13 Deduction for one-half of self-employment tax. Self-employment income is not reported as Other Income.

Complete Guide To Taxes Freelancers And The Self Employed Addition Words Tax Guide Employee Tax Forms

Complete Guide To Taxes Freelancers And The Self Employed Addition Words Tax Guide Employee Tax Forms

3132019 IRS Schedule 1.

Schedule 1 self employment tax. Enter here and on. Wage earners cannot deduct Social Security and Medicare taxes. Part II Optional Methods To Figure Net Earnings see instructions.

432019 Individuals use IRS Schedule SE to figure out how much self-employment tax they owe. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Line 27 has a deduction for the self-employment tax.

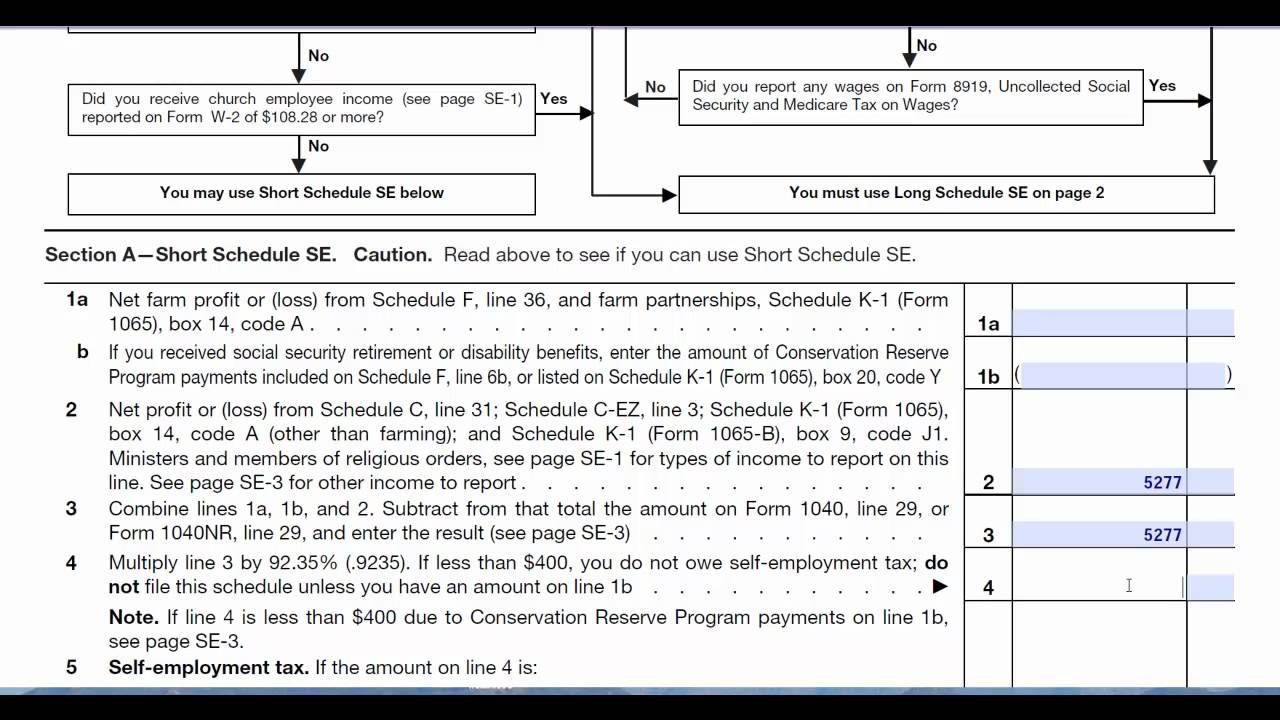

Self-employment tax is based on your business income. Use the flow chart on the front to determine which one you will use. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program.

4212021 If you work for yourself you are self-employed meaning you dont work for an employer. 8272014 For self-employment income earned in 2013 and 2014 the self-employment tax rate is 153. Social Security and Medicare taxes of most wage earners are figured by their employers.

This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits. 2202021 The 2500 was reported to the taxpayers LLC on form 1099-G in box 6 entitled taxable grants. Generally a taxpayers share of ordinary income reported on a Schedule K-1 from a partnership engaged in a trade or business is subject to the self-employment tax.

Multiply line 12 by 50 050. The rate consists of two parts. You do not file IRS Schedule 1 with the older 1040 series forms such as Form 1040A or Form 1040EZ.

Also you can deduct the employer-equivalent portion of your SE tax in figuring your adjusted gross income. Form 1040-NR line 27. S corporations can pay out some of their profits as a distribution.

The self-employment tax consists of the Old-Age Survivors and Disability Insurance social security and the Hospital Insurance Medicare taxes. Schedule 1 Form 1040 or 1040-SR line 14 or. Multiply line 5 by 50 050.

Use Schedule SE Form 1040 to figure the tax due on net earnings from self-employment. You must pay the Social Security and Medicare taxes as self-employment tax SECA. The IRS will.

Add lines 10 and 11. 9112019 The self-employment tax rate for 2021 As noted the self-employment tax rate is 153 of net earnings. Schedule SE is one of many schedules of Form 1040 the form you use to file your individual income tax return.

You figure self-employment tax SE tax yourself using Schedule SE Form 1040 or 1040-SR. 11252009 Use Form 1040 Schedule SE to calculate self-employment tax. 612019 Income reported on a Form K-1 from an S-Corporation is not subject to self-employment tax so TurboTax is not going to generate a Schedule SE.

Schedule 2 Form 1040 line 4. Who Must File Form 1040 Schedule 1. However for 2011 the rate is reduced to 133.

Even if you get a 1099-MISC or 1099-NEC make sure you dont confuse self-employment income with Other Income. For Paperwork Reduction Act Notice see your tax return instructions. That rate is the sum of a 124 Social Security tax and a.

1 Self-employment tax is calculated using Schedule SE a part of your personal tax return Form 10401040-SR. Enter the result here and on. Distributions are not subject to self-employment tax.

Interestingly on line 8 of form 1099-G ProSeries asks if the amount reported in box 2. 6 Deduction for one-half of self-employment tax. It is reported on Line 8 of Schedule 1.

Schedule 1 Form 1040 line 14. The self-employment tax rate for self-employment earnings is generally 153. IRS Says Members K-1 Income Subject to Self-Employment Tax By Kenneth H.

Enter here and on. Schedule 1 can be attached to Form 1040-SR and Form 1040-NR. 142021 If the total of your net earnings from self-employment from all businesses is 400 or more use Schedule SE Form 1040 Self-Employment Tax to figure your net earnings from self-employment and tax owed.

You use it to calculate your total self-employment tax which you must report on another schedule of Form 1040 Schedule 4 line 57. Youll use this form to calculate how much Social Security and Medicare tax you owe based on your total wages and self-employment. What You Need to Know to Do Your Taxes Heres line-by-line guidance on this new tax form.

Bridges CPA PFS December 2014 Tax rules which were enacted long before the LLC format came into existence provide that a general partners K-1 ordinary business income is subject to self-employment tax while a limited partners K-1 income is not except for guaranteed payments. There is a short form and a long form on Schedule SE. ProSeries links box 6 taxable grants of Form 1099-G to Schedule 1 Additional income line 8 Other Income bypassing Schedule C and thus avoiding Self Employment Taxes.

1142021 Form 1040 Schedule 1 Additional Income and Adjustments to Income was created as part of the Form 1040 redesign implemented for tax year 2018. Schedule SE Form 1040 or 1040-SR 2019.

Customizing You To Your Market Profit And Loss Statement Good Essay Sample Resume

Customizing You To Your Market Profit And Loss Statement Good Essay Sample Resume

Calculate Your Self Employment Taxes Sole Proprietorship Sole Proprietor Self

Calculate Your Self Employment Taxes Sole Proprietorship Sole Proprietor Self

Pin On Starting A Business Side Hustles After Divorce

Pin On Starting A Business Side Hustles After Divorce

Self Employed Tax Guide 2019 Stashing Coins Filing Taxes Tax Guide Saving Money Budget

Self Employed Tax Guide 2019 Stashing Coins Filing Taxes Tax Guide Saving Money Budget

Top 10 Tax Tips For The Self Employed How Many Of These Do You Follow Need Help Call Bookkeeping Business Small Business Finance Small Business Bookkeeping

Top 10 Tax Tips For The Self Employed How Many Of These Do You Follow Need Help Call Bookkeeping Business Small Business Finance Small Business Bookkeeping

Self Employment Tax Calculator For 2020 Good Money Sense Money Sense Self Employment Self

Self Employment Tax Calculator For 2020 Good Money Sense Money Sense Self Employment Self

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Self Employed Tax Calculator Business Tax Self Employment Success Business

Self Employed Tax Calculator Business Tax Self Employment Success Business

Selfemployedproduct Job Info Tax Forms Self Assessment

Selfemployedproduct Job Info Tax Forms Self Assessment

The Self Employment Tax Explained By A Self Employed Cpa Self Employment Employment Business Tax

The Self Employment Tax Explained By A Self Employed Cpa Self Employment Employment Business Tax

Freelance Writer Taxes Self Employment Tax Freelance Writer Freelance Writing Profit And Loss Statement

Freelance Writer Taxes Self Employment Tax Freelance Writer Freelance Writing Profit And Loss Statement

Self Employment Income Statement Template Unique Example Format In E Statement Template Free Down Statement Template Profit And Loss Statement Income Statement

Self Employment Income Statement Template Unique Example Format In E Statement Template Free Down Statement Template Profit And Loss Statement Income Statement

7 Self Employment Tax Forms For Home Business Owners Tax Forms Self Employment Extra Money

7 Self Employment Tax Forms For Home Business Owners Tax Forms Self Employment Extra Money

Self Employment Income Statement Template Fresh Self Employment Profit And Loss Statement Line Marketing Income Statement Statement Template Self Employment

Self Employment Income Statement Template Fresh Self Employment Profit And Loss Statement Line Marketing Income Statement Statement Template Self Employment

How To Figure Self Employment Taxes Tax Deductions Income Tax Tax Credits

How To Figure Self Employment Taxes Tax Deductions Income Tax Tax Credits

Form 1040 Schedule C 2016 Instruction Income Tax Return Internal Revenue Service Irs Forms

Form 1040 Schedule C 2016 Instruction Income Tax Return Internal Revenue Service Irs Forms