1292016 Self employment taxes are comprised of two parts. Social Security and Medicare.

Ifrsbox Example How To Consolidate Ifrsbox Making Ifrs Easy C3fe206d Resumesample Resumefor Financial Position Financial Statement Analysis Positivity

Ifrsbox Example How To Consolidate Ifrsbox Making Ifrs Easy C3fe206d Resumesample Resumefor Financial Position Financial Statement Analysis Positivity

Self employed people pay a lower rate of NIC National Insurance contributions called Class 4 national insurance.

Self employment tax on 80000. Small business owners contractors freelancers gig workers and others whose net profit is greater than 400 are required to pay self-employment tax. Bill earned 40000 in employee wages and 80000 in self-employment income. Allied is the Distributor of Choice for Industrial Automation.

8142020 The Self-Employment tax is calculated on 9235 of your total income. Ad Wide Selection of Tools. Self-employment income of over 400 is taxed for employment taxeseg Social Security and Medicare.

The key difference is in two areas National Insurance Contributions and the ability to deduct expenses and costs before calculating any deductions. This rate is derived from the fact that self-employed taxpayers can deduct the employers portion of the tax which is 765. Taxes on Employment Income.

The tax rate is currently 153 of your income with 124 going to Social Security and 29 going to Medicare. 2112021 To calculate self-employment taxes multiply your net self-employment income by 09235. You will pay 62 percent and your employer will pay Social Security taxes of 62 percent.

However under the appropriate circumstances with an S Corp the amount that exceeds the reasonable salary you make is not subject to self-employment taxes. You each also pay Medicare taxes of 145 percent on all your wages - no limit. Lets say 3100 in FICA taxes has been withheld from your wages.

852014 Your self-employment taxes on your 200000 share of the profits will be 20308. Taxes on Directors fee Consultation fees and All Other Income. Allied is the Distributor of Choice for Industrial Automation.

9112019 The self-employment tax rate for 2021 As noted the self-employment tax rate is 153 of net earnings. For example if you operate your business as a sole proprietorship and you earn 100000 for the year self-employment tax is due on the entire amount. If you are self-employed your Social Security tax rate is 124 percent and your Medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion.

More information about the calculations performed is available on the details page. That rate is the sum of a 124 Social Security tax and a. This percentage is a combination of Social Security and Medicare tax.

Self employment taxes are comprised of two parts. Now lets suppose you form an S corporation and you and your partner each take a reasonable salary which you determine is 80000. You also owe about 3720 as self-employment tax on your 30000 of self-employment income.

9152020 205 on the next 48534 of taxable income on the portion of taxable income over 48535 up to 97069 plus. Employed and Self Employed uses tax information from the tax year 2021 2022 to show you take-home pay. See what happens when you are both employed and self employed at the same time - with UK income tax National Insurance student loan and pension deductions.

4172020 The total of 80000 from your wages and your self-employment is less than the Social Security maximum of 117000 so your Social Security tax is due on all of your income. You will pay 62 percent and your employer will pay Social Security taxes of 62 percent on the first 128400 of your covered wages. 26 on the next 53404 of taxable income on the portion of taxable income over 97069 up to 150473 plus.

Ad Wide Selection of Tools. 622019 If the 8000 of income were wages you would have paid FICA taxes on the wages. You shouldnt be paying any income taxes.

Self employment profits are subject to the same income taxes as those taken from employed people. Then if the result is less than the contribution and benefit base for the year multiply the result by the total self-employment tax rate currently 153 percent. The employment income of non-residents is taxed at the flat rate of 15 or the progressive resident tax rates see table above whichever is the higher tax amount.

29 on the next 63895 of taxable income on the portion of taxable income over 150473 up to 214368 plus. Self-employed workers are taxed at 153 of the net profit. However if your employee wages are lower than the Social Security tax ceiling youll have to pay Social Security taxes on your self-employment income until your wages and self-employment income combined exceed the ceiling amount.

You will pay an additional 09 Medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly and 125000 married filing separate. Social Security and Medicare.

Proof Of Income Letter Pdf Unique Proof Of In E Letter 20 Samples Formats In Pdf Word Lettering Letter Templates Letter Writing Template

Proof Of Income Letter Pdf Unique Proof Of In E Letter 20 Samples Formats In Pdf Word Lettering Letter Templates Letter Writing Template

It S Not Too Early To Start Thinking About Taxes College Expenses Starting Tax

It S Not Too Early To Start Thinking About Taxes College Expenses Starting Tax

Tax Reform How Physicians And The Self Employed Are Affected Physician On Fire

Tax Reform How Physicians And The Self Employed Are Affected Physician On Fire

Computer Repair Service Agreement Free Printable Documents Computer Repair Services Contract Template Computer Repair

Computer Repair Service Agreement Free Printable Documents Computer Repair Services Contract Template Computer Repair

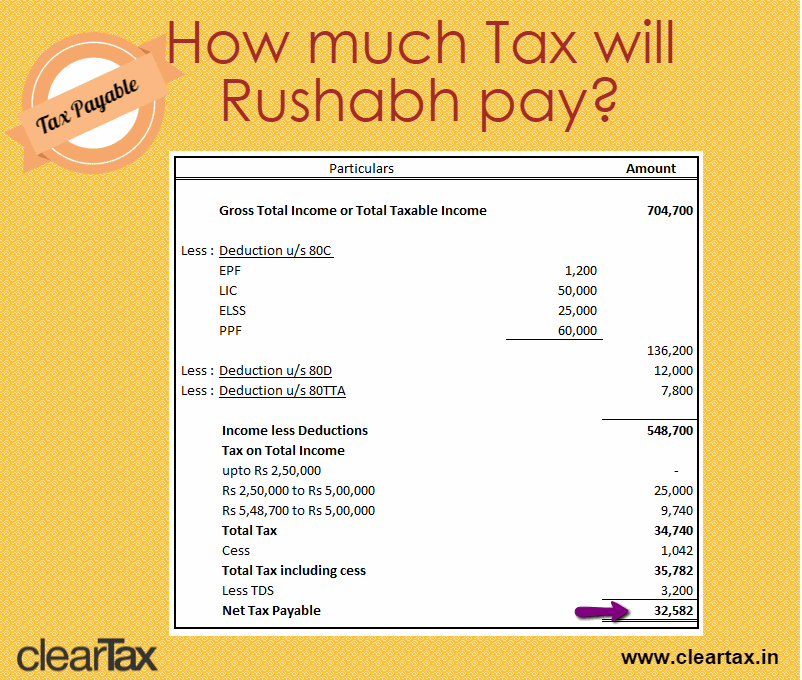

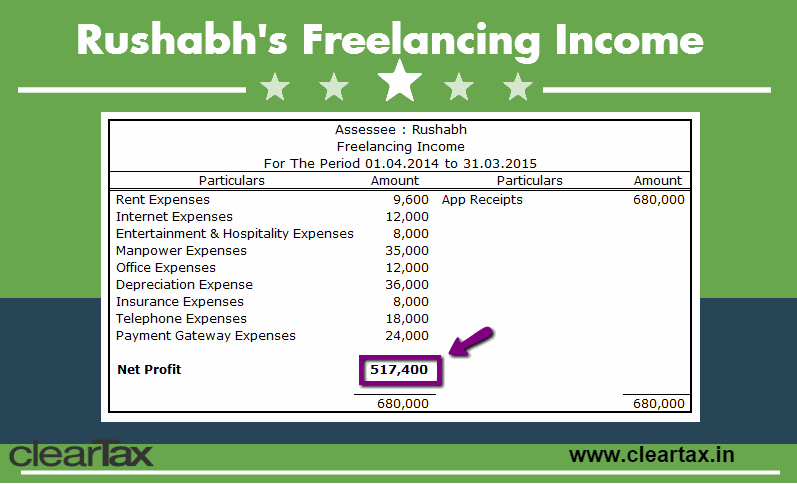

Freelancer S Tax Computation Expenses Total Taxable Income How Much Tax To Be Paid Other Taxes That Apply

Freelancer S Tax Computation Expenses Total Taxable Income How Much Tax To Be Paid Other Taxes That Apply

Self Employment Tax What Is The Self Employment Tax In 2019

Self Employment Tax What Is The Self Employment Tax In 2019

Free Contribution Margin Income Statement Template Pdf Sample In 2021 Statement Template Income Statement Contribution Margin

Free Contribution Margin Income Statement Template Pdf Sample In 2021 Statement Template Income Statement Contribution Margin

Start Your Own Tax Business No Experience Required Earn 20 000 80 000 In 4 Months As An Umbrell Tax Software Social Media Marketing Platforms Irs Taxes

Start Your Own Tax Business No Experience Required Earn 20 000 80 000 In 4 Months As An Umbrell Tax Software Social Media Marketing Platforms Irs Taxes

Answers To Questions About Saas And Some Guidelines To Help You Keep It All Straight Capterra Helps People Find And Saas This Or That Questions Helping People

Answers To Questions About Saas And Some Guidelines To Help You Keep It All Straight Capterra Helps People Find And Saas This Or That Questions Helping People

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Salary Income

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Salary Income

Financial Plan Business Plan Financial Plan Template Financial Planning Business Plan Template

Financial Plan Business Plan Financial Plan Template Financial Planning Business Plan Template

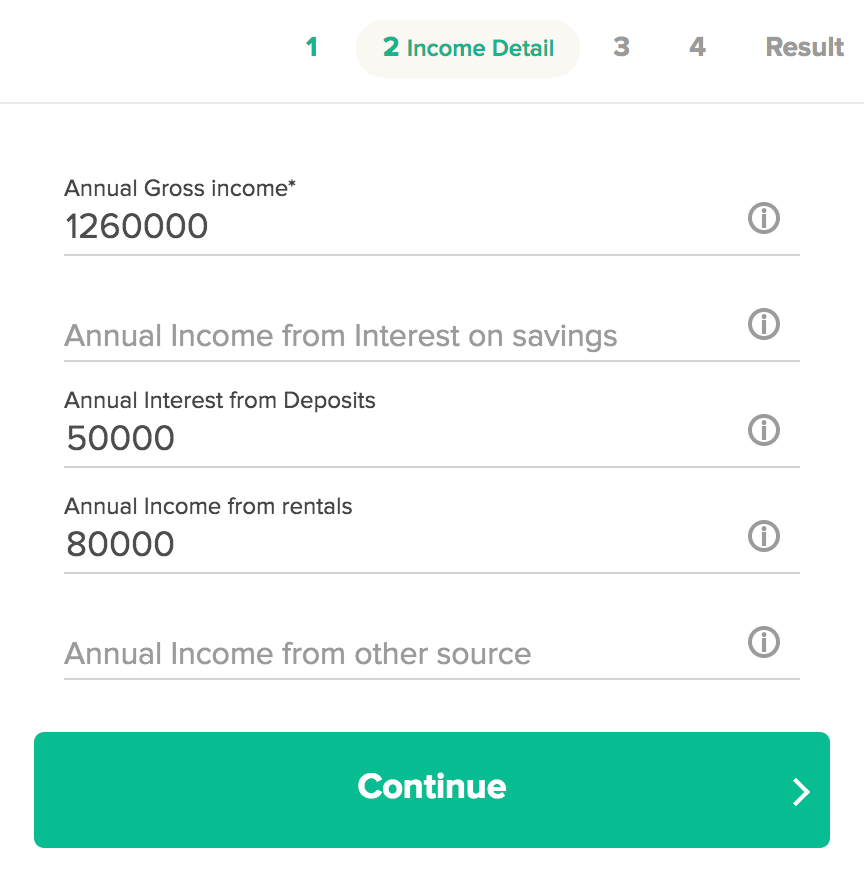

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Freelancer S Tax Computation Expenses Total Taxable Income How Much Tax To Be Paid Other Taxes That Apply

Freelancer S Tax Computation Expenses Total Taxable Income How Much Tax To Be Paid Other Taxes That Apply

Construction Business Budget Workbook Template Ad Paid Business Construction Budget Template Wo Workbook Template Workbook Construction Business

Construction Business Budget Workbook Template Ad Paid Business Construction Budget Template Wo Workbook Template Workbook Construction Business

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

How To Calculate Self Employment Tax Four Pillar Freedom

How To Calculate Self Employment Tax Four Pillar Freedom