Enter here and on. Printable Form 1040 Schedule 2.

Employment And Labor Law 8th Edition Self Employment Tax Calculator Employee Development Department Employment Self Employment Business Tax Employment

Employment And Labor Law 8th Edition Self Employment Tax Calculator Employee Development Department Employment Self Employment Business Tax Employment

Are you looking telecalling part time jobs.

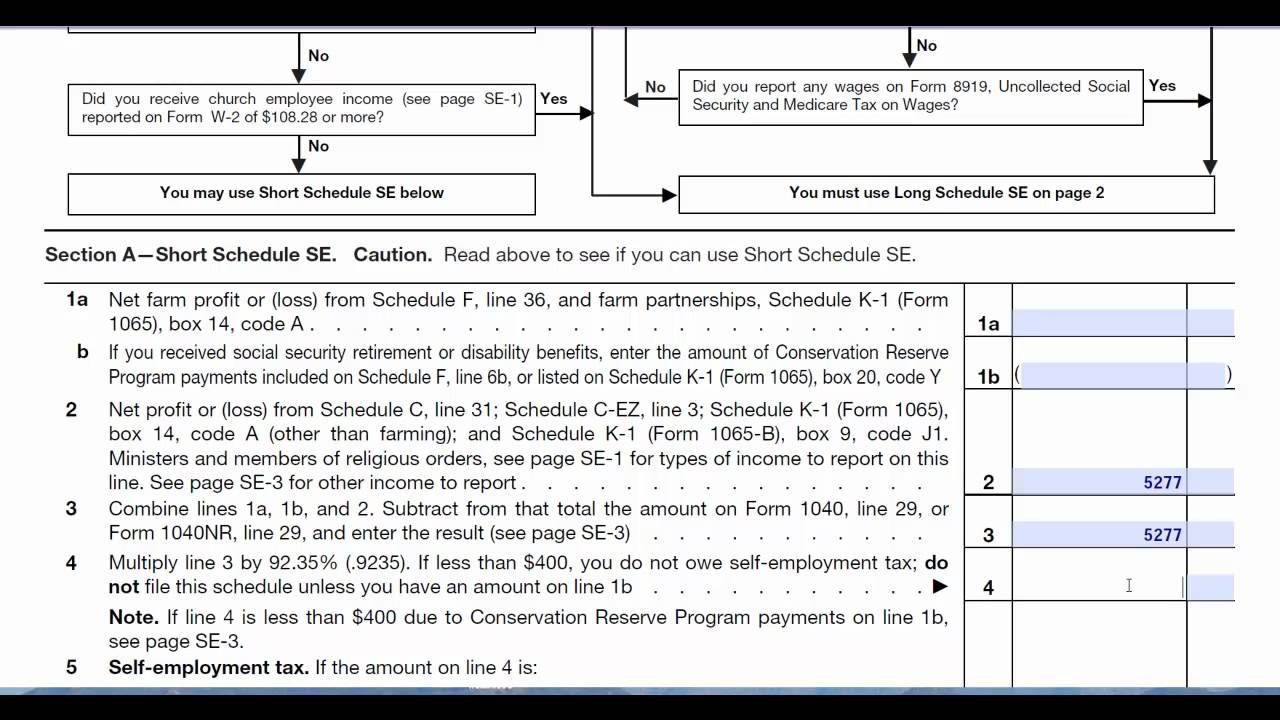

Schedule 2 self employment tax. 1162021 Self-employment tax Schedule SE. Unreported social security and Medicare tax. Schedule 2 Form 1040 line 4.

Multiply line 6 by 29 0029. Enter the amount from Line 12 on Schedule 2 Form 1040 Line 4 to include the amount of self-employment tax you owe. These free PDF files are unaltered and are sourced directly from the publisher.

You have 87700 in wages and 45500 in net self-employment income for a total of 133200 leaving 300 in self-employed income over the threshold. 9112019 The self-employment tax rate is 153. Are you looking telecalling part time jobs.

If youre required to pay self-employment tax attach Schedule SE Form 1040 Self-Employment Tax and Schedule 2 Form 1040 Additional Taxes PDF to your Form 1040 US. 4212021 Youll enter the Schedule SE calculations on IRS Form 10401040-SR in two places. Self-employment tax applies to net earnings what many call profit.

612019 As part of Tax Reform the three different 1040 forms 1040EZ 1040A and 1040 have been replaced with a new Form 1040 and six new schedules Schedule 1-6. 1272020 The 153 self-employment tax is composed of a 124 Social Security tax on the first 137700 of net self-employment income for the year 2020 142800 in 2021 and a Medicare tax of 29 on all net self-employment income. Your employer will pay 765 62 145 in taxes on 87700.

Next multiply your self-employment taxable income by the 153 self employment tax rate. Lines 2-4 will ask you to take your total net self-employment income and multiply it by 9235 to calculate your net earnings which is the part of your income that is subject to self-employment tax. Page 1 of the new 1040 has general information about you your spouse your dependents and filing status as well as signatures and the bottom of the page.

11252009 Enter the sum of 1a 1b and 2 on line 3 of Long Schedule SE. Click any of the IRS Schedule 2 form links below to download save view and print the file for the corresponding year. Enter line 2 - Use optional method for farm SE income or line 3 - Use optional method for non-farm income.

Who Must Pay Self-Employment SE Tax Self-Employed Persons You must pay SE tax if you had net. 13 Deduction for one-half of self-employment tax. Enter the amount on Line 13 on Schedule 1 Form 1040 Line 1 to claim the deduction for one-half of the self-employment tax.

That rate is the sum of a 124 for Social Security and 29 for Medicare. We have multiple opening in UK process. Calculate your self-employment taxes.

Individual Income Tax Return or Form 1040-SR US. Select section 1 - General. 2020 Schedule 2 Instructions page.

If this amount is less than 400 then you do not need to pay any self-employment tax. Weve rounded the result because the IRS gives you the option of rounding off cents to whole dollars on your tax return and schedules. Even if you had a loss or a small amount of income from self-employment it may be to your benefit to file Schedule SE and use either optional method.

Add lines 10 and 11. Calculate your tax obligation - This is where you multiply the line above 3 by 9235 9235. Tax Return for Seniors.

We have multiple opening in UK process. 432019 Located on page one of Schedule SE the short version of Schedule SE is just six lines long. Self-Employment Tax Schedule SE worksheet.

2020 Schedule 2 Form. Self-Employment Tax Rate The self-employment tax rate is 153. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program.

Ad Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. The rate consists of two parts.

Use Schedule SE Form 1040 to figure the tax due on net earnings from self-employment. Write the total amount after multiplying on this line. For example say your farm income was 0 line 1a you had no earnings from social security retirement or disability line 1a and your business had a profit of 800 line 2.

Your self-employment taxes are 14130. Ad Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix. 92350 x 153 14130.

This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits. Multiply line 12 by 50 050. Enter here and on.

Go to the Taxes. In the instruc-tions for Part II of Schedule SE dis-cussed later.

The Self Employment Tax Explained By A Self Employed Cpa Self Employment Employment Business Tax

The Self Employment Tax Explained By A Self Employed Cpa Self Employment Employment Business Tax

Irs Tax Tips For The Self Employed Irs Taxes Online Marketing Business Loans

Irs Tax Tips For The Self Employed Irs Taxes Online Marketing Business Loans

Selfemployedproduct Job Info Tax Forms Self Assessment

Selfemployedproduct Job Info Tax Forms Self Assessment

Organize Small Business Taxes Plus Free Printables Small Business Tax Business Tax Business Organization

Organize Small Business Taxes Plus Free Printables Small Business Tax Business Tax Business Organization

Pin On Starting A Business Side Hustles After Divorce

Pin On Starting A Business Side Hustles After Divorce

7 Self Employment Tax Forms For Home Business Owners Tax Forms Self Employment Extra Money

7 Self Employment Tax Forms For Home Business Owners Tax Forms Self Employment Extra Money

Was Sie Zu Ihrem Steuertermin Mitnehmen Sollten Taxes For Small Business Business Ihrem Mitnehmen Sie Tax Appointment Business Tax Tax Organization

Was Sie Zu Ihrem Steuertermin Mitnehmen Sollten Taxes For Small Business Business Ihrem Mitnehmen Sie Tax Appointment Business Tax Tax Organization

Complete Guide To Taxes Freelancers And The Self Employed Addition Words Tax Guide Tax Forms

Complete Guide To Taxes Freelancers And The Self Employed Addition Words Tax Guide Tax Forms

Self Employment Tax Calculator 1099 Schedule C Estimated Taxes Self Employment Self Tax Payment

Self Employment Tax Calculator 1099 Schedule C Estimated Taxes Self Employment Self Tax Payment

Instructions For Form 8995 2019 Internal Revenue Service Workbook Internal Revenue Service Federal Income Tax

Instructions For Form 8995 2019 Internal Revenue Service Workbook Internal Revenue Service Federal Income Tax

Freelance Writer Taxes Self Employment Tax Freelance Writer Freelance Writing Profit And Loss Statement

Freelance Writer Taxes Self Employment Tax Freelance Writer Freelance Writing Profit And Loss Statement

Customizing You To Your Market Home Business Business Tax Return

Customizing You To Your Market Home Business Business Tax Return

Taxes By Teresa Schedule Your Appointment Today Tax Refund Self Employment Tax

Taxes By Teresa Schedule Your Appointment Today Tax Refund Self Employment Tax

Self Employment Income Statement Template Fresh Self Employment Profit And Loss Statement Line Marketing Income Statement Statement Template Self Employment

Self Employment Income Statement Template Fresh Self Employment Profit And Loss Statement Line Marketing Income Statement Statement Template Self Employment

7 Self Employment Tax Forms For Home Business Owners Tax Forms Business Tax Small Business Finance

7 Self Employment Tax Forms For Home Business Owners Tax Forms Business Tax Small Business Finance

Complete Guide To Taxes Freelancers And The Self Employed Addition Words Tax Guide Employee Tax Forms

Complete Guide To Taxes Freelancers And The Self Employed Addition Words Tax Guide Employee Tax Forms

Calculate Your Self Employment Taxes Sole Proprietorship Sole Proprietor Self

Calculate Your Self Employment Taxes Sole Proprietorship Sole Proprietor Self