Total self-employment tax rate is therefore 124 29 153. Self-employment tax applies to net earnings what many call profit.

Paying Self Employment Tax For The First Time Credit Karma

Paying Self Employment Tax For The First Time Credit Karma

The law sets a maximum amount of net earnings that is subject to the Social Security tax.

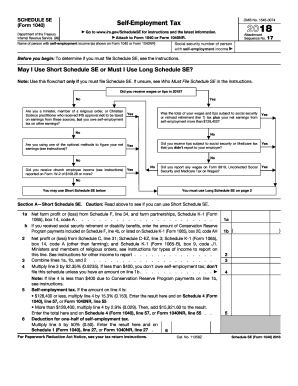

Line 9 self employment tax. Enter here and on. 1212021 The total self-employment tax is 153 of your net earnings and consists of two parts. If your employer sends you a W-9 instead of a W-4 the company has likely classified you as an independent contractor.

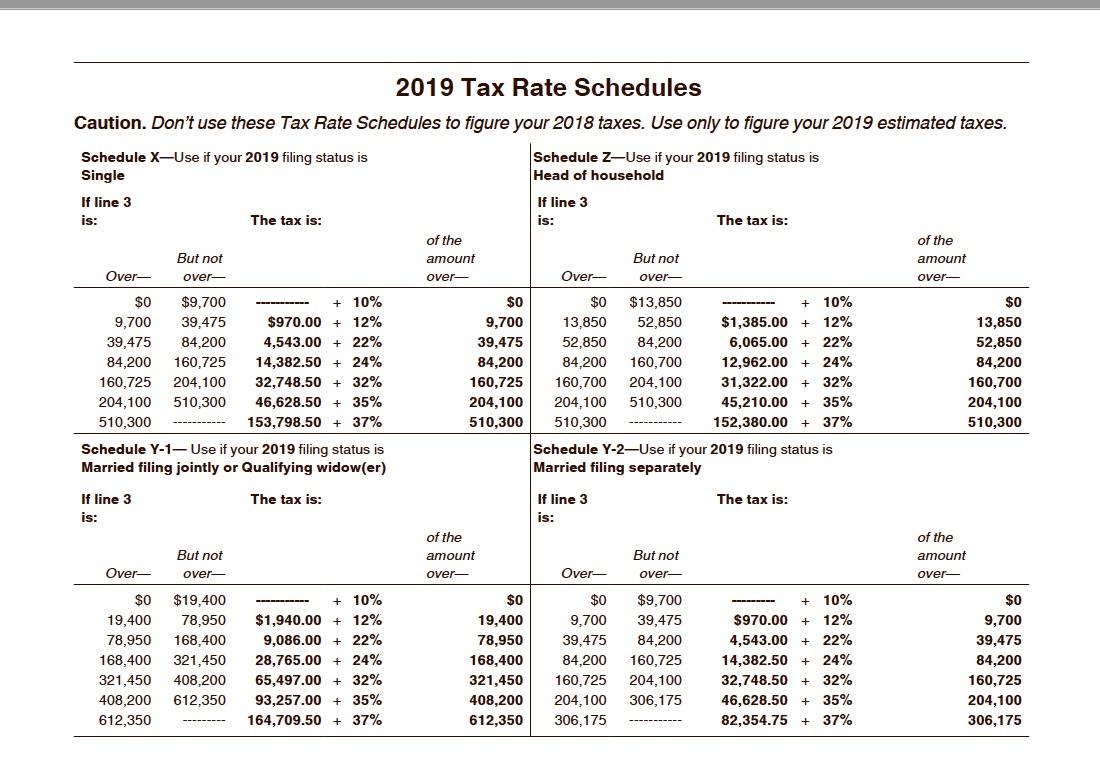

7122019 The SE tax is the way the Feds collect Social Security and Medicare taxes on non-salary income from work-related activities. You need to use it if you have earned over 600 in that year without being hired as an employee. Under the scenario where you have a day job earning 50000 your total self-employment tax would be 2678 10168 12846.

However the Social Security portion may only apply to a part of your income. From this amount 124 accounts for Social Security and 29 goes towards Medicare. For 2021 the Social Security wage base is 142800.

Anything over that amount is not subject to the tax. The rate consists of two parts. Multiply line 6 by 29 0029.

Add lines 10 and 11. 5252019 If youre self-employed you can claim a federal deduction for half the SE tax you pay which can help lower your taxes. The tax rate can be divided into two with 765 making up the employer contributions and 765 the employee contributions.

Multiply line 12 by 50 050. Self-Employment Tax Rate The self-employment tax rate is 153. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

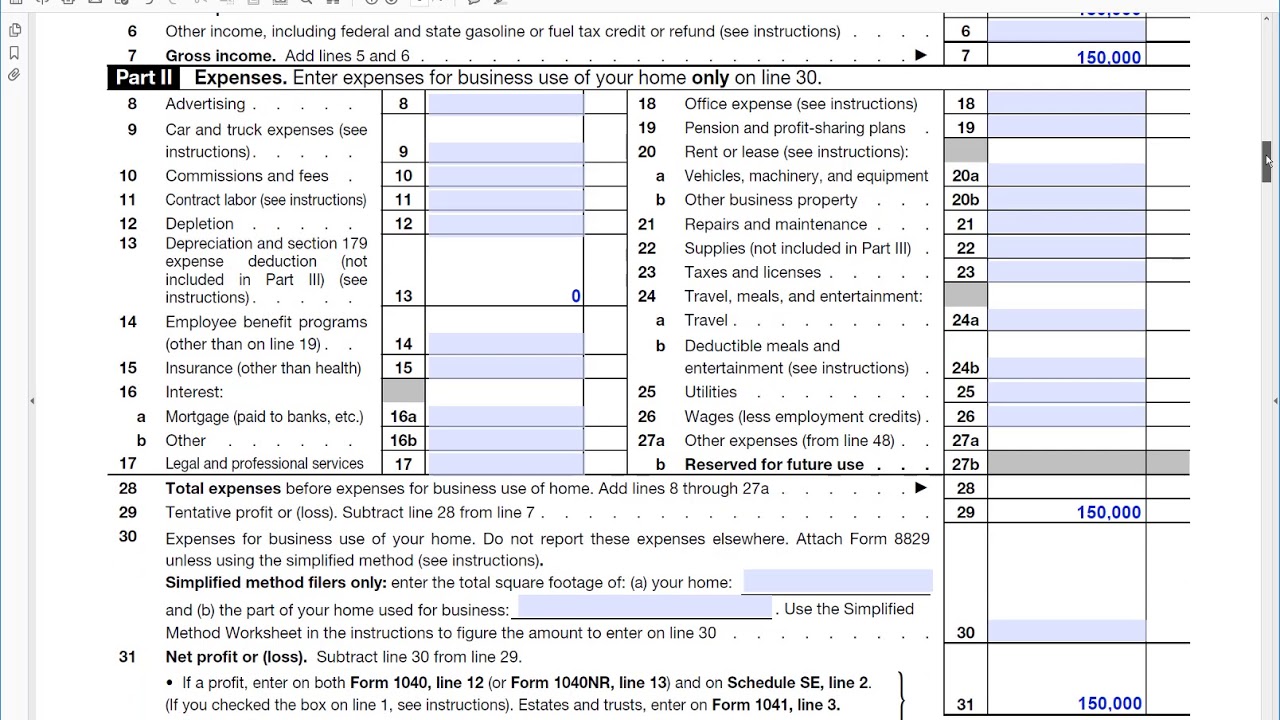

These lines pertain to forms for the 2020 tax year the return youd file in 2021. A self-employed person having net income of exactly 137700 in 2020 would have to. Of line 6 or line 9 by 124 0124.

3252021 How much is self-employment tax. What are Self-Employment taxes. 1112019 The self-employment tax rate for 2018 is 153.

There is no tax cap like the Social Security portion. Schedule 2 Form 1040 line 4. 1252021 W-9 forms are for self-employed workers like freelancers independent contractors and consultants.

1292016 The full 153 tax only applies up to the wage base limit for Social Security which is 137700 in 2020. The first part is Social Security at 124. 13 Deduction for one-half of self-employment tax.

7222018 For the Medicare portion of the self-employment tax and FICA all wages from traditional employment and business earnings are taxed at 29. Multiply the amount from line 4 4422364 by 0153 to calculate your total self-employment tax for 2018. The SE tax rate is 153 with 124 for Social Security and 29 for Medicare.

Finally multiply line 5 by 50 to get your total self-employment deduction. Enter here and on. Thats because of the Social Security wage base.

322021 For 2020 the first 137700 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax Social Security tax or railroad retirement tier 1 tax. For 2019 the SE tax. 1112021 Under the scenario where you do not have a day job your total self-employment tax would be 2678 11451 14129.

The self-employment tax rate is 153 with 124 for Social Security and 29 for Medicare. We report your SE tax on Schedule SE and also calculate the deduction that goes along with it. Above that level only the 29 self-employment Medicare tax applies.

You now know how to calculate the self-employment tax. That rate is the sum of a 124 for Social Security and 29 for Medicare. 9112019 The self-employment tax rate is 153.

1272020 The 153 self-employment tax is composed of a 124 Social Security tax on the first 137700 of net self-employment income for the year 2020 142800 in 2021 and a Medicare tax of 29 on all net self-employment income. 4282021 Other income is reported on line 8 of Schedule 1 of the 2020 Form 1040 then the total from line 9 of Schedule 1 is transferred to line 8 of the 1040 itself. Under the Affordable Care Act there is an additional 09 Medicare tax for income wages and compensation that exceed 200000 if you are single a head of household.

Employment And Labor Law 8th Edition Self Employment Tax Calculator Employee Development Department Employment Self Employment Business Tax Employment

Employment And Labor Law 8th Edition Self Employment Tax Calculator Employee Development Department Employment Self Employment Business Tax Employment

Self Employment Tax Form Fill Out And Sign Printable Pdf Template Signnow

Self Employment Tax Form Fill Out And Sign Printable Pdf Template Signnow

4 Tax Tips For Small Business Owners Tips Taxes Taxtime Income Tax Tips Tax Return Tips Small Business Business Advice Business Tax

4 Tax Tips For Small Business Owners Tips Taxes Taxtime Income Tax Tips Tax Return Tips Small Business Business Advice Business Tax

Https Www Guidestone Org Media Guidestone Corporate Ministry Tools Mintaxguide 2112 Mintaxguidesec4 Pdf La En

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Fill Out A Self Calculating Schedule C Profit Or Loss From Business Youtube

How To Fill Out A Self Calculating Schedule C Profit Or Loss From Business Youtube

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Self Employment Income Statement Template Fresh Self Employment Profit And Loss Statement Line Marketing Income Statement Statement Template Self Employment

Self Employment Income Statement Template Fresh Self Employment Profit And Loss Statement Line Marketing Income Statement Statement Template Self Employment

What Is Irs Form W 9 Turbotax Tax Tips Videos

What Is Irs Form W 9 Turbotax Tax Tips Videos

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png) Form 2106 Employee Business Expenses Definition

Form 2106 Employee Business Expenses Definition

Http Www Mymoneyblog Com Images 0902 Scorp Gif Self Employment Income Tax S Corporation

Http Www Mymoneyblog Com Images 0902 Scorp Gif Self Employment Income Tax S Corporation

Self Employment Ledger Forms Lovely Self Employment Ledger 40 Free Templates Examples Peterainsworth Self Employment Self Profit And Loss Statement

Self Employment Ledger Forms Lovely Self Employment Ledger 40 Free Templates Examples Peterainsworth Self Employment Self Profit And Loss Statement

Wait What I Have To Pay Taxes 4 Times A Year What You Need To Know About Taxes And Self Employment Miranda Mer Finance Saving Filing Taxes Tax Preparation

Wait What I Have To Pay Taxes 4 Times A Year What You Need To Know About Taxes And Self Employment Miranda Mer Finance Saving Filing Taxes Tax Preparation

Calculate Your Self Employment Taxes Sole Proprietorship Sole Proprietor Self

Calculate Your Self Employment Taxes Sole Proprietorship Sole Proprietor Self

Your Self Employed Tax Return Youtube

Your Self Employed Tax Return Youtube

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

How To Calculate Self Employment Tax Self Employment Business Tax Deductions Small Business Tax Deductions

How To Calculate Self Employment Tax Self Employment Business Tax Deductions Small Business Tax Deductions

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos