1282017 Those who are self-employed or earning contracting income will pay 153 of earnings in whats known as SECA taxes Self-Employment Contributions Act. 11182020 Additionally Schedule 1 contains information on the following adjustments to income.

Payroll Reconciliation Excel Template Inspirational 5 Sample Payroll Register Business Template Example In 2021 Self Employment Employment Form Bookkeeping Templates

Payroll Reconciliation Excel Template Inspirational 5 Sample Payroll Register Business Template Example In 2021 Self Employment Employment Form Bookkeeping Templates

Refer to the IRS Instructions for Schedule SE for more information regarding which partnership income must be reported as self-employment income.

Schedule 1 self employment. 432019 Schedule SE is one of many schedules of Form 1040 the form you use to file your individual income tax return. Generally a taxpayers share of ordinary income reported on a Schedule K-1 from a partnership engaged in a trade or. Multiply line 12 by 50 050.

Only those partners who have section G marked General or LLC member-manager with an applicable I1 Partner Type will carry an amount to line 14a. Add lines 10 and 11. Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income.

Bridges CPA PFS December 2014. What you should have been doing is treating yourselves as employees of the LLCS-Corp paying wages and withholding social security and medicare tax and then reporting that on a W-2. 4282021 Other income includes earnings other than wages or income from self-employment retirement income or investments foreign income and canceled debts.

Enter here and on. The self-employment tax consists of the Old-Age Survivors and Disability Insurance social security and the Hospital Insurance Medicare taxes. Self-employment tax due can be determined by inputting profits and losses on the Schedule SE.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021. As an LLC being treated as an S-Corporation for tax purposes you do not file Schedule SE. If youre not a farmer you can skip this line.

142021 If the total of your net earnings from self-employment from all businesses is 400 or more use Schedule SE Form 1040 Self-Employment Tax to figure your net earnings from self-employment and tax owed. You can calculate your net earnings by taking your total self-employment income for the year multiplied. 1099-NEC Snap and Autofill.

8272014 Generally a taxpayers share of ordinary income reported on a Schedule K-1 from a partnership engaged in a trade or business is subject to the self-employment tax. Part II Optional Methods To Figure Net Earnings see instructions. IRS Says Members K-1 Income Subject to Self-Employment Tax.

Schedule K-1 Form 1065 - Self-Employment Earnings Loss This article focuses solely on the entry of Self-Employment Earnings Loss which is found on Box 14 of the Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc. How to fill out the Schedule SE Can you use the short Schedule SE. Enter here and on.

However like any general rule there are a myriad of exceptions including one excepting a limited partners share of ordinary income from a partnership. Schedule K1 assists business partners in reporting their share of the profits losses deductions and credits. Tax rules which were enacted long before the LLC format came into existence provide that a general partners K-1 ordinary business income is subject to self-employment tax while a limited partners K-1 income is not except for guaranteed payments.

Other income must be reported on Schedule 1 and Form 1040 and its taxable. Self-Employment Tax Section A. For additional information regarding the requirements for Schedule K-1 Form 1065 see.

Self-employment income is not reported as Other Income. Certain business expenses for performing artists fee-based government officials or reservists. Partnerships need to file IRS Form 1065 and Schedule K1 for tax purposes.

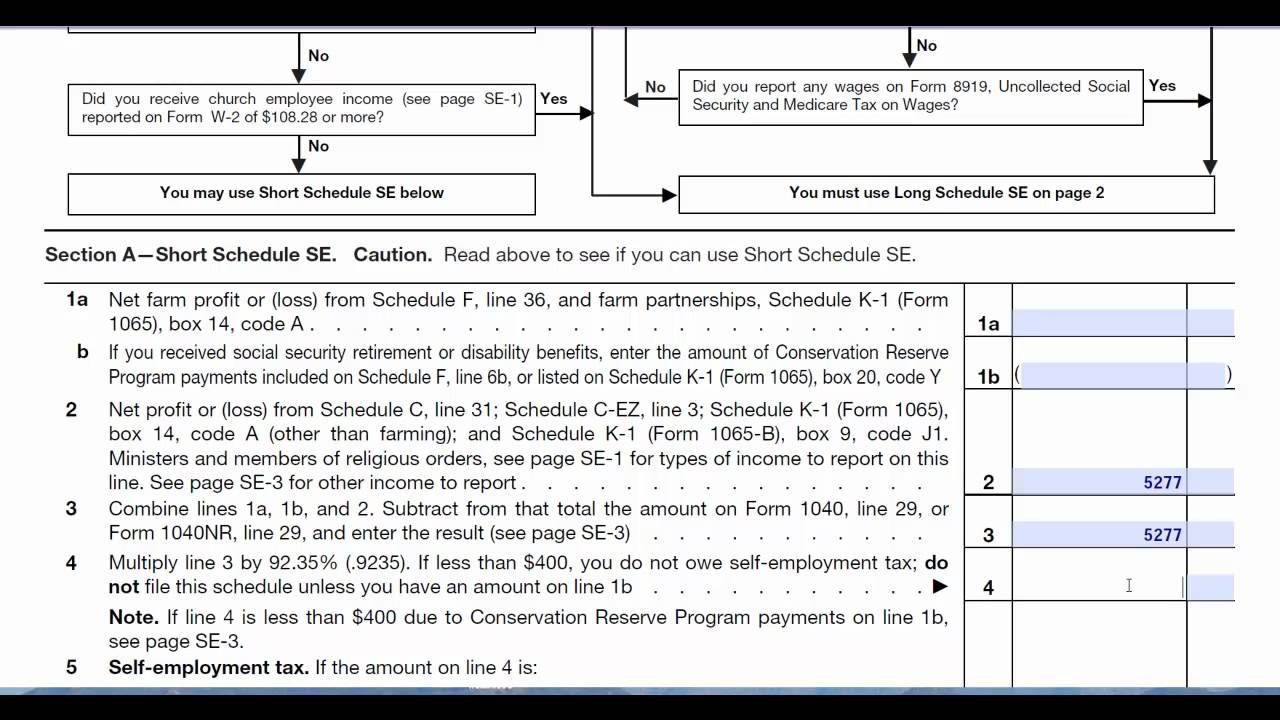

Schedule K1 is provided on IRS Form 1065 for taxpayers to report self-employment taxes related to a business partnership. Lines 2 3 and 4 Calculating net earnings. The self-employment tax rate for self-employment earnings is generally 153.

3302020 So the amount on line 16 schedule 1 represents your allowable self-employed insurance deduction which is the product of a complicated calculation based on your income and the amounts reported on your form 1095-A. This self-employment tax is imposed in addition to the regular income tax you already pay and is imposed on your self-employment earnings. Schedule 2 Form 1040 line 4.

Line 1 Farm income. Self-employment retirement plan contributions such as SEP IRAs or SIMPLE IRAs. 13 Deduction for one-half of self-employment tax.

This is where youll calculate your net earnings for the tax year. Other Income is generally taxable income that is considered to be not common income. This line pertains to income from farming.

It is reported on Line 8 of Schedule 1. You use it to calculate your total self-employment tax which you must report on another schedule of Form 1040 Schedule 4 line 57. 612019 How do I account for self employment taxes on Schedule K1 income.

Schedule 1 Form 1040 line 14. However for 2011 the rate is reduced to 133. Available in mobile app only.

The IRS will.

Help How Do I Report Self Employment Income For Medicaid Or The Marketplace Healthcare Counts Self Employment Statement Template Income Statement

Help How Do I Report Self Employment Income For Medicaid Or The Marketplace Healthcare Counts Self Employment Statement Template Income Statement

Creating Your Ideal Schedule When You Re Self Employed Marketing Advice Small Business Tips Small Business Marketing

Creating Your Ideal Schedule When You Re Self Employed Marketing Advice Small Business Tips Small Business Marketing

Profit And Loss Statement For Self Employed Profit And Loss Statement Statement Template Bank Statement

Profit And Loss Statement For Self Employed Profit And Loss Statement Statement Template Bank Statement

Customizing You To Your Market Letter Example Business Template Lettering

Customizing You To Your Market Letter Example Business Template Lettering

7 Self Employment Tax Forms For Home Business Owners Tax Forms Self Employment Extra Money

7 Self Employment Tax Forms For Home Business Owners Tax Forms Self Employment Extra Money

Calculate Your Self Employment Taxes Sole Proprietorship Sole Proprietor Self

Calculate Your Self Employment Taxes Sole Proprietorship Sole Proprietor Self

Self Employment Ledger Forms Lovely Self Employment Ledger 40 Free Templates Examples Peterainsworth Self Employment Self Profit And Loss Statement

Self Employment Ledger Forms Lovely Self Employment Ledger 40 Free Templates Examples Peterainsworth Self Employment Self Profit And Loss Statement

Self Employed Weekly Printable Time Sheet Self Printables Week

Self Employed Weekly Printable Time Sheet Self Printables Week

Customizing You To Your Market Profit And Loss Statement Good Essay Sample Resume

Customizing You To Your Market Profit And Loss Statement Good Essay Sample Resume

Freelance Writer Taxes Self Employment Tax Freelance Writer Freelance Writing Profit And Loss Statement

Freelance Writer Taxes Self Employment Tax Freelance Writer Freelance Writing Profit And Loss Statement

Sample One Page Business Plan Template Self Employment Entrepreneur Small Business Small Business Plan One Page Business Plan Business Plan Template

Sample One Page Business Plan Template Self Employment Entrepreneur Small Business Small Business Plan One Page Business Plan Business Plan Template

Osgood Associates Improving How The Workforce Works Self Employment Work Smarter Employment

Osgood Associates Improving How The Workforce Works Self Employment Work Smarter Employment

Self Employed Favorite Quotes Story Of My Life Words

Self Employed Favorite Quotes Story Of My Life Words

Self Employment Income Statement Template Unique Example Format In E Statement Template Free Down Statement Template Profit And Loss Statement Income Statement

Self Employment Income Statement Template Unique Example Format In E Statement Template Free Down Statement Template Profit And Loss Statement Income Statement

Self Employment Income Statement Template Fresh Self Employment Profit And Loss Statement Line Marketing Income Statement Statement Template Self Employment

Self Employment Income Statement Template Fresh Self Employment Profit And Loss Statement Line Marketing Income Statement Statement Template Self Employment

Self Employed Contractor Resume Beautiful Model Essays Dissertations And Academic Support Resume For

Self Employed Contractor Resume Beautiful Model Essays Dissertations And Academic Support Resume For

Self Employed Tax Calculator Business Tax Self Employment Success Business

Self Employed Tax Calculator Business Tax Self Employment Success Business