This program operates just like the Section 8 program only your voucher is used to pay your mortgage and other homeownership expenses. 342021 Fill out the forgiveness form the EZ form or the equivalent from your lender.

How To Track Your Business Income Correctly Small Business Finance Business Finance Finance

How To Track Your Business Income Correctly Small Business Finance Business Finance Finance

You are otherwise in business for yourself including a.

Can you be self employed and get section 8. In determining if you are qualified for section 8 benefits all income to include self-employment income must be documented and reported to the section 8 department. When it comes to applying for food stamps the application process will be the same for you as it is for a traditionally-employed applicant. In many states including California and Nevada you can apply for food stamps online.

The first step is to determine just what sort of self-employed the household member is. The maximum amount of payroll expenses that qualify for. Section 8 or Low-Income Housing Tax Credit LIHTC is self-employment income.

Allowing such a self-employed. 3312020 To use the expanded unemployment benefits as a self-employed individual you will need to self-certify that youre self-employed and seeking part-time employment. You carry on a trade or business as a sole proprietor or an independent contractor.

Yes you can use a Section 8 Housing Choice Voucher to help pay your mortgage but the housing authority that manages your voucher must participate in HUDs Homeownership Voucher Program. Through the American Rescue Plan this program has been extended through August 29 2021 for some self-employed who do not qualify for regular state benefits. Types of Self-Employment Income.

There are times when the individual is not sure if they are considered self-employed. You are a member of a partnership that carries on a trade or business. Self-Employed Individual Availing of the 8 Income Tax Rate.

The application will ask you about yourself such as your date of birth and Social Security. The income qualifications for Section 8. 9252016 There are so many factors to consider when determining income for those who are self-employed.

You cannot claim the grant if you trade through a limited company or a. How much you can qualify for depends on the length of the period covered by forgiveness called a covered period. The 8 withholding rate is applied on income regardless of the amount.

Submit Application for Registration by accomplishing BIR Form No. You should be keeping receipts and if you work as an independent you likely should be filing a Schedule C w the IRS just like every other business does. 4302020 HUD grants priority for Section 8 vouchers to those who would be classified as extremely low-income levels and then to those with very low income.

Obtain the application from your local health and human services agency. Note that if you can work from home with pay youre not eligible for unemployment. Generally self-employment household members are either.

The provision under Section 24A2b of the Tax Code as amended which allows an option of 8 income tax rate on gross salesreceipts and other non-operating income in excess of P25000000 is available only to self-employed individuals earning income purely from self-employment andor practice of profession. Sub-Contractors who are paid by an employer with a 1099-form. 3262020 To be eligible for the fourth grant you must be a self-employed individual or a member of a partnership.

A1 New Business Registrant. 7232018 This 8 withholding tax rate replaces the two-tier rate of 10 for self-employed and professionals earning less than P720000 income every year or 15 for those earning more than P720000 per year. 1142018 One of the most difficult type of income to determine for managers of affordable housing rental properties eg.

Or if youre currently receiving paid sick leave or any other type of paid leave you cant file for unemployment under. 3312021 Self-employed small business owners have not historically been able to get unemployment benefits but thats now changed with the addition of a Pandemic Unemployment Assistance PUA program. A2 Registration Information Update.

There are limits to how much you can count toward your eligible payroll expenses. The eight-week covered period. Based on the number of issues we see when reviewing the tenant files of clients and the questions I receive on the subject during training a discussion of.

Losing my section 8 to take a hit or miss job is what seems like too huge of a risk when you have a child but sitting around unemployed bf works but it isnt enough I cant take it anymoreanyone know what section 8 policy is on the self employed or have any advice. 1901 to the concerned Revenue District Office having jurisdiction over the place of residence or where the Head Office is located together with the complete documentary requirements. Generally you are self-employed if any of the following apply to you.

10182011 You have to report your income to the IRS just like everyone else. 6292012 The job itself isnt a risk. Low-income status is typically last in line but could be granted a Section 8 voucher if they were classified as continuously assisted by public housing programs or those who are in HUD-assisted homeownership programs.

1242021 The IRS provides the eligibility guidelines for this tax-based benefit program and if youre a self-employed worker freelancer or gig worker you may be eligible for this assistance program. The guidance explains that it is appropriate to limit the forgiveness of owner compensation replacement for individuals with self-employment income who file a Schedule C to eight weeks worth 852 of 2019 net profitmany self-employed individuals have few of the overhead expenses that qualify for forgiveness under the ActAs a result most of their receipts will constitute net income.

How To Apply For A Ppp Loan When Self Employed Divvy

How To Apply For A Ppp Loan When Self Employed Divvy

8 Benefits Of Self Employment To Encourage You To Be Your Own Boss Self Employment Job Inspiration Self

8 Benefits Of Self Employment To Encourage You To Be Your Own Boss Self Employment Job Inspiration Self

On Average 2 2 Of Workers In Oecd Are Self Employed Women W Staff How Does Your Country Compare Self Employment Primary Activities

On Average 2 2 Of Workers In Oecd Are Self Employed Women W Staff How Does Your Country Compare Self Employment Primary Activities

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Small Business Finance Small Business Bookkeeping Bookkeeping Business

Sole Trader Bookkeeping Spreadsheet Goselfemployed Co Small Business Finance Small Business Bookkeeping Bookkeeping Business

How To Register As Self Employed In The Uk A Simple Guide

How To Register As Self Employed In The Uk A Simple Guide

Previous Employment Verification Form

Previous Employment Verification Form

Sa302 Tax Calculation Request Form Tax Self Assessment This Or That Questions

Sa302 Tax Calculation Request Form Tax Self Assessment This Or That Questions

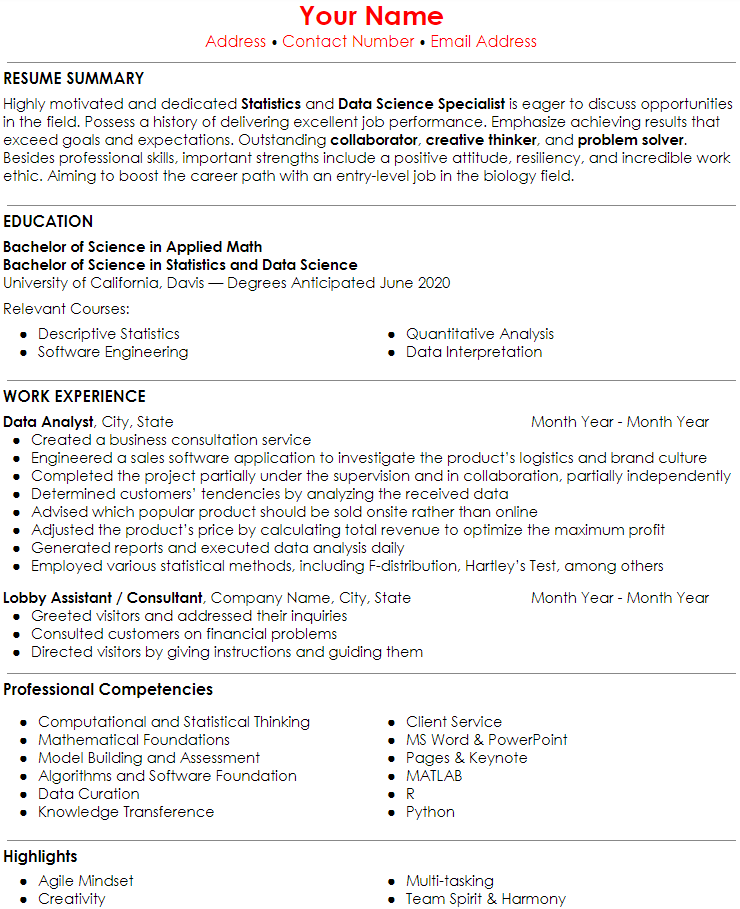

How To List Self Employment And Freelance Work On Resume Skillroads Com Ai Resume Career Builder

How To List Self Employment And Freelance Work On Resume Skillroads Com Ai Resume Career Builder

How To Apply For A Ppp Loan When Self Employed Divvy

How To Apply For A Ppp Loan When Self Employed Divvy

Self Employed Health Insurance Deduction Healthinsurance Org

Self Employed Health Insurance Deduction Healthinsurance Org

Help How Do I Report Self Employment Income For Medicaid Or The Marketplace Healthcare Counts Self Employment Statement Template Income Statement

Help How Do I Report Self Employment Income For Medicaid Or The Marketplace Healthcare Counts Self Employment Statement Template Income Statement

Self Employment Tax Grubhub Doordash Instacart Uber Eats

Self Employment Tax Grubhub Doordash Instacart Uber Eats

Free Resume Examples Self Employed My Yahoo Image Search Results Resume Skills Section Resume Examples Resume Skills

Free Resume Examples Self Employed My Yahoo Image Search Results Resume Skills Section Resume Examples Resume Skills

Fha Loan For Self Employed In 2021 Fha Lenders

Fha Loan For Self Employed In 2021 Fha Lenders

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Business Tax Tax Write Offs Small Business Organization

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Business Tax Tax Write Offs Small Business Organization

Self Employment Ledger Forms Lovely 8 Free Self Employment Ledger Template Self Employment Business Advice Self

Self Employment Ledger Forms Lovely 8 Free Self Employment Ledger Template Self Employment Business Advice Self

10 Self Employed Money Mistakes That Will Get You Burned Small Business Organization Small Business Bookkeeping Business Advice

10 Self Employed Money Mistakes That Will Get You Burned Small Business Organization Small Business Bookkeeping Business Advice

Customizing You To Your Market The Rev Self Employment The Covenant

Customizing You To Your Market The Rev Self Employment The Covenant