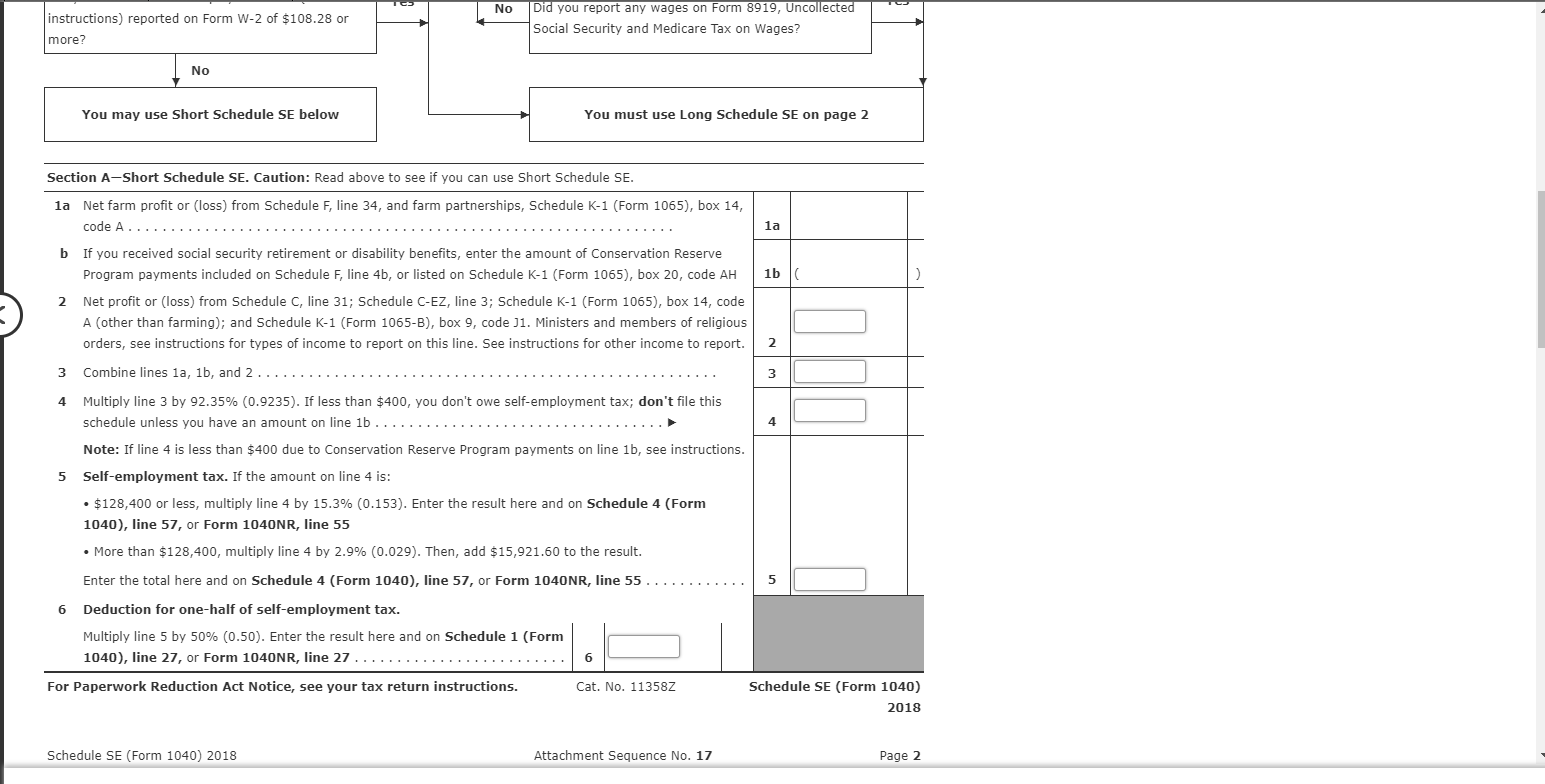

The rate consists of two parts. To find the taxable amount multiply 100000 by 9235.

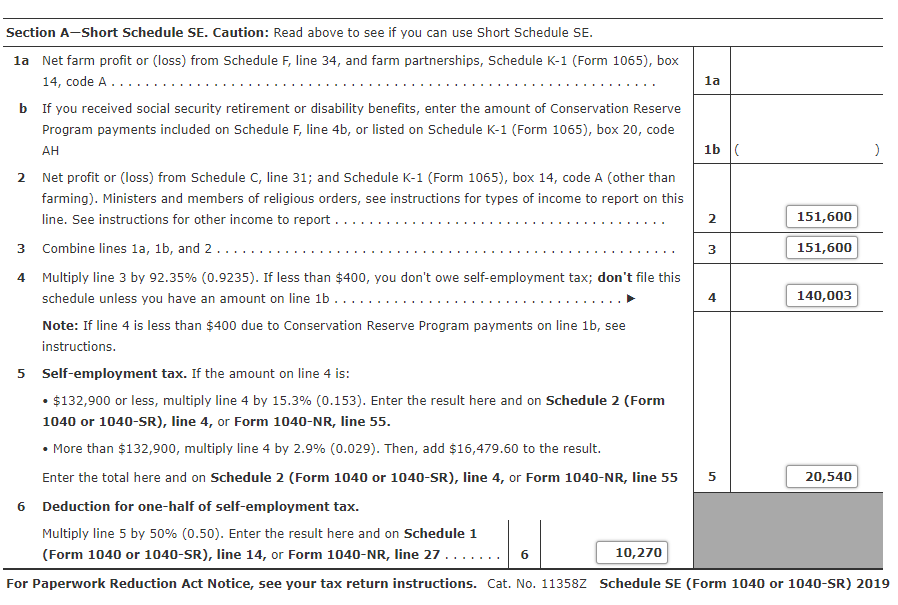

Solved Problem 6 16 Algorithmic Self Employment Tax Lo Chegg Com

Solved Problem 6 16 Algorithmic Self Employment Tax Lo Chegg Com

7222018 For 2020 the most you will pay for the Social Security portion is 1707480.

Self employment tax 7.65. The9235 adjustment on Form SE serves to reduce the Schedule C net profit by 765100 minus 9235 equals 765. Self-employed workers get stuck paying the entire FICA tax on their own. 9112019 What is self-employment tax.

1 This is known as the self-employment tax. That rate is the sum of a 124 for Social Security and 29 for Medicare. The self-employment tax rate is 153.

1292016 Self-employment taxes are designed to make sure that the federal government gets the full amount of payroll taxes its owed. To ensure that self-employed individuals still contribute toward Social Security and Medicare the federal government passed the Self-Employed Contributions Act SECA in 1954. The tax amount is based on the the business income of the individual.

A self-employed person does not draw a true wage so there is no FICA withholding. There is no tax cap like the Social Security portion. Because the 765 deduction takes into account the employer-half of your FICA taxes which the business would deduct if you were paid as an employee.

124 for Social Security and 29 for Medicare. To pay the full amount a self-employed person is responsible for both halves or 153 of earned income. Half of the self-employment tax or 765 calculated as half of 153 as a business deduction.

This will help reduce the gross income on your own tax return but wont have an. 8192015 Behind the scenes the employer kicks in a matching 765 contribution on the employees behalf making it a total of 153 of the employees wages going to the government 765 x 2 153. While the tax is charged on a taxpayers business profit the IRS lets them count the employer.

3252021 Lets say you had net income from self-employment of 100000 for 2021. Employers and employees each pay one-half the 153 765 each. 3192021 So each party pays 765 of their income for a total FICA contribution of 153.

1112019 Self-employment tax deductions You can deduct from the employer portion of your self-employment tax 765 when filing your personal income tax return. The Medicare tax applies to 9235 of all earned income. 1272020 They would each pay 765 of the employees eligible wages.

For these individuals theres a 124 Social Security tax plus a 29 Medicare tax. To calculate your FICA tax burden you can multiply your gross pay by 765. 1 Employees only have to pay half of these taxes employers pay the other half while business owners pay the entire tax amount.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Meanwhile a 1099 contractor has to pay the entire Social Security tax called Self-Employment Tax on her own. Self-employed persons on the other hand are subject to the entire153 rate.

Self-employment tax applies to net earnings what. 232018 The difference is the 765 Social Security tax that the employer pays on behalf of its employee. The 9235 rate is derived from the fact that self-employed taxpayers can deduct the employers portion of the tax which is 765 100 765 9235.

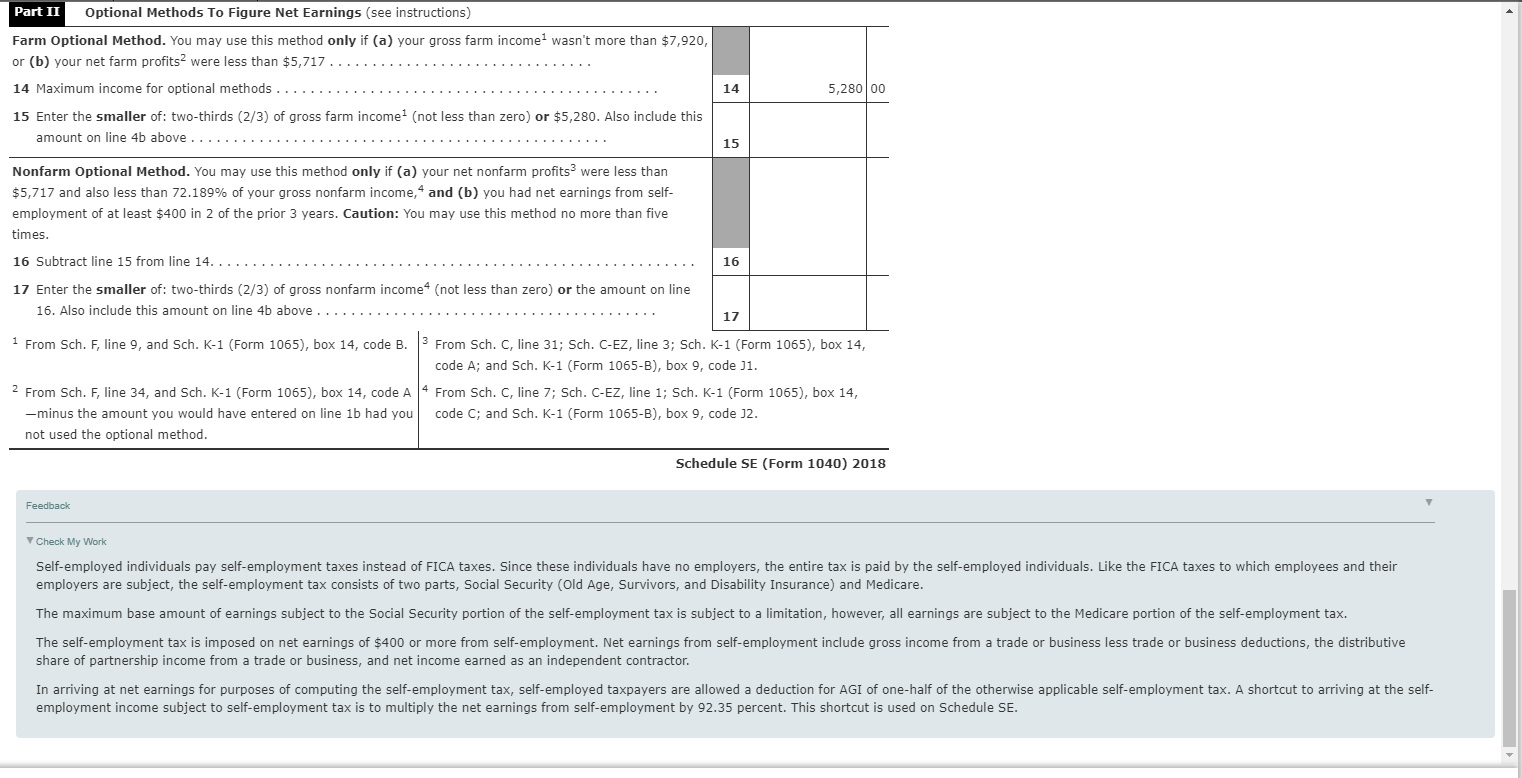

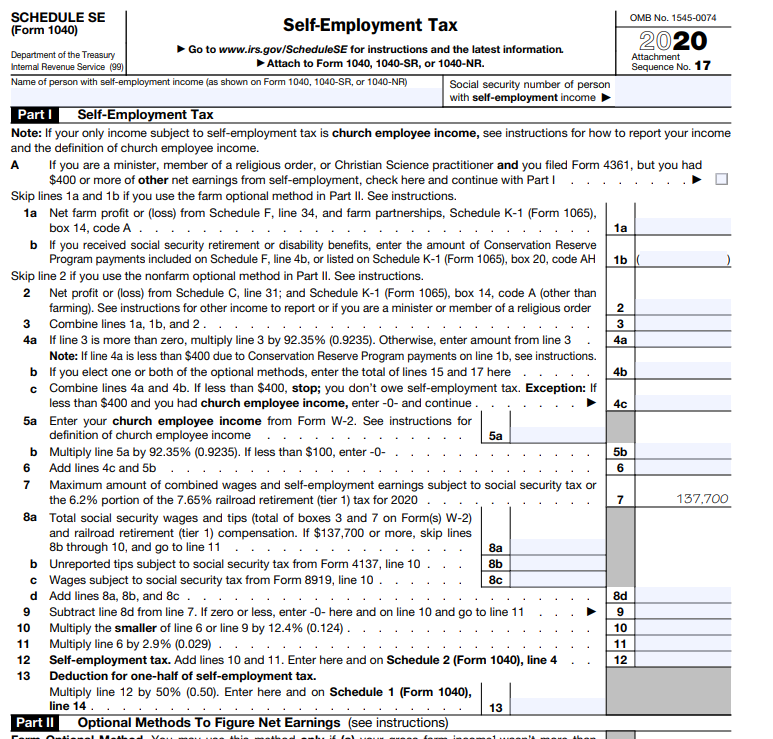

1 An individuals self-employment tax liability is equivalent to the sum of Social Security and Medicare taxes paid by both employees and employers in a traditional employment relationship. An employee only pays the remaining half of Social Security from her 100k salary. 322021 Self Employment tax line 7 Schedule SE line 7 is the maximum amount of combined wages and self-employment earnings subject to social security tax or the 62 portion of the 765 railroad retirement tier 1 tax for 2020.

11232020 The tax rate for self-employment income is 153 for Social Security and Medicare in two parts. Put another way the self-employment tax rate is generally 153 while traditional employers and employees only pay 765 respectively in Social. Self-Employment Tax Rate The self-employment tax rate is 153.

SECA established that without employers paying half the tax self-employed individuals would pay the whole 153. Instead the self-employed person pays self-employment tax of 153. 1212021 Employers pay 765 and their employees pay 765.

An independent contractor however is both the employer and the employee. For the Medicare portion of the self-employment tax and FICA all wages from traditional employment and business earnings are taxed at 29. For regular workers your employer withholds money for Social Security.

Filing Taxes When You Re Self Employed Denver Pro Tax

Filing Taxes When You Re Self Employed Denver Pro Tax

Understanding Self Employment Taxes As A Freelancer Tax Queen

Understanding Self Employment Taxes As A Freelancer Tax Queen

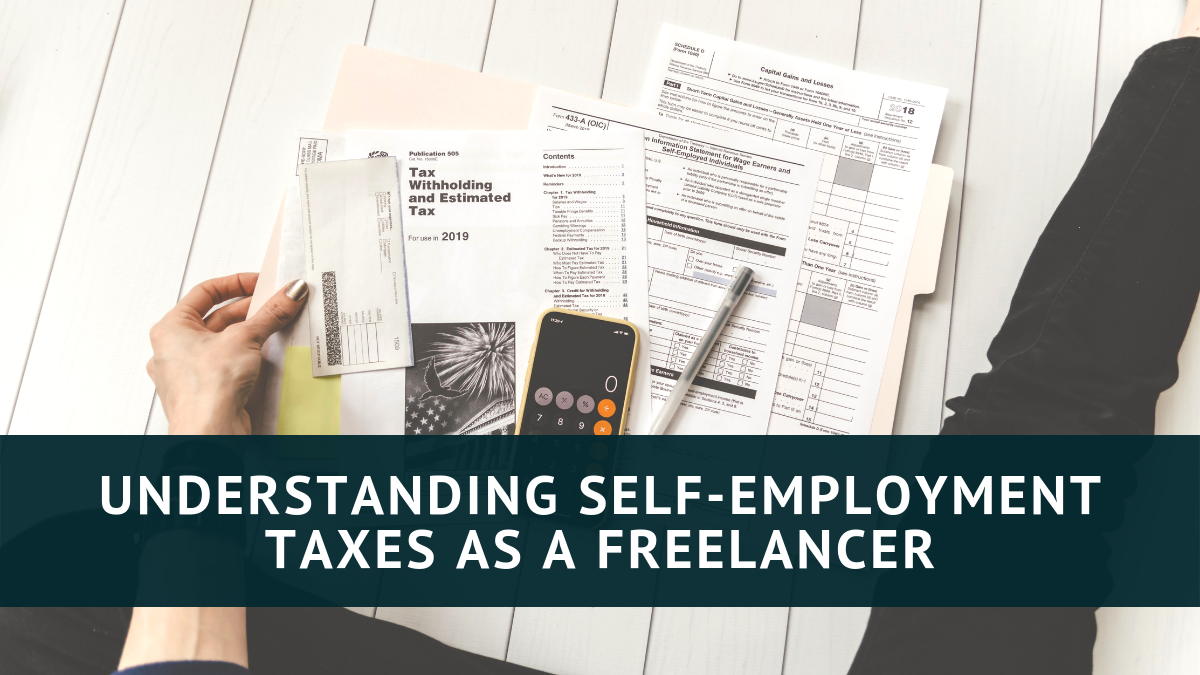

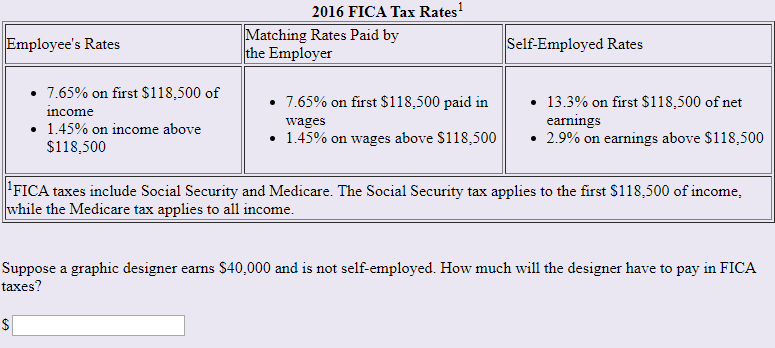

Solved Suppose A Graphic Designer Earns 40 000 And Is No Chegg Com

Solved Suppose A Graphic Designer Earns 40 000 And Is No Chegg Com

Small Business Guide To Taxes 03032010

Small Business Guide To Taxes 03032010

How The Self Employment Tax Is Miscalculated Strategic Finance

How The Self Employment Tax Is Miscalculated Strategic Finance

Self Employment Tax Rates 2019 The Way To Decrease Your Tax Bill Small Business Growth

What Is Fica Tax Contribution Rates Examples

What Is Fica Tax Contribution Rates Examples

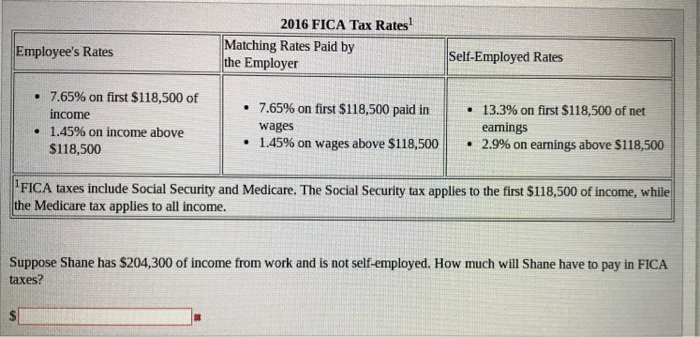

Solved 2016 Fica Tax Rates Matching Rates Paid By The Emp Chegg Com

Solved 2016 Fica Tax Rates Matching Rates Paid By The Emp Chegg Com

Self Employment Tax What Is The Self Employment Tax In 2019

Self Employment Tax What Is The Self Employment Tax In 2019

Solved Problem 6 16 Algorithmic Self Employment Tax Lo Chegg Com

Solved Problem 6 16 Algorithmic Self Employment Tax Lo Chegg Com

How To Calculate Self Employment Tax Four Pillar Freedom

How To Calculate Self Employment Tax Four Pillar Freedom

Self Employment Tax Grubhub Doordash Instacart Uber Eats

Self Employment Tax Grubhub Doordash Instacart Uber Eats

Freelance Writer Taxes Self Employment Tax Arcticllama Com

Freelance Writer Taxes Self Employment Tax Arcticllama Com

Converting To An S Corporation To Reduce Self Employment Tax

Why Is Self Employment Tax Based On 92 35 Of Self Employment Income Dinesen Tax

Why Is Self Employment Tax Based On 92 35 Of Self Employment Income Dinesen Tax

Tax Information For Real Estate Agents Presented By Walker Business Systems Ppt Download

Tax Information For Real Estate Agents Presented By Walker Business Systems Ppt Download

Exclusive S Corp Tax Calculator Newway Accounting

Exclusive S Corp Tax Calculator Newway Accounting

What Is Self Employment Tax 2020 21 Rates Bench Accounting

What Is Self Employment Tax 2020 21 Rates Bench Accounting