It is most often used for unemployment compensation and State and Local Income tax refunds. If the item relates to an activity for which you are required to file Schedule C E or F or Form 4835 report the taxable amount allocable to the activity on that schedule or form instead.

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

The self-employment tax applies evenly to everyone regardless of your income bracket.

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

1099-g self employment tax. 2202021 Interestingly on line 8 of form 1099-G ProSeries asks if the amount reported in box 2 state income tax refunds credits or offsets applies to income from a business and if so links box 2 to line 6 other income of Schedule C thus subjecting it to Self Employment Taxes. If you expect to. Your income tax bracket determines how much you should save for income tax.

Ad Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix. Therefore it would not be considered self-employment income. State or local income tax refunds credits or offsets.

More In Forms and Instructions. Except as explained below this is your taxable amount. If the item relates to an activity for which you are required to file Schedule C Form 1040 Profit or Loss From.

272021 The 1099-G is reported as personal income and not business income as it is not directly related to the operation of his business. The amount will flow to line 6 of your schedule C and be included in gross income and net income will then flow to the schedule SE. All individuals who received unemployment insurance UI benefits in 2020 will receive the 1099-G tax form.

Using Sch F will allow you to flow from 1099-G to Schedule F seamlessly and be the correct form to use. Ad Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix. Form 1099-G - Taxable Grants.

The amount of your benefits will be shown in Box 1 on your 1099-G. Form 1099-G - Taxable Grants Entries on Form 1099-G Box 6 Taxable Grants this covers certain government payments are generally reported on Form 1040 Line 21. 422018 1099-G Form for unemployment compensation If you are drawing unemployment income from the state government those unemployment benefits are subject to taxes.

We have multiple opening in UK process. Entries on Form 1099-G Certain Government Payments Box 6 this covers certain government payments are generally reported on IRS Schedule 1 Form 1040 Additional Income and Adjustments to Income Line 8. You will enter this information in the federal interview section under the Personal Income tab.

About Form 1099-G Certain Government Payments. Do not report the incorrect 1099-G income on your tax return. The 1099 tax rate consists of two parts.

Are you looking telecalling part time jobs. Federal state or local governments file this form if they made payments of. 3142021 Yes income from fishing is considered self-employment and is subject to self employment tax.

Unemployment Insurance UI Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Extended Benefits EB Federal Pandemic Unemployment Compensation FPUC and Lost Wages Assistance LWA. It is most often used for unemployment compensation and State and Local Income tax refunds. If you collected unemployment insurance last year you will need the 1099-G form from IDES to complete your federal and state tax returns.

Select Personal Income and select Ill choose what I work on. The most common uses of the 1099-G is to report. 652019 You can enter it under your Business income in Other Income.

By clicking the thumb icon in a post. Can you get a tax return on a. Combine the box 1 amounts from all Forms 1099-G and report the total as income on the unemployment compensation line of your tax return.

If youve chosen to have taxes withheld from your benefits that amount will appear in Box 4. Then enter a description SBIR Grant reported on 1099-G and the amount. The Colorado Department of Labor and Employment provides Form 1099-G documents to claimants detailing the amount of unemployment benefits the claimant has been paid during the year.

The most common uses of the 1099-G is to report unemployment compensation as well as any state or local income tax refunds you received that year. 124 for social security tax and 29 for Medicare. If you received a 1099-G Form this year from a government agency you may need to report some of the information it contains on your tax return.

If you made more than 400 you need to pay self-employment tax. We have multiple opening in UK process. Tax Form 1099-G Issues.

For W-2 employees most of this is covered by your employer but not for the self-employed. We cannot provide advice. This shows government payments.

If you are married filing jointly each spouse must figure his or her taxable amount separately. Check with the IRS if you are not sure what to do. The 1099-G tax form includes the amount of benefits paid to you for any the following programs.

Self-employment taxes total roughly 153 which includes Medicare and Social Security taxes. Reemployment trade adjustment assistance RTAA payments. Are you looking telecalling part time jobs.

1099 Contractors and Freelancers The IRS taxes 1099 contractors as self-employed.

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg) Reporting 1099 Misc Box 3 Payments

Reporting 1099 Misc Box 3 Payments

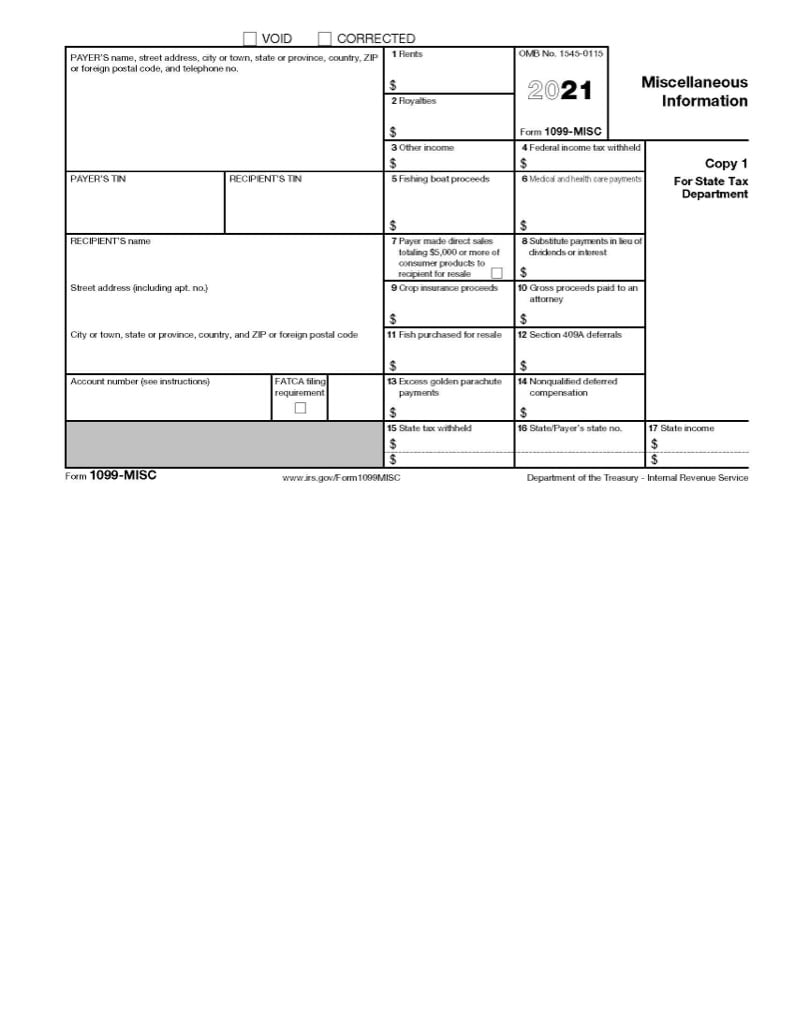

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1099 Misc Form What Is It And Do You Need To File It

1099 Misc Form What Is It And Do You Need To File It

/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

How Much Should I Set Aside For Taxes 1099

How Much Should I Set Aside For Taxes 1099

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Irs Schedule Se 1040 Form Pdffiller

Irs Schedule Se 1040 Form Pdffiller

Instant Form 1099 Generator Create 1099 Easily Form Pros

Instant Form 1099 Generator Create 1099 Easily Form Pros

Self Employment Tax Page 1 Line 17qq Com

Self Employment Tax Page 1 Line 17qq Com

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc