A ruling shows whether a worker is an employee or selfemployed and whether that workers employment is pensionable or insurable. Home workers doing pieceworkAssisting family members employers spouses or first- or second-degree relatives provided that they are not insured under another primary insurance institutionSales representativesinsurance brokers provided that they serve one company only and are employed in selling its products in person internally or externally.

Warm Up Mental Math And Estimation Ppt Download

Warm Up Mental Math And Estimation Ppt Download

Commission by share or by piecework or in some other atypical fashion may still be regarded as an employee.

Self-employment piecework. Some employees work for more than one employer at the same time. A Microanalysis of Personal Profiles 3 likelihood of being long-term self-employed if one enters self-employment at a young age. If a worker or payer is not sure of the workers employment status either can ask the CRA for a ruling.

Income from self-employment is earned income when determining eligibility. Piecework Piecework Withdraw of deposits Loans for house. Section 6 concludes our analysis.

Self-employment includes but is not limited to small business farming sales dressmaking piecework in the home and rental income received as a result of a clients efforts in managing the property. Music Appreciation Unit 3 Renaissance Life. The actual work provided can be digital or manual in-house or outsourced high-skilled or low-skilled on-site or off-site large- or small-.

Are special PRSI rules for the employment of family members. 3152021 The increased level of insecurity in labor markets has generated much debate on precarious work arrangementsfrom illegal and temporary work to home working piecework freelancing and online jobsbased on the assumption that the ongoing deregulation and transition to flexible labor markets incur higher risks for the labor force Eichhorst and Marx 2015. Some employees work for more than one employer at the same time.

For self-employed workers who technically are not employees and are deemed not to be earning wages. Arrangementsrelationships such as versions of casual work dependent self-employment informal work piecework home work and crowdwork in a wide range of sectors. Causal self-employment piecework and part time often un-registered or un-taxed work the concept of employment needs to be widened to include non-employee workers.

This is particularly true when looking at the main categories traditionally used to interpret work and employment and compare them with the emerging of new forms of work for instance self-employment which often blur the distinction between dependent and independent workerThe proliferating of new and old risks for workers with non-standard forms of employment including. Statements in contracts considered by. Land purchases purchases Loans for other debts Loans for installment Loans for purchases in a lump sum Total of cash income actual of all household members including the householder.

Code of Practice in determining Employment status. Some employees do not work on the employers premises. Commission by share or by piecework or in some other atypical fashion may still be regarded as an employee.

Music Appreciation Unit 3 Music of the Medieval Era. The factors to consider. The increased level of insecurity in labor markets has generated much debate on precarious work arrangementsfrom illegal and temporary work to home working piecework freelancing and online jobsbased on the assumption that the ongoing deregulation and transition to flexible labor markets incur higher risks for the labor force Eichhorst and Marx 2015.

Self employment is defined as working for oneself rather than an employer. For federal tax purposes the self-employment tax imposed by the Self-Employment Contributions Act of 1954 codified as Chapter 2 of Subtitle A of the Internal Revenue Code is 153 of net earnings from self-employment. When determining whether income meets the self employment definition all factors relating to the income source must be explored with the participant.

Some employees do not work. When budgeting self-employment income a month in which business expenses exceed gross earnings does not equal a loss of earned. Self-Employment Status of Individuals.

The Government is to launch a public awareness campaign on false self-employment amid concerns about the rise in workers deprived of entitlements by being forced to work as self-employed. Data and Overview Statistics 21 The Dataset The KHPS is an annual non-gover nment micro level survey and so far results are available for surveys. To ask for a CPPEI ruling you can.

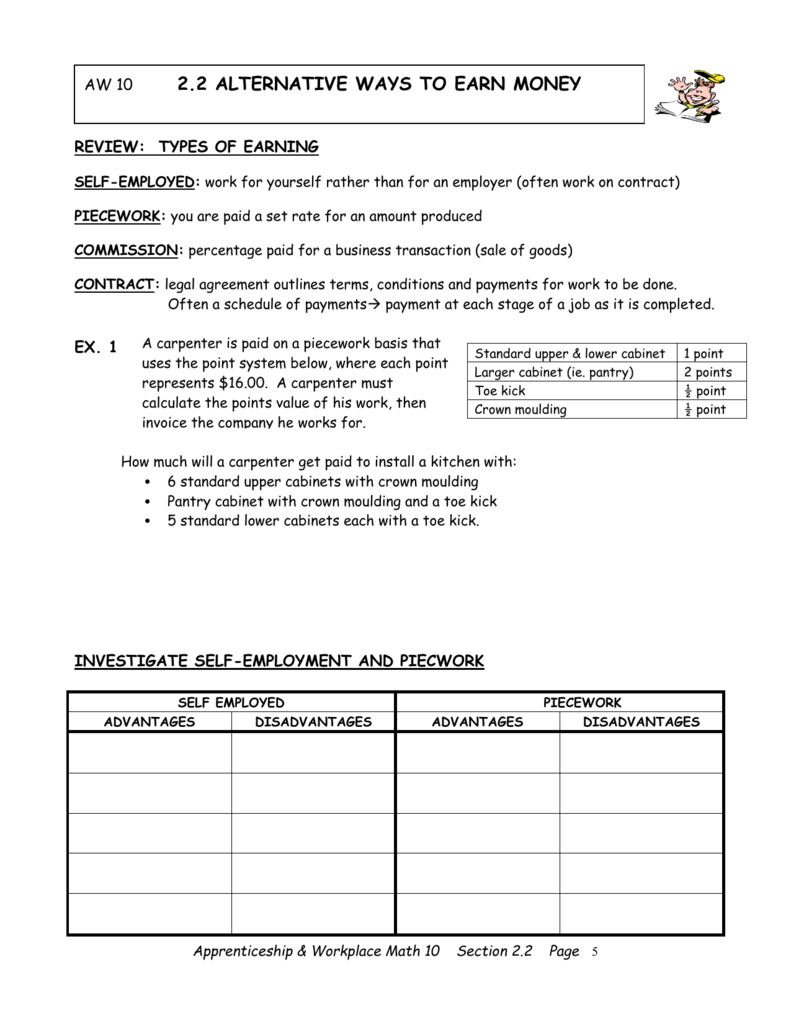

Self-employment includes but is not limited to small business farming sales dressmaking piecework in the home roomers boarders and rental income received as a result of a clients efforts in managing the property. Consumer Math Unit 2 SELF-EMPLOYMENT.

Ppt B Income Powerpoint Presentation Free Download Id 1673662

Ppt B Income Powerpoint Presentation Free Download Id 1673662

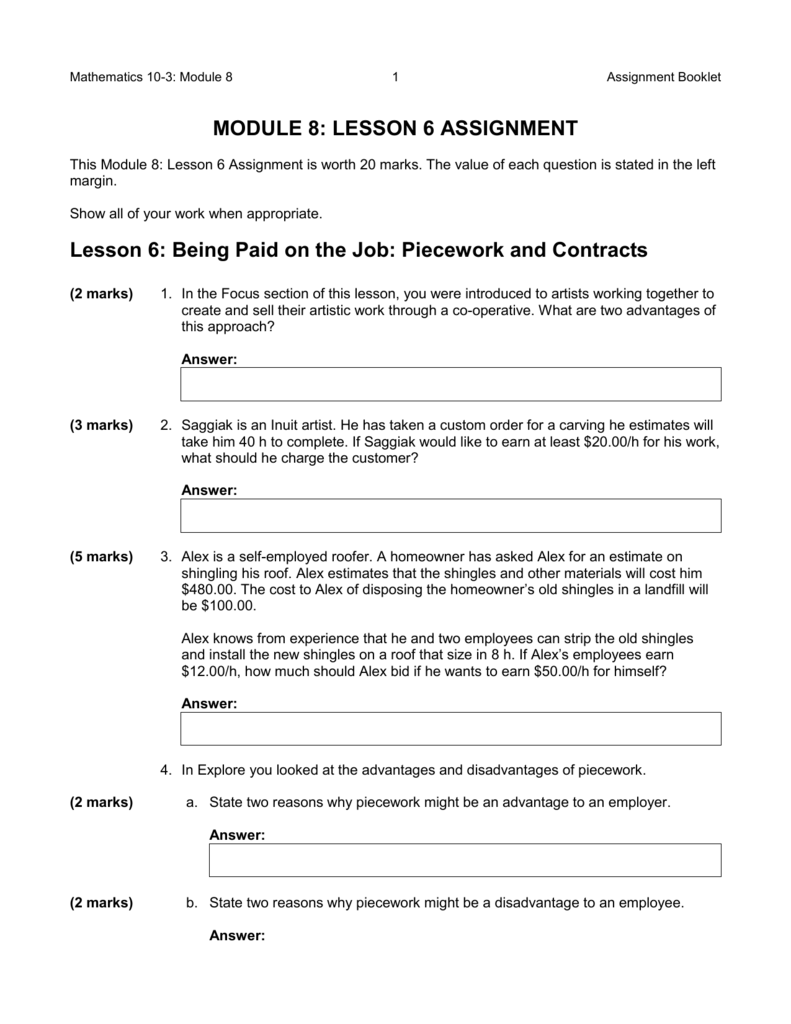

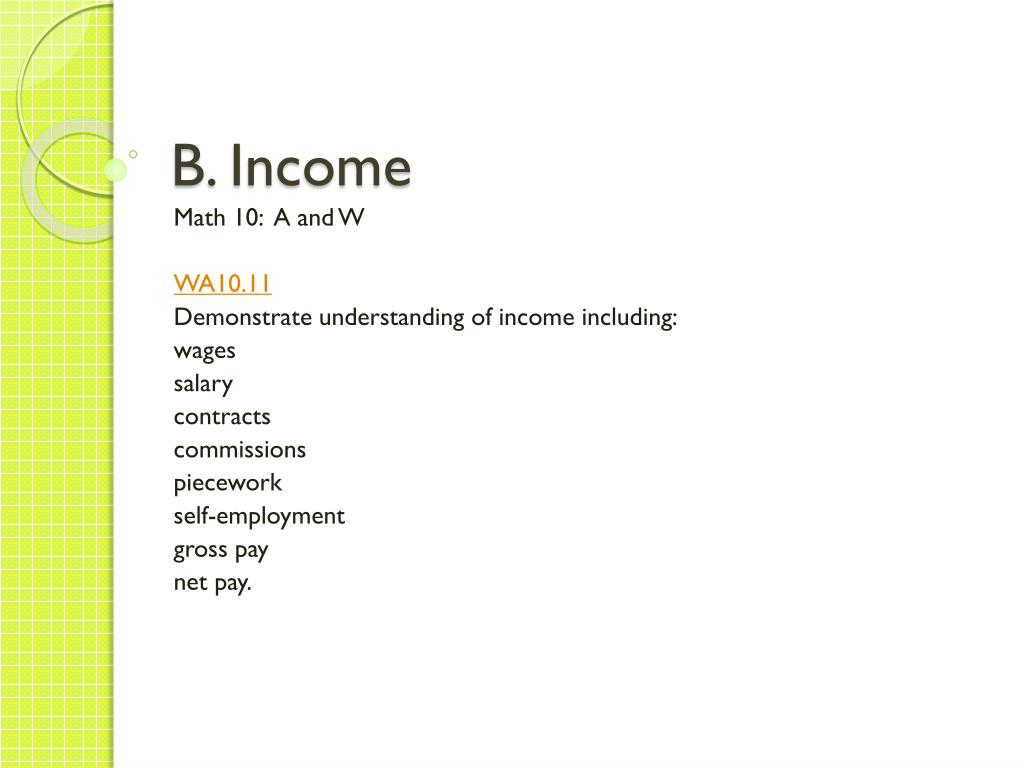

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

Warm Up Mental Math And Estimation Ppt Download

Warm Up Mental Math And Estimation Ppt Download

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

Pay Piecework Rates Horticulture Showcase Fair Work Ombudsman

Pay Piecework Rates Horticulture Showcase Fair Work Ombudsman

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

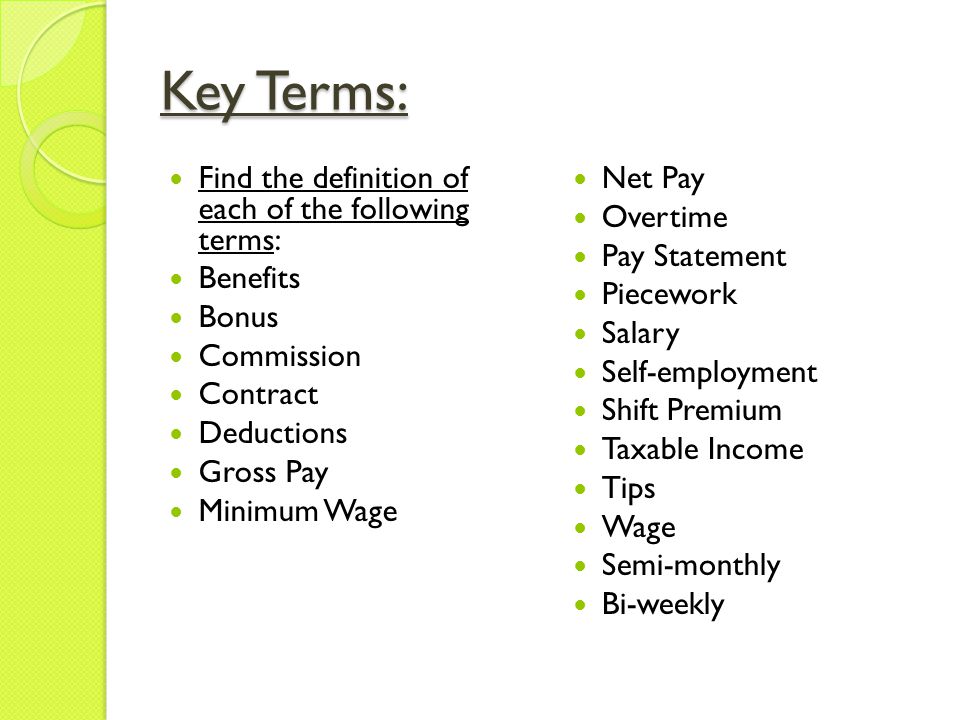

Unit 1 Employment Basics Unit 1 Vocabulary Base

Unit 1 Employment Basics Unit 1 Vocabulary Base

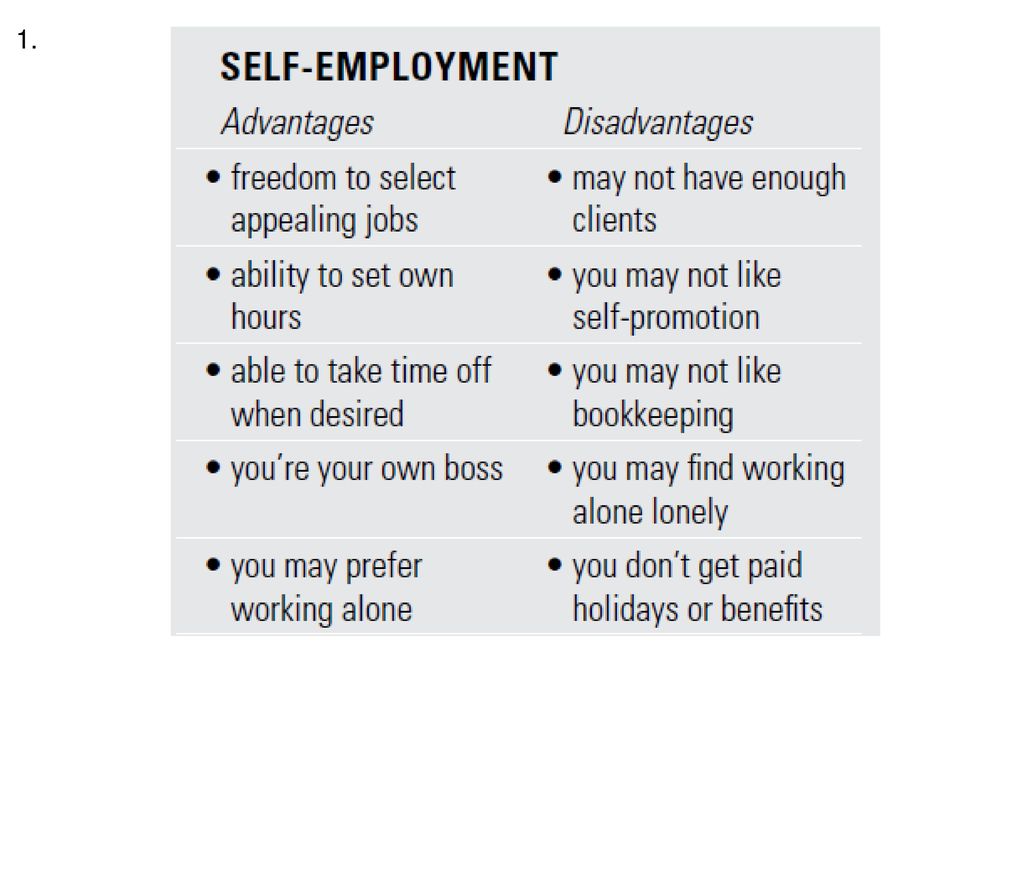

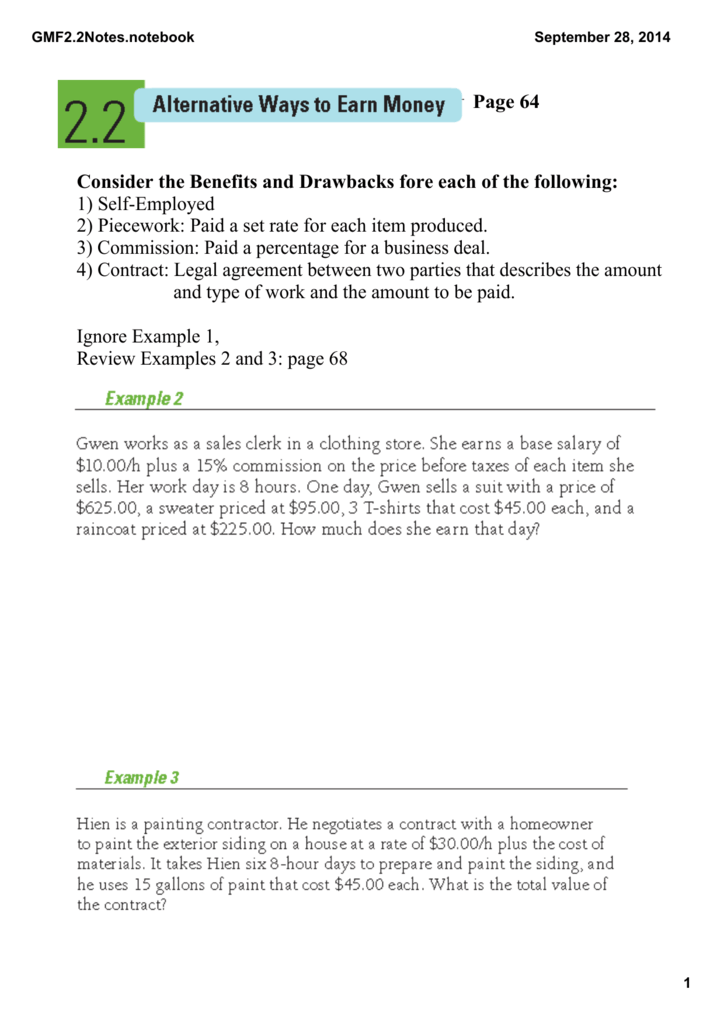

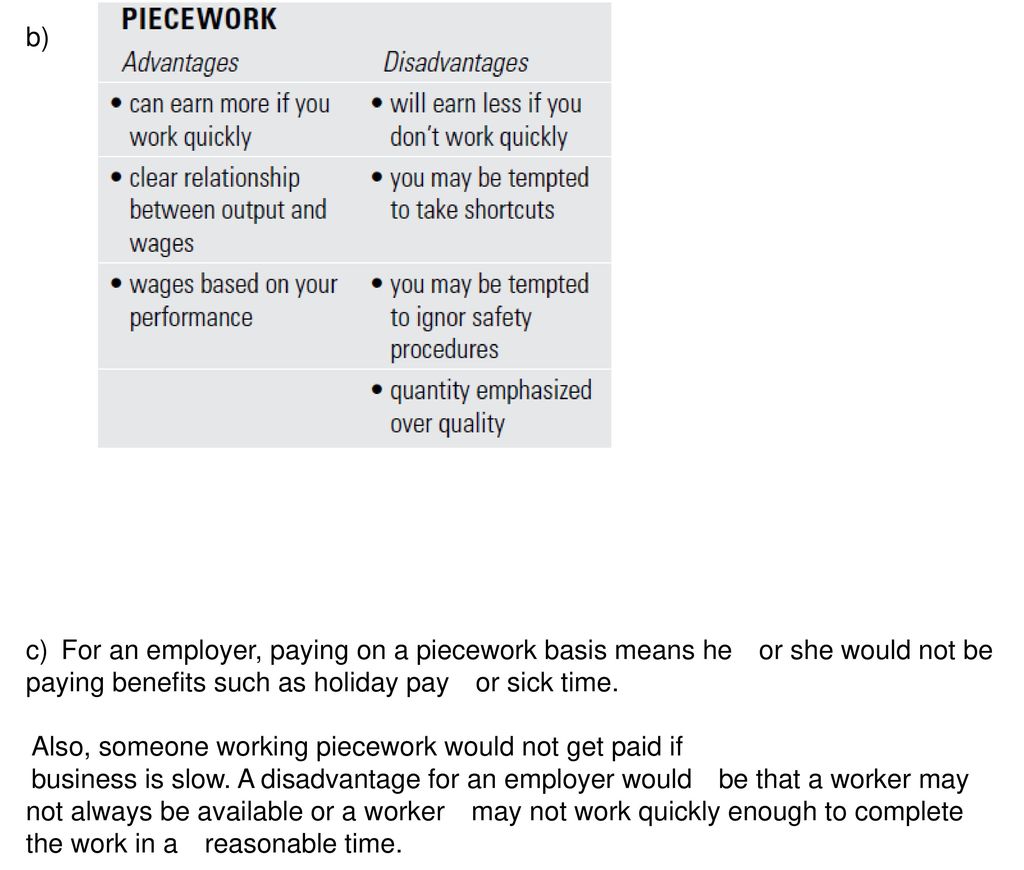

Page 64 Consider The Benefits And Drawbacks Fore Each Of The

Page 64 Consider The Benefits And Drawbacks Fore Each Of The

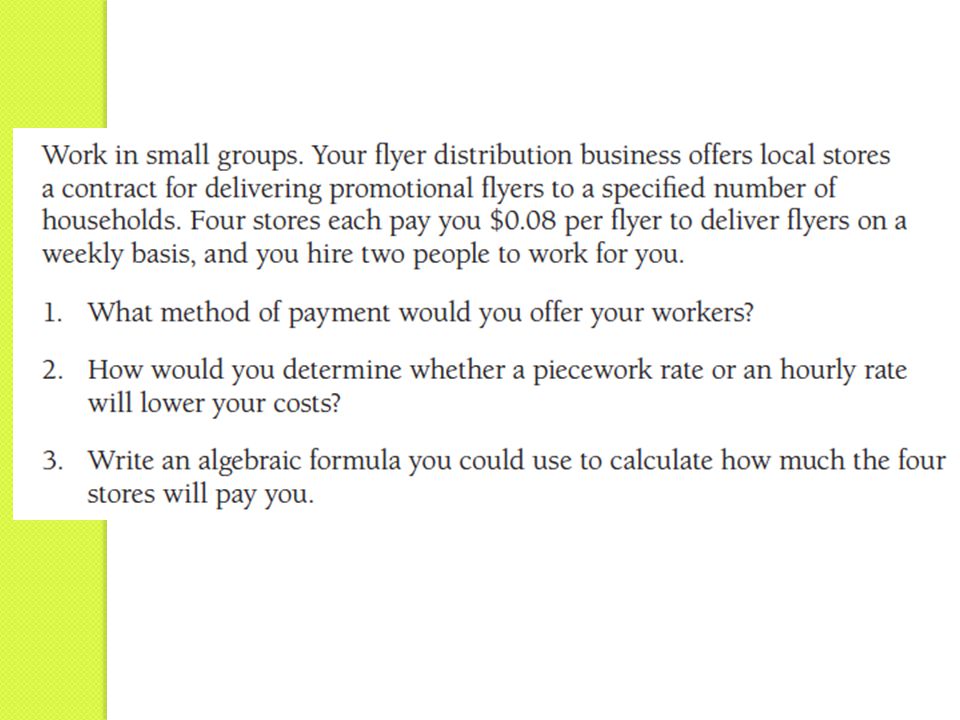

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

Warm Up Mental Math And Estimation Ppt Download

Warm Up Mental Math And Estimation Ppt Download

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

Unit 1 Employment Basics Unit 1 Vocabulary Base

Unit 1 Employment Basics Unit 1 Vocabulary Base

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

B Income Math 10 A And W Wa10 11 Demonstrate Understanding Of Income Including Wages Salary Contracts Commissions Piecework Self Employment Gross Pay Ppt Download

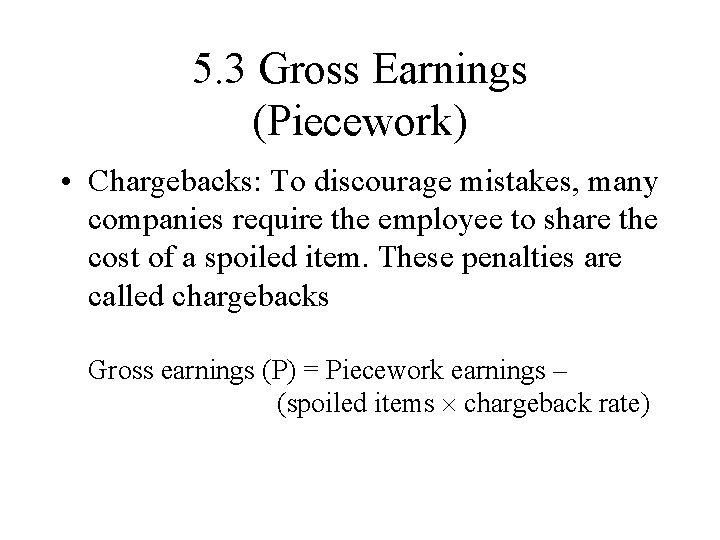

5 1 Payroll Gross Earnings Wages And Salaries

5 1 Payroll Gross Earnings Wages And Salaries