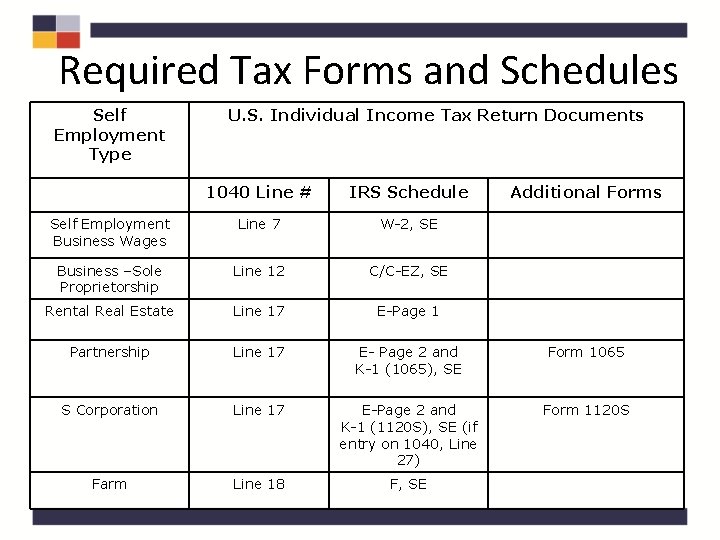

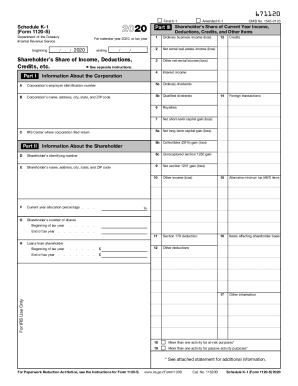

However an S corporation need not pay all of its profits to its employee s as wages. 382021 Forms and Instructions About Schedule K-1 Form 1120-S Shareholders Share of Income Deductions Credits etc.

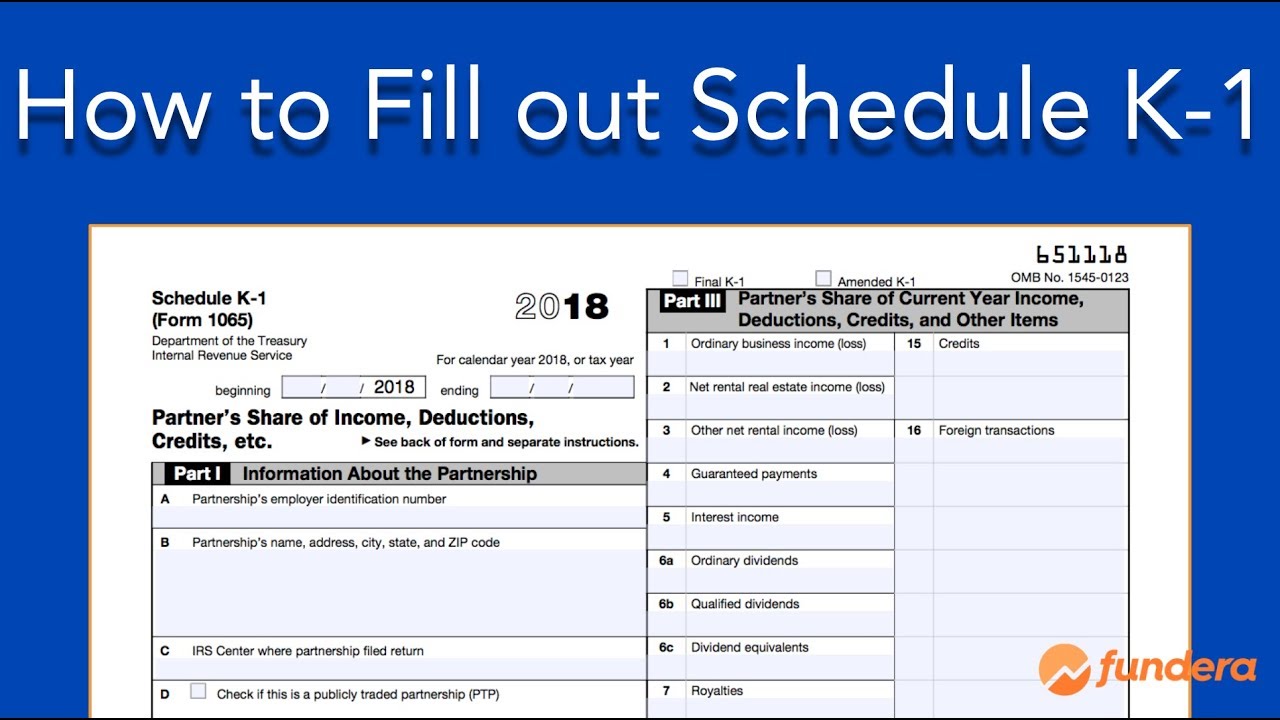

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedules K and K-1 General Instructions Purpose of Schedules The corporation is liable for taxes on lines 22a 22b and 22c on page 1 of Form 1120-S.

1120s k-1 self employment tax. About Schedule K-1 Form 1120-S Shareholders Share of Income Deductions Credits etc. The range depends on how much bookkeeping is required help us help you. Per IRS Instructions for Form 1120S page 20.

Your share of S corporation income isnt self-employment income and it isnt subject to self-employment tax. Generally a taxpayers share of ordinary income reported on a Schedule K-1 from a partnership engaged in a trade or business is. Items shown on Schedule K-1 on your tax return.

That is employers portion of FICA Federal Insurance Contributions Act plus FUTA Federal Unemployment Tax Act taxes. Y-T-D Paystub is required but is not used in the calculation of qualifying income. 2192020 I was told by the CPA firm that prepared the 1120 S that ordinary business income on line 1 of K-1 is subject to ss taxes.

1262019 Where do I enter self-employment health insurance premiums paid on Form 1120-S S-Corporation to have it flow to a Schedule K-1. As discussed in the August issue of our newsletter in a recent district court case Reither in the US. When self employed and using the income you must.

Check out our Corporate Fee Structure at-. Review the Business Returns A business Credit Report and PL may be required check investor guidelines If two years tax returns required average the Income only if not declining. Shareholders of an S corporation are not self-employed.

A sole proprietor pays self-employment tax of 153 Social Security and Medicare on all profits. Shareholders are liable for tax on their shares of the corporations income reduced by any taxes paid by the corporation on income. The 1120-S instructions explain.

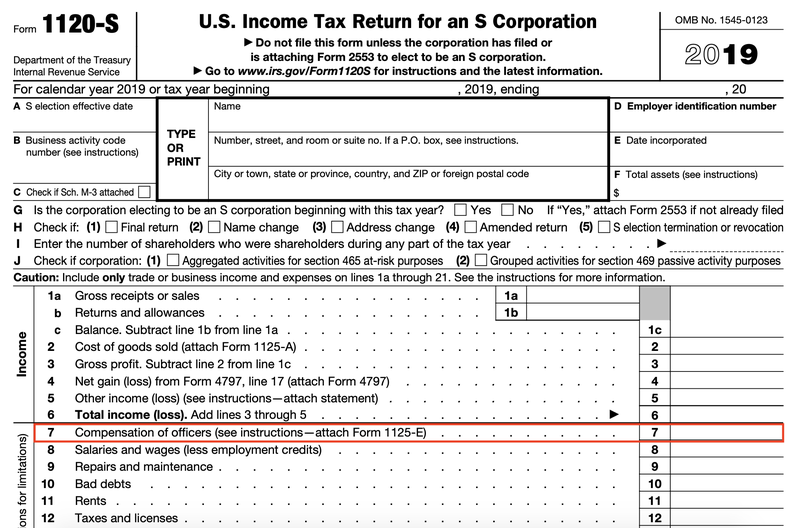

Tax return Series Form 1120 with K1 Page 1. Ad Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix. A K1S screen does not produce Schedule SE because S corporation income is not considered self-employment income.

Are you looking telecalling part time jobs. Scroll down to the Other Items to be Reported on Schedules K-1 Smart Worksheet. Ad Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix.

They are employees of the corporation if they perform services for the corporation on a regular and continuous basis. It is the shareholders responsibility to consider and apply. 10132018 A Using the IRS Tax Form 1120S to determine your self-employed borrowers income Your borrower should have 1120S self-employed income type for the calculator On the income tab choose the borrower the income is being evaluated for Click the magnifying glass next to the1065 income calculator.

12302014 On line 12 form 1120S - you include ONLY taxes paid by S-corporation. The S corporation files a copy of this schedule with the IRS to report your share of the corporations income deductions credits etc. Having said that most S-Corp tax returns are prepared for 375 which includes state eFile and generating K-1s.

Schedules K and K-1 General Instructions Purpose of Schedules The corporation is liable for taxes on lines 22a 22b and 22c on page 1 of Form 1120S. 612019 Distributions are not subject to self-employment tax. We have multiple opening in UK process.

However a K-1 generated from a Form 1120S an underlying entity with the S Corp election is reported on the shareholders personal tax return on Schedule E Page 2 just like most K-1s but it is not subjected to. However for 2011 the rate is reduced to 133. The self-employment tax rate for self-employment earnings is generally 153.

The amount of loss and deduction you may claim on your tax return may be less than the amount reported on Schedule K-1. You do not include employees portion of FICA Federal Insurance Contributions Act and do not include federal income tax withholding from wages. 1082020 You simply cannot report K-1 1120-S income as self-employment income.

To Enter Self-Employed Health Insurance on Form 1120-S. Since the publication of that newsletter the IRS has issued a Chief Counsel Advice in which it determined that the members of an LLC management company. Unlike most partnership income S corporation income is not self-employment income and is not subject to self-employment tax.

More specifically line one is subject to ss tax. Why is Schedule SE not being produced for K-1 income from an S corporation. Go to Form 1120-S page 3-5 Schedule K Line 17.

It is ordinary farm business income. 612020 A Form 1065 is also called a partnership tax return and typically your K-1 income will be subjected to self-employment taxes. A corporate tax return for S-Corps on Form 1120S starts at 375 with a not-to-exceed fee of 775.

Are you looking telecalling part time jobs. We have multiple opening in UK process. Shareholders are liable for tax on their shares of the corporations income reduced by any taxes paid by the corporation on income.

District Court for New Mexico the court ruled that an LLC members K-1 income was subject to self-employment tax.

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

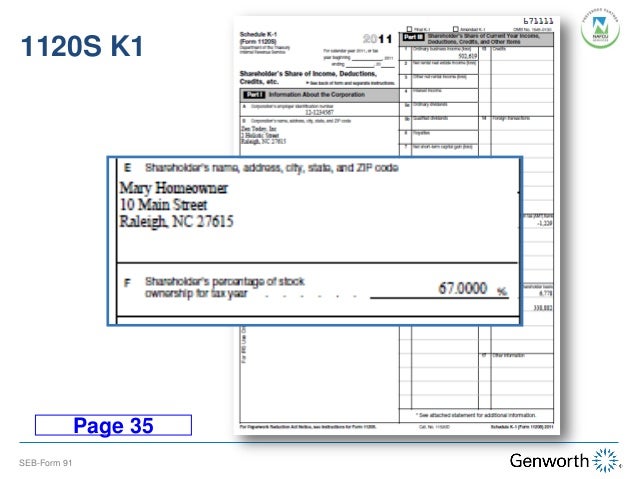

Https New Content Mortgageinsurance Genworth Com Documents Training Course Review 20s Corporation 20tax 20return 20form 201120s 20and 201040 20with 20w2 20and 20k1 Pdf

Https New Content Mortgageinsurance Genworth Com Documents Training Course Seb Form1120k1 Presentation 0420 Pdf

Self Employed Borrower Case Study Part I Completing The Form 91 Wit

Self Employed Borrower Case Study Part I Completing The Form 91 Wit

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Simple And Complete Guide To S Corporations Online Tax Professionals

Simple And Complete Guide To S Corporations Online Tax Professionals

Selfemployment Income Examples Of Selfemployment Income Sole Proprietorship

Selfemployment Income Examples Of Selfemployment Income Sole Proprietorship

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

How To Fill Out A Self Calculating Form 1120s S Corporation Tax Return And Schedule K 1 Youtube

How To Fill Out A Self Calculating Form 1120s S Corporation Tax Return And Schedule K 1 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

2015 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2015 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

A Beginner S Guide To S Corporation Taxes The Blueprint

A Beginner S Guide To S Corporation Taxes The Blueprint

Schedule K 1 Entire Lesson Pub 4491 Part 3 Nttc Training Ppt Download

Schedule K 1 Entire Lesson Pub 4491 Part 3 Nttc Training Ppt Download