W 9 Form 2016 Pdf Fillable Brilliant Free W2 Forms From Irs Throughout Free W 9 Form In 2021 Tax Forms Employee Tax Forms Irs Forms

W 9 Form 2016 Pdf Fillable Brilliant Free W2 Forms From Irs Throughout Free W 9 Form In 2021 Tax Forms Employee Tax Forms Irs Forms

Pin By Paul Lionetti On Quick Saves In 2021 Tax Forms Internal Revenue Service Fillable Forms

Pin By Paul Lionetti On Quick Saves In 2021 Tax Forms Internal Revenue Service Fillable Forms

2013 W2 Form Microsoft Dynamics Gp 2015 R2 Feature Of The Day W2 W2 Forms Microsoft Dynamics Microsoft Dynamics Gp

2013 W2 Form Microsoft Dynamics Gp 2015 R2 Feature Of The Day W2 W2 Forms Microsoft Dynamics Microsoft Dynamics Gp

Proof Of Income Self Employed Doctors Note Lettering Sample Resume

Proof Of Income Self Employed Doctors Note Lettering Sample Resume

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms W2 Forms Income Tax

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms W2 Forms Income Tax

Pin By Flowers Sweetie On Sweetie Banks Tax Professionals Tax Preparation Self Employment Feelings

Pin By Flowers Sweetie On Sweetie Banks Tax Professionals Tax Preparation Self Employment Feelings

Tops W 3 Tax Form Lttr 2 Part Carbonless 10 Continuous Forms Tax Forms Blank Form Form

Tops W 3 Tax Form Lttr 2 Part Carbonless 10 Continuous Forms Tax Forms Blank Form Form

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

Pin By Lance Burton On Unlock Payroll Template Tax Refund Money Template

Pin By Lance Burton On Unlock Payroll Template Tax Refund Money Template

2013 W2 Form W 2 2013 W2 Forms Letter Example Job Application Form

2013 W2 Form W 2 2013 W2 Forms Letter Example Job Application Form

We Make You A Personalized W2 Tax Statement Great For Income Tax Purposes Or Proof Of Income For Self Employed Contractors Bar Income Statement Income Tax

We Make You A Personalized W2 Tax Statement Great For Income Tax Purposes Or Proof Of Income For Self Employed Contractors Bar Income Statement Income Tax

Understanding Your Forms W 2 Wage Tax Statement Tax Forms W2 Forms The Motley Fool

Understanding Your Forms W 2 Wage Tax Statement Tax Forms W2 Forms The Motley Fool

Self Employment Income Statement Template Unique Self Employment Ledger 40 Free Templates Examp Statement Template Profit And Loss Statement Income Statement

Self Employment Income Statement Template Unique Self Employment Ledger 40 Free Templates Examp Statement Template Profit And Loss Statement Income Statement

Tax Return Fake Tax Return Tax Letter Of Employment

Tax Return Fake Tax Return Tax Letter Of Employment

Pin On Independent Artists Worldwide

Pin On Independent Artists Worldwide

We Make You A Personalized W2 Tax Statement Great For Income Tax Purposes Or Proof Of Income For Self Employed Contractors Bar Tax Forms Income Tax W2 Forms

We Make You A Personalized W2 Tax Statement Great For Income Tax Purposes Or Proof Of Income For Self Employed Contractors Bar Tax Forms Income Tax W2 Forms