2172021 How Much is the Credit. This form cannot be filed on its own it must be attached to Form 1040 US.

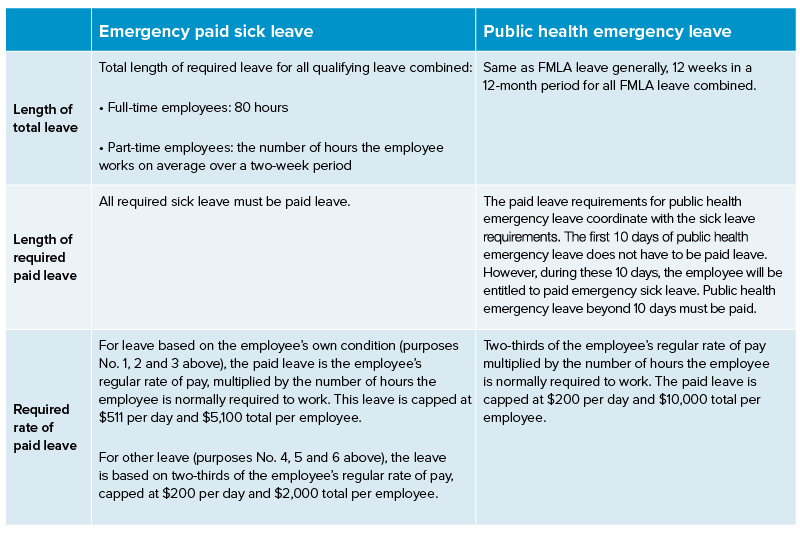

Covid 19 New Paid Leave Requirements And Clarifications For Employers Advisories Aflac

Covid 19 New Paid Leave Requirements And Clarifications For Employers Advisories Aflac

Yes it appears that Li is eligible for an equivalent credit for sick leave.

Self-employment for the sick leave credit. 292021 The Sick Leave Credit for self-employed individuals is calculated at two different rates depending on whether you were impacted personally or were impacted due to caring for another individual. We have multiple opening in UK process. Individual Income Tax Return.

Taxpayers must maintain appropriate documentation establishing their eligibility. Ad Are you looking telecalling part time jobs. You can qualify for these credits even if you have a day job on top of your self-employment.

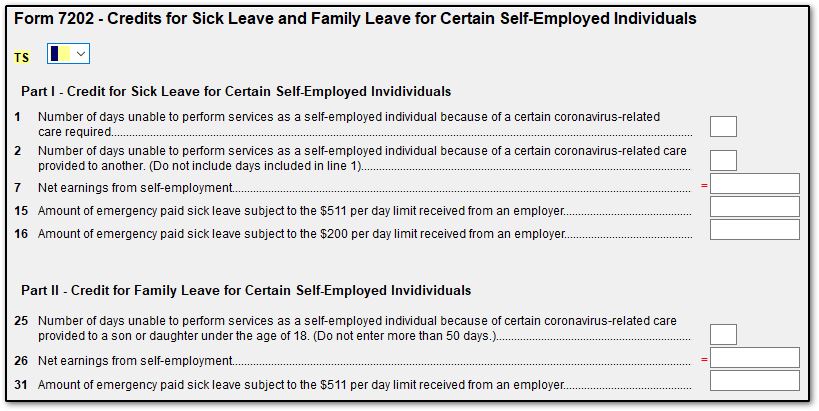

The credits are available for the period from April 1 2020 through March 31 2021. Eligible self-employed individuals will determine their qualified sick and family leave equivalent tax credits with the new IRS Form 7202 Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals PDF. Being subject to a federal state or local quarantine or isolation order due to COVID-19.

To receive the maximum credit a taxpayer would need to qualify for the maximum amount of days for sick 10 and family leave 50 and have self-employment income more than 132860 511260 and not have received compensation for qualified sick or family leave under FFCRA from an employer. A self-employed individual claiming the credit for the individuals own condition or quarantine may claim up to 10 days 80 hours of sick leave wages ie net self-employment income up to 511 per day and 5110 in the aggregate. 1152020 A self-employed individual may be eligible to claim a tax credit under the qualified sick leave and qualified family leave provisions of COVID-19 legislation.

Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix. The larger sick leave credit up to ten days of eligibility is for an individual unable to work or telework for ONE of the following reasons. Theyll claim the tax credits on their 2020 Form 1040 for leave taken between April 1 2020 and December 31 2020 and on their 2021 Form 1040 for leave taken.

The tax credit for paid sick leave applies to eligible self-employed taxpayers who are unable to work including telework or working remotely due to. The credit is reported on Form 7202 Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals. The credits had been available through December 31 2020 but were extended through March 31 2021.

292021 An eligible self-employed individual is an individual who regularly carries on a trade or business and would be entitled to receive qualified sick leave wages or qualified family leave wages if the individual were an employee of an eligible employer that is subject to the requirements of the Families First Coronavirus Relief Act FFCRA. 3172021 Yes if you qualify for paid sick leave andor paid family leave and claim the tax credit you are legally required to report it on your federal income taxes. 252021 The tax credit for paid sick leave applies to eligible self-employed taxpayers who are unable to work including telework or working remotely due to.

Ad Are you looking telecalling part time jobs. In other words this credit will be calculated at the same time your tax return is prepared. Being advised by a.

Self-Employed taxpayers qualify for the credit for sick leave if they were unable to perform services from April 1st December 31st 2020 as a self-employed individual for any of the following reasons. Subject to a federal state or local quarantineisolation order related to Covid-19. Find Latest Call Centre Outsourcing Job Vacancies In Uk On Receptix.

We have multiple opening in UK process. 292021 Eligible self-employed individuals must conduct a trade or business that qualifies as self-employment income and be eligible to receive qualified sick or family leave wages under the Emergency Paid Sick Leave Act as if the taxpayer was an employee. Self-employed individuals may claim a refundable credit for a qualified sick leave or family leave equivalent amount if they cannot work due to COVID-19.

The income tax credit may be used to offset federal self-employment tax for any taxable year equal to their qualified sick leave equivalent amount or qualified family leave equivalent amount. Yes self-employed taxpayers are eligible for credits equivalent to the credits employers receive when their employees cant work because of COVID-19 related reasons. Being advised by a health care provider to self-quarantine due to COVID-19.

Being subject to a federal state or local quarantine or isolation order due to COVID-19. 2192021 If you were sick and not able to work you could receive as much as 511 per day for 10 days which equates to a self-employed sick leave tax credit of 5110. Self-employed people may qualify for up to 15110 in refundable tax credits for sick and family leave.

Frequently Asked Questions Understanding Universal Credit

Frequently Asked Questions Understanding Universal Credit

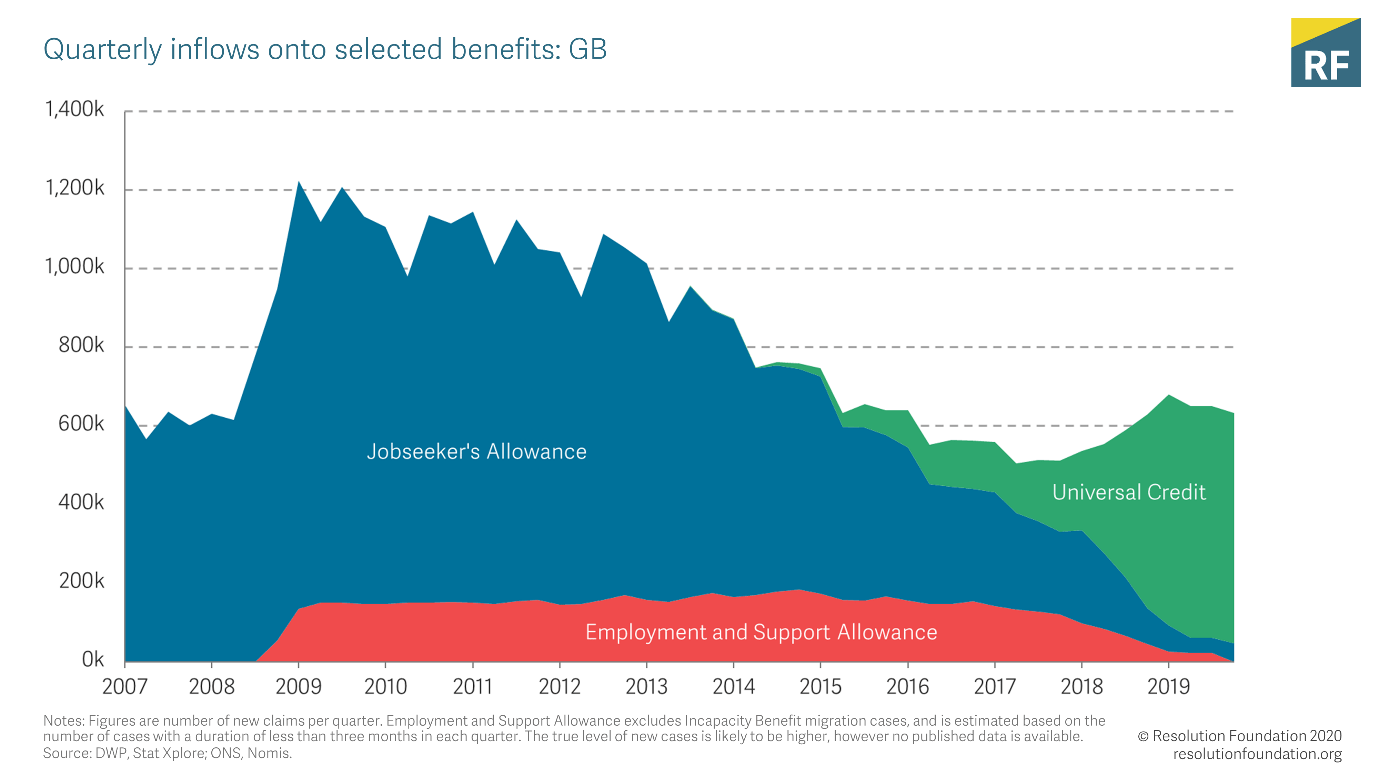

Coronavirus And The Benefits System What Support Is Available Resolution Foundation

Coronavirus And The Benefits System What Support Is Available Resolution Foundation

Sickness Leave Form Template Jotform

Sickness Leave Form Template Jotform

Coronavirus Employees Illness Or Self Isolation Low Incomes Tax Reform Group

Coronavirus Employees Illness Or Self Isolation Low Incomes Tax Reform Group

Paid Sick Leave To Protect Income Health And Jobs Through The Covid 19 Crisis

Paid Sick Leave To Protect Income Health And Jobs Through The Covid 19 Crisis

Paid Sick Leave To Protect Income Health And Jobs Through The Covid 19 Crisis

Paid Sick Leave To Protect Income Health And Jobs Through The Covid 19 Crisis

Http Www Nationalpartnership Org Our Work Resources Economic Justice New Emergency Legislation Paid Sick Days Paid Leave Child Care Pdf

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Self Employed And Taxes Deductions For Health Retirement

Self Employed And Taxes Deductions For Health Retirement

Self Employed Sick Pay Can The Self Employed Get Sick Pay

Self Employed Sick Pay Can The Self Employed Get Sick Pay

Paid Sick Leave To Protect Income Health And Jobs Through The Covid 19 Crisis

Paid Sick Leave To Protect Income Health And Jobs Through The Covid 19 Crisis

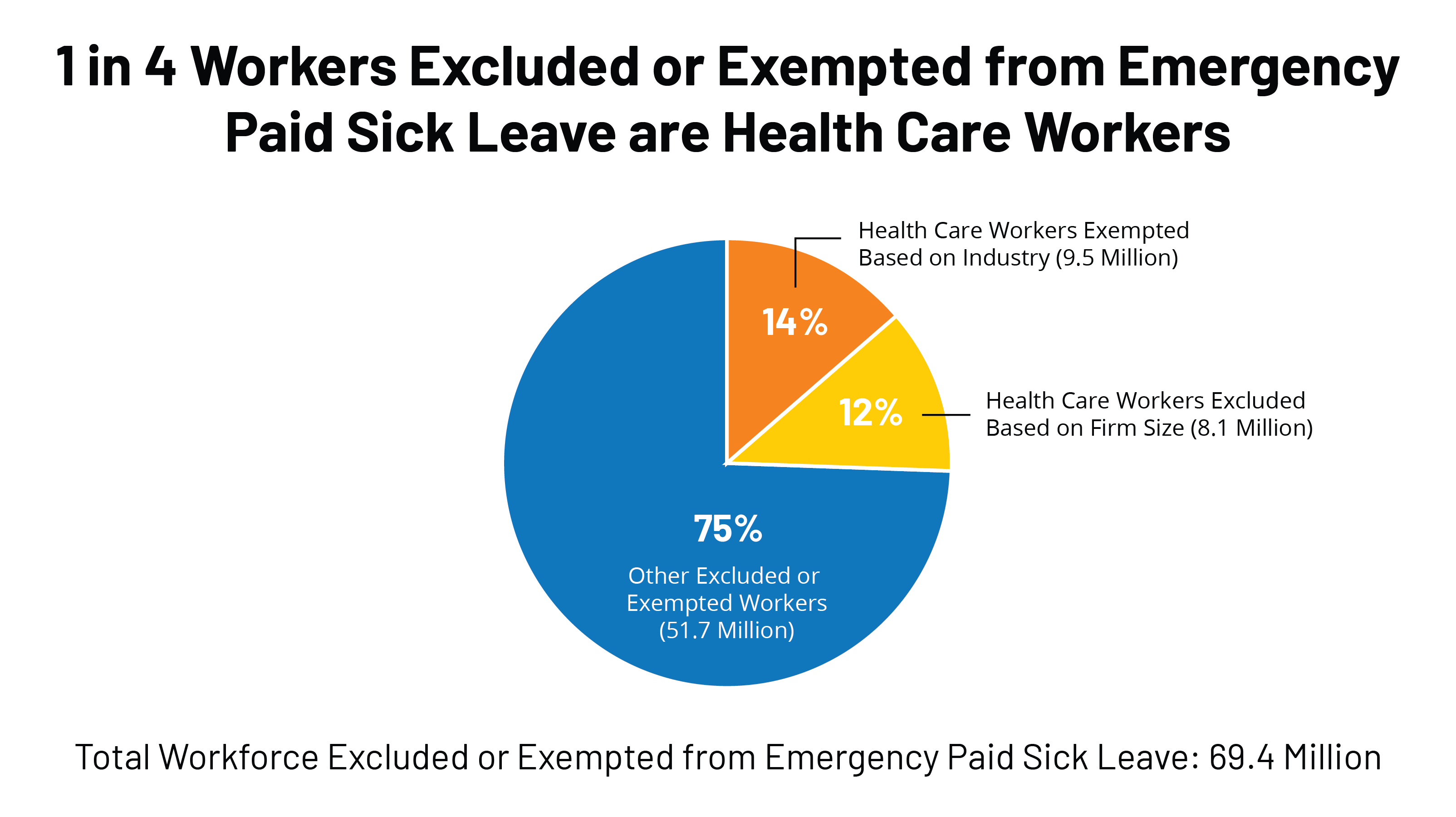

Gaps In The Emergency Paid Sick Leave Law For Health Care Workers Kff

Gaps In The Emergency Paid Sick Leave Law For Health Care Workers Kff

Freelancer S Guide To Using Your Paid Leave Tax Credit A Better Balance

Freelancer S Guide To Using Your Paid Leave Tax Credit A Better Balance

Https Austintexas Gov Sites Default Files Files Aph 20covid 20testing 20notice 20to 20employer Pdf

Berkeley Raises Minimum Wage To 15 59 Citing Statistics After Past Raise

Berkeley Raises Minimum Wage To 15 59 Citing Statistics After Past Raise

Form 7202 Covid 19 Credit For Sick Leave Or Family Leave Drake20

Form 7202 Covid 19 Credit For Sick Leave Or Family Leave Drake20

Paid Sick Leave To Protect Income Health And Jobs Through The Covid 19 Crisis

Paid Sick Leave To Protect Income Health And Jobs Through The Covid 19 Crisis

Coronavirus Self Employment And Paying Tax Low Incomes Tax Reform Group

Coronavirus Self Employment And Paying Tax Low Incomes Tax Reform Group

Paid Sick Leave To Protect Income Health And Jobs Through The Covid 19 Crisis

Paid Sick Leave To Protect Income Health And Jobs Through The Covid 19 Crisis