152020 202021 National Insurance Rates for Self Employed in the UK. Class 4 if your profits are 8164 or more a year.

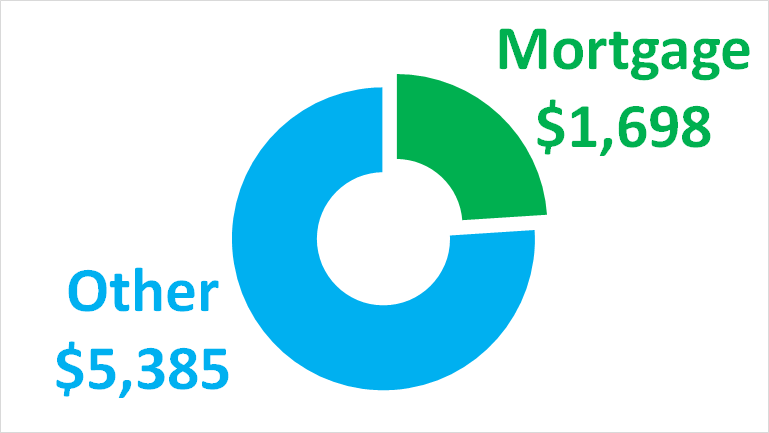

I Make 85 000 A Year How Much House Can I Afford Bundle

I Make 85 000 A Year How Much House Can I Afford Bundle

If you are self employed chances are that you possibly have multiple sources of income.

Self employment tax on 85000. 0 on the first 12500 you earn. This is 85000 minus your personal allowance of 12500 capped at your higher earnings limit of 50000. 1152021 When that total reaches the VAT registration threshold 85000 for a 12-month period ending in 202021 you need to register by the end of the following month.

If youre self-employed and your turnover is more than 85000 you will have to enter an individual amount for each kind of expenses plus a total at the end. Self-Employment Tax Rate The self-employment tax rate is 153. 20 on income between 12571 and 50270.

Next all VAT-registered businesses will need to comply with Making Tax Digital for VAT from April 2022. 9102018 Self-employed people are liable to pay Class 2 or Class 4 National Insurance. The rate is 9 on profits between 8164 and 45000 and 2 on profits over 45000.

Businesses with a taxable turnover of 85000 or more MUST register for VAT which is why it. Class 4 Lower Profits Threshold. This applies to the initial 128400 of your salary.

You must however register for VAT if. Check if you still need to fill in a tax return If you do not think you need to fill in a tax return. Class 4 NI Rate.

For example if your VAT taxable turnover exceeds 85000 for the twelve months to 31 August 2020 you need to register for VAT by 30 September 2020. Class 4 Rate above 50000. Self employed people pay a lower rate of NIC National Insurance contributions called Class 4 national insurance.

Since you are earning above this limit you will. 8212020 HMRC is introducing Making Tax Digital gradually. Medicare and Social Security.

Class 2 Small Profits Threshold. 20 on income between 12501 and 50000. The Class 2 rate is applicable to those earning less than 6025 per year while Class 4 is applicable to those earning over 8164 a year.

45 on income over 150000. Class 2 Small Profits Threshold. Class 2 NICs can be avoided if self employment profits are below the exemptions limit.

Youll need to fill in the Self-employment full pages if. For Medicare you pay 145 from your salary with no upper limit. You can file these taxes along with your Income tax in the Self Assessment form.

They also pay a weekly fixed rate Class 2 NIC. 40 on income between 50271 and 150000. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

Your business is more complicated or your turnover including any taxable coronavirus support scheme payments for the year is 85000 or more youve changed your accounting date your taxable self-employed period known as the basis period is not the same as your. Class 2 Rate per week. 3312010 In 2021-22 self-employed workers and employees pay.

Class 4 Rate above 50000. 462019 201920 National Insurance Rates for Self Employed in the UK. If annual turnover is below 85000 you can just enter your total expenses without having to itemise them.

If you are self-employed you will have to pay VAT if the turnover of your business is more than 85000 tax year 201718. If you are self-employed your Social Security tax rate is 124 percent and your Medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion. The VAT taxable turnover refers to the total value of everything that you sell that isnt exempt from VAT.

Class 4 Lower Profits Threshold. In the 2020-21 tax year self-employed and employees paid. The rate consists of two parts.

For full details and past rates visit this page. Who should use the SA103F Self-employment Full form If your business is more complex your annual turnover was 85000 or more or you need to make some adjustments to your profits you will need the Self-employment Full form SA103F. Making Tax Digital for VAT started from 1 April 2019 affecting VAT-registered businesses with a taxable turnover above the VAT threshold of 85000.

Other useful information for self employed in 201920 tax year. The different expenses you can include if youre self-employed are. Normally you pay 62 towards Social Security and your employer pays the other 62.

Your VAT taxable turnover exceeds the current threshold of 85000 for a 12-month period ending in 202021. 0 on the first 12570 you earn. You pay no tax on this personal allowance.

Class 2 Rate per week. You will pay an additional 09 Medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly and 125000 married filing separate. For full details and past rates visit this page.

You will pay an additional 09 Medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly and 125000 married filing separate. 4212021 If your turnover is below a certain threshold you will have no legal obligation to pay VAT. Fill in the Self-employment shortpages if your turnover was less than 85000 or would have been if youd traded for a full year.

If it was 1000 or less read Trading income allowance below. Class 4 NI Rate. Only VAT registered businesses have the ability can claim back any VAT they have paid because they have access to relevant forms.

If you are self-employed your Social Security tax rate is 124 percent and your Medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion. Other useful information for self employed in 202021 tax year. Self-employment taxes are made up of two parts.

8192020 The Two Parts of Self-Employment Taxes. You will then pay the basic tax rate of 20 on 37500.

Going Abroad 15 Smart Ways To Travel With Money Ways To Travel Travel Money Changers

Going Abroad 15 Smart Ways To Travel With Money Ways To Travel Travel Money Changers

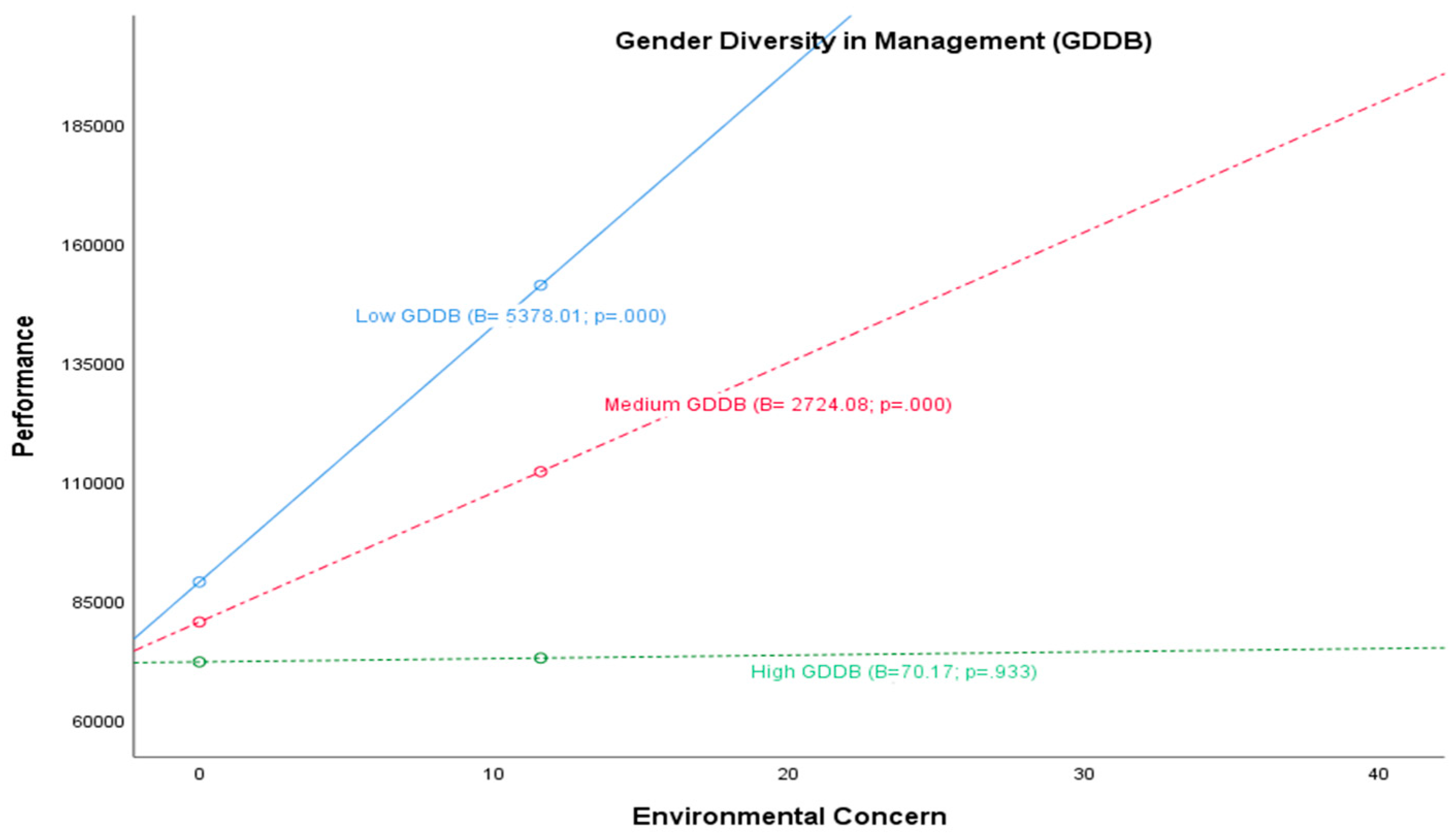

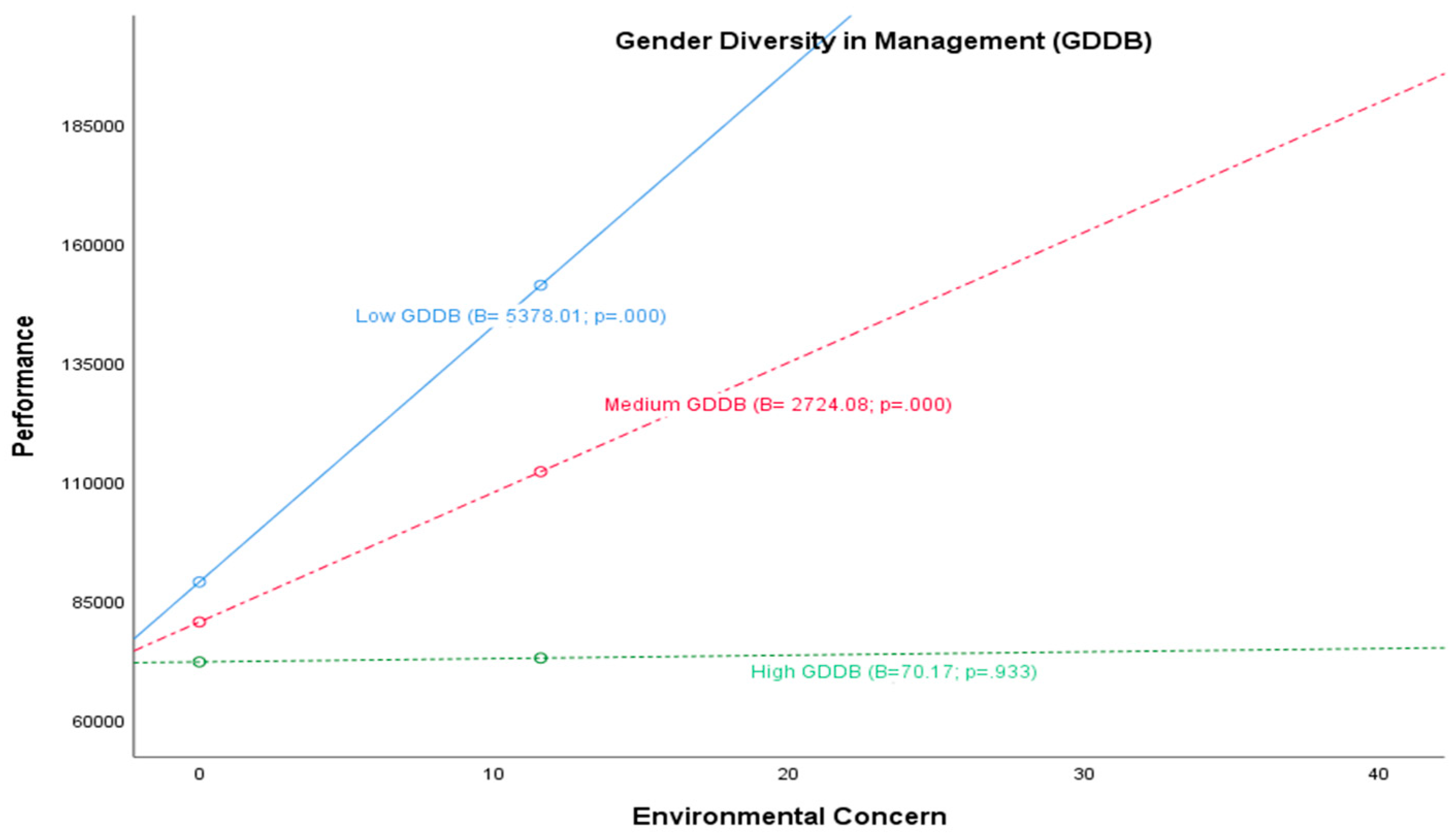

Sustainability Free Full Text Does Gender Diversity Affect Performance In Agri Food Cooperatives A Moderated Model Html

Sustainability Free Full Text Does Gender Diversity Affect Performance In Agri Food Cooperatives A Moderated Model Html

85 000 After Tax 2021 Income Tax Uk

85 000 After Tax 2021 Income Tax Uk

Http Www Lpem Org Repec Lpe Efijnl 198922 Pdf

Access 85000 Plr Products Ebooks Videos Software Templates Articles Graphics And Mo Business Illustration Freelance Graphic Design Digital Entrepreneur

Access 85000 Plr Products Ebooks Videos Software Templates Articles Graphics And Mo Business Illustration Freelance Graphic Design Digital Entrepreneur

Http Www Lpem Org Repec Lpe Efijnl 198922 Pdf

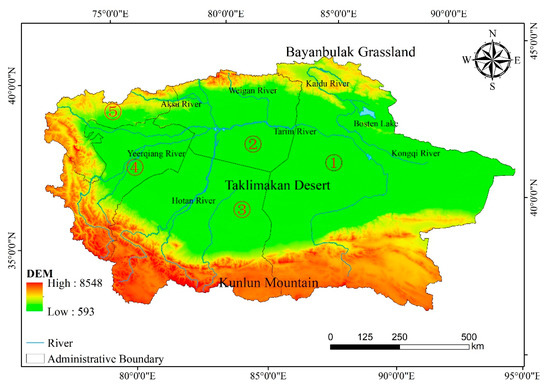

Sustainability Free Full Text Spatiotemporal Evolution Characteristics In Ecosystem Service Values Based On Land Use Cover Change In The Tarim River Basin China Html

Sustainability Free Full Text Spatiotemporal Evolution Characteristics In Ecosystem Service Values Based On Land Use Cover Change In The Tarim River Basin China Html

Http Www Lpem Org Repec Lpe Efijnl 198922 Pdf

Autumn Budget 2017 A Summary For Small Business Owners The Winchester Bookkeeping Company

Https Www Mdpi Com 2199 8531 7 1 37 Pdf

Http Www Lpem Org Repec Lpe Efijnl 198922 Pdf

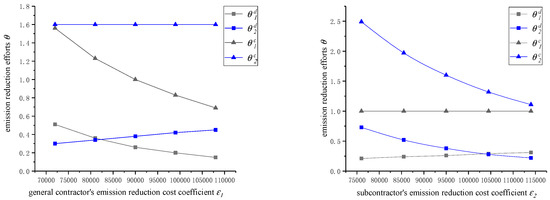

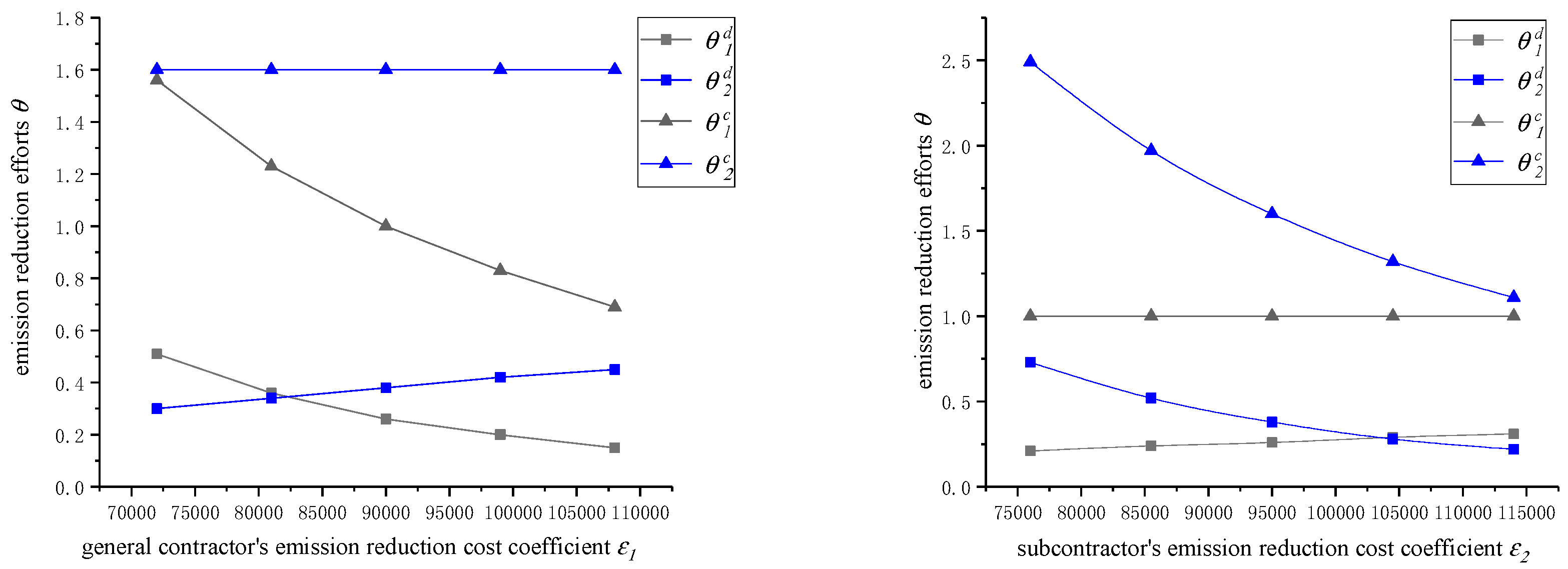

Sustainability Free Full Text Profit Distribution Model For Construction Supply Chain With Cap And Trade Policy Html

Sustainability Free Full Text Profit Distribution Model For Construction Supply Chain With Cap And Trade Policy Html

85 000 After Tax Ie Breakdown May 2021 Incomeaftertax Com

85 000 After Tax Ie Breakdown May 2021 Incomeaftertax Com

26 Cover Letter Sample Pdf Cover Letter For Resume Cover Letter Resume Cover Letter Examples

26 Cover Letter Sample Pdf Cover Letter For Resume Cover Letter Resume Cover Letter Examples

Sage Business Cases Growth And Attaining Global Competitive Advantage A Study Of Hindalco

Sage Business Cases Growth And Attaining Global Competitive Advantage A Study Of Hindalco

What Is Vat And Do I Need To Register For Vat

What Is Vat And Do I Need To Register For Vat

Sustainability Free Full Text Profit Distribution Model For Construction Supply Chain With Cap And Trade Policy Html

Sustainability Free Full Text Profit Distribution Model For Construction Supply Chain With Cap And Trade Policy Html

Http Www Lpem Org Repec Lpe Efijnl 198922 Pdf